TORONTO – While rating the industry as “outperform”, a BMO Capital Markets report published Monday says the Canadian media and telecom business will generate $62 billion in revenue in 2012 and see an overall growth rate of about 3%, as compared to last year. Of that revenue, about 75% comes from our big four of BCE, Rogers Communications, Telus and Shaw Communications.

While wireless, wireline broadband and specialty television will continue to be the revenue drivers, overall growth will be partially offset by declines in legacy data, voice and print media, says the report. Look for the overall share of Canadian consumers’ wallets for telecom and media to be the same through 2014 (about 4%).

Wireless

Relatively low wireless penetration in Canada (78% at the end of 2011 while most other comparable countries, including the U.S., have passed the 100% mark, due to multi-device and multi-subscription households) shows there is yet more room for subscriber growth – and as Canadians add more and more smart phones to their households, data usage will continue to climb.

“While still ahead of GDP, wireless revenue growth has slowed recently since the introduction of new lower end pricing plans from new entrants in 2009. The overall customer base continues to grow and pricing (ARPU) has been relatively stable. There has been a dramatic mix shift from voice to data with the proliferation of smartphones. Indeed, voice represented over 90% of blended ARPU in 2007 compared to around half in 2012,” says the report by BMO’s Tim Casey.

It also points to the recently launched shared data pricing plans from Rogers, Bell and Telus as a switch which will sustain growth in wireless. The plans are intended to boost adoption of data-only devices like tablets and even though those don’t carry a voice portion of a bill, they also don’t carry any device subsidies since Canadians buy them at retail.

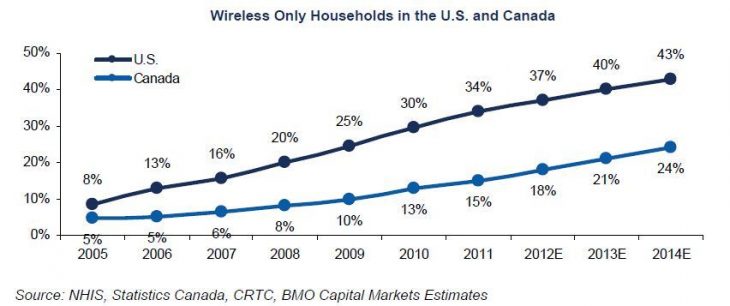

The loss of wireline voice customers continues for the Canadian legacy carriers, notes the report, but at a slower rate than in the U.S. where customers have been much quicker to ditch their home phones for just wireless (see chart below). That is thanks to higher wireless penetration, earlier launch of pure-play unlimited prepaid wireless carriers, a fragmented industry structure less incentivized to offer discounted bundled services and government-subsidized lifeline programs, reads the report.

Residential broadband

“It seems beyond debate that the demand for data will continue to grow,” says the report. “Consumer behaviour patterns (OTT services, increased web applications, etc.) are evolving as broadband speeds enable new use-cases for residential high-speed Internet.”

While cable companies are still grabbing more of the net new residential broadband customers while marketing their network’s traditional speed lead, as telcos push fibre deeper into their networks (driven by their roll out of IPTV services that are claiming wireline video customers from cable) cable’s broadband advantage is narrowing somewhat. “We expect cable companies to continue to increasingly focus their branding on their superior broadband performance,” reads the report. Network performance is a key metric for consumers jumping into new IP-based products and services such as Netflix and other over-the-top video.

That performance, coupled with the desired access to those new online services means wired broadband “enjoys reasonable pricing power given strong consumer demand and a service provider duopoly,” writes Casey.

Media

Advertising is a direct reflection of the economy and because of that, media companies are always immediately affected by the pullback of advertising budgets in the face of tough macroeconomic conditions. Plus, adds the report, buyers are waiting later and later to commit to campaign purchases, making predictions on the future of this portion of the business very difficult. Despite that, “We expect that Internet, mobile and radio will grow (at the expense of print) and specialty television will grow (at the expense of conventional),” writes Casey (see Canadian ad revenue chart below).

Since TV remains the best way for brands to reach a big audience, advertising and subscription dollars will grow there, led specifically by sports and women’s genres, both of which have high appeal to those advertisers. Even though “pay television subscribers were down for the year in Canada; however, we expect this to rebound somewhat as more “TV Everywhere” products (effectively OTT platforms offered by BDUs, which can replicate wireline channel subscriptions) become available and marketing increases,” says the report, referring to the likes of Rogers Anyplace TV and Shaw Go. “We expect modest growth from television driven by pay and specialty. Any gains in conventional television revenues will be driven by broad economic expansion, in our view.”

When it comes to radio, whose demise has been wrongly predicted by so many, it “remains a resilient and stable business in aggregate, despite the never-ending technological threats,” says the report. “Radio is an affordable and effective advertising medium, particularly for reaching a local market. The majority of radio listeners tune in from one of two places – the car or the office. Prior to 2009, radio revenue grew at single-digits annually, driven primarily by FM radio. Since 2009, industry revenues have recovered to pre-recession levels. We expect a GDP-like revenue profile for radio from 2012 to 2014.”

While other shifts are clearly on the horizon, such as spending on social media platforms to reach a younger demographic, it’s not disrupting the traditional market just yet, says the report. “Social media allows companies to have an engaged and direct conversation with consumers; however, it appears these platforms, at least so far, are complementary, not substitutive, to most incumbent media.”

– Greg O’Brien