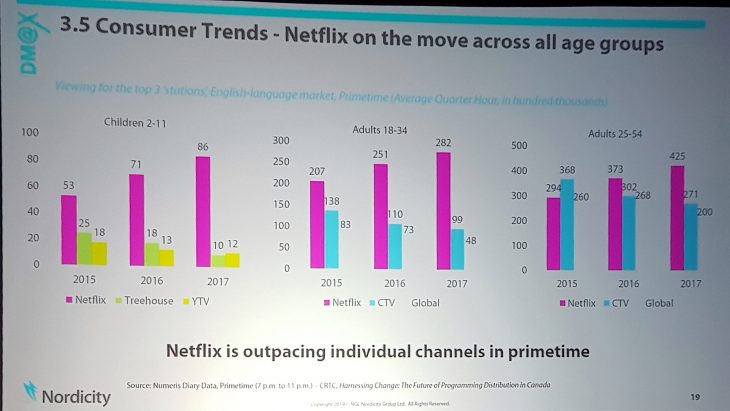

TORONTO – "Viewing of Canadian content by anyone under 50 is just nose-diving,” due to the growth of Netflix which is now the top channel for prime time viewing according to researcher Peter Lyman, senior partner at Nordicity Group.

That means the federal government and CRTC must respond now to the disruptive impacts of OTT providers if the creation of Canadian content is to rebound.

Lyman made the comments at the DM@X conference on digital media held at the University of Toronto where he presented his findings on the state of digital media in Canada. The report, The Digital Media Universe in Canada: Measuring the Revenues, the Audiences, and the Future Prospects, was commissioned by DM@X.

The report also highlighted that in the U.S., time spent on mobile apps since 2015 has exceeded time spent watching television, though the report concedes viewers often are opening apps at the same time they are watching TV (Ed note: Guilty!). It noted that even Netflix views the growing usage of mobile apps as a threat to its numbers.

In particular, Lyman’s report also found multiplayer games such as Fortnite and PUBG which have hundreds of millions of online players have “become a place where you don't just go to play, but rather hang out,” and for many young adults it has replaced the mall.

“Thus, impact of mobile phones is more than a drain of advertising dollars, it diverts time away from content, whether delivered via OTT or cable.” The report found that in 2017 more than half of the digital ad revenue came from mobile devices. “This trend will only grow stronger with the introduction of 5G technology, which will greatly increase bandwidth capacity,” said Lyman.

The study found Google and Facebook have captured 49% of the global digital ad revenue. In Canada, the dominance is even greater, with Google and Facebook grabbing 75% of Canadian digital ad revenues in 2018, up from 70% in the previous year. While Google’s growth in Canada has stalled, the report forecasts Amazon will capture 7% of all Internet ad revenues in the U.S. by 2020.

Canadians spend almost three hours on smartphones/tablets daily, about two-thirds of that time with Facebook and Google. The report also found that “viewer tolerance of mobile advertising will drive up value of mobile for content.”

In 2017 digital platforms like Netflix, Apple, Amazon and the like together spent US$15 billion on programming, including new entrant Facebook. The good news for Canadian content producers is that there are now a “lot more doors to knock on” said Lyman. “But it’s also a much more restrained market and the terms of trade are more stringent even though there are more buyers.”

To counter the threat of Netflix to domestic content production he noted that the European Union is planning to tax digital services. For example the report noted that France has placed a 2% levy on Netflix and YouTube.

While the growth of Netflix is levelling off, Lyman said for Canadian content producers and broadcasters to compete it’s imperative that the federal government and CRTC work together in 2019 to “find a Canadian solution.”

He explained how OTT growth and its appetite for new programming has created huge new demands for foreign service/location (FLS) production in Canada. He noted that FLS production represented 45% of the total volume of film and TV production in Canada in 2017, a 42% increase from 2016, but in contrast production for the Canadian market remains flat or has declined.

That means while larger, integrated Canadian production companies can take advantage of the FLS demand, smaller companies who rely more on the Canadian market are struggling.

Lyman predicted that Netflix’s spending spree on content will have to level off “some day” to respond to shareholders' demand for profitability. In the meantime he contended in order for production of new Canadian content to thrive the industry needs to consider whether it should scale up “through content creation and distribution, or is broadcasting/content production integration required?” Within that discussion he added that the industry and government need to figure out how to extract and deploy funding from inbound OTT platforms.

He conceded that there are concerns about creating a two-tiered system for producers where success distributing to international markets results in a lack of new Canadian content.

Digital music

Nordicity’s research also highlighted the global recorded music industry revenue reached US$17.3 billion in 2017 with 38% of it from streaming. The industry has now experienced three consecutive years of growth following 15 years of decline. In Canada the total Canadian music market (physical+ digital+ performance+ sync) was valued at $569 million in 2017.

While music revenues are rising generally the “value gap,” the mismatch between the value that some digital platforms, in particular online user upload services (e.g. YouTube, Soundcloud, Vimeo), extract from music content and the revenue actually returned to the rightsholders and creators is still an issue notes the report.

“Since many of the digital platforms are not yet turning a profit, it could also be argued that the music consumer is paying less to get more, and is no longer forced to buy a complete album with some selections in which they are not interested.”

It noted that ISPs are also using "safe harbor provisions,” to avoid being responsible for copyright infringement. As a result of all this, creators and rightsholders make less than before. The report also found that while music piracy was down by 50% in the U.S. since 2013, 38% of consumers globally still steal music, and 32% steal digital music using stream ripping.

Universal, Sony and Warner labels represent 80% of the music business and together they earned approximately US$6 billion in the first half of 2018. Streaming made up over 50% of their revenues, contributing US$3.24 billion.