TORONTO – Canadian broadcasters have returned from the Los Angeles Screenings, where they were wrong-footed by Netflix snatching must-have U.S. series from under their noses for the first time.

"With Netflix in the mix, license fees went through the roof as it brought blank checks to the table and went in to buy world rights," one U.S. studio seller privately told Cartt.ca on the weekend. "Anybody selling anything just has to do one-stop shopping," they added.

Another studio executive told Cartt.ca on condition of anonymity that post-broadcast rights fees (i.e. the ability to stream shows on the likes of CraveTV, shomi and Netflix after they air on a linear TV channel) have jumped 40% to 50% this year as compared to last.

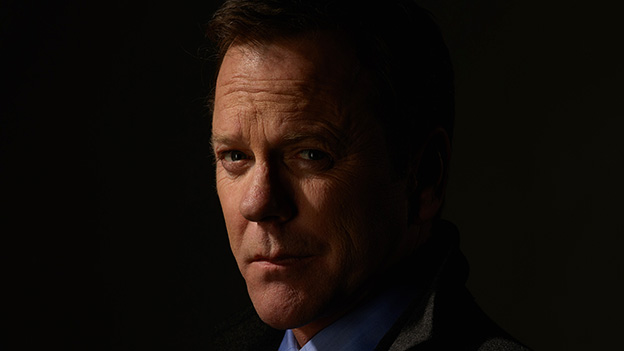

One seller was eOne Television CEO John Morayniss, who pitched two new ABC series to the Canadians during their annual Hollywood shopping expedition – the Mark Gordon Company's Designated Survivor, the most buzzed about show at the screenings starring Kiefer Sutherland, and Conviction.

A frustrated Bell Media saw both ABC shows, distributed internationally by eOne, not fall under its traditional output deal with Disney/ABC.

Global TV programmers, now working for parent Corus Entertainment, also had Designated Survivor and Conviction in their sights, given their close relationship with eOne after collaborations on Rookie Blue, The Code and Private Eyes. In the end, Designated Survivor became the subject of a fierce bidding war between Netflix, CTV and Global, with the Canadian broadcaster coming out on top as it nabbed both Kiefer Sutherland's return to primetime, and Conviction.

CTV will also stream Designated Survivor on CraveTV.

CTV acquired other U.S. series like Notorious from Sony Pictures Television and ABC Studio, Training Day from Warner Bros., The Exorcist from 20th Century Fox, Time After Time from Warner Bros., and the new comedy American Housewife from ABC Studios.

CTV also picked up This is Us from 20th Century Fox.

"Original, emotional, supercharged, and salacious, next season's lineup is without question a game-changing collection of titles," Mike Cosentino, senior vice president of programming at CTV networks and CraveTV, said in a statement on Monday.

Netflix is also understood to have bought two CW rookie shows for the Canadian market, Riverdale, from The Flash exec producer Greg Berlanti, and Frequency, from Supernatural showrunner Jeremy Carver.

Both CW shows are less valuable to the Canadian nets, given that CW has minimal over-the-air bleed into Canada, except for Vancouver, and so no simulcast.

While Supergirl has a new home stateside on CW, having moved from CBS, it has no home in Canada yet after Global Television passed on a renewal. Elsewhere, output deals mean City is has picked up a few new Fox shows: Lethal Weapon, 24: Legacy and Prison Break.

Colette Watson, vice president of broadcast TV and operations at Rogers Media, told Cartt.ca that Netflix boldly joined the hunt for new U.S. shows from the studios at last week's TV market. "They were an aggressive bidder on a lot of programming," she said.

However, Watson added Rogers Media remained "strategic" in terms of its program acquisition, and looked to fill holes in its schedule rather than overspend for rookie and returning shows. While acknowledging that the price of digital rights rose markedly this year as Netflix came to the table, Watson added Shomi did the bidding for SVOD rights, and not her team at Rogers Media.

Global Television is understood to have picked up a raft of CBS shows, including Pull, MacGyver, Pitch, Pure Genius, Timeless, Kevin Can Wait, Man With the Plan, The Good Place and The Great Indoors.

As well, it's also rumoured that Netflix and Amazon entered into a bidding war for the Canadian viewing rights to the new Star Trek series, which CBS is making exclusively available in the U.S. on its streaming site CBS All Access – meaning there is no simultaneous substitution advantage for a Canadian broadcaster to buy that particular show. "It was the first time there was a non-linear original show available at the marketplace," said the first studio source.

That said, when it comes to first window rights, studios would rather still sell to broadcasters and not just SVOD OTT providers – plus it's in the studios' best interests to ensure many competitors for rights stay healthy. "I don't see strong support for going first-run SVOD in the Canadian territory," said the studio executive. "It's too much money for the studios (selling it the usual way)… and if we don't sell to the linear guys in Canada, the spill is coming in anyway (via the U.S. broadcasters, which are all carried by our BDUs), so if we don't cover off linear, we've basically burned our rights before we even get to an SVOD window. If we don't protect the simulcast, we're out of business."

With files from Greg O'Brien