GATINEAU – Total revenue for Canada’s telecommunications sector was $53.4 billion in 2020, a decrease of 1.4% compared to 2019, the CRTC says.

This is according to the telecom portion of the CRTC’s Communications Market Report (CMR; formally the Communications Monitoring Report), released last month.

The report features data from 2020, during which the Covid-19 pandemic began, non-essential travel was curtailed and many Canadians ended up working from home. During this time, there were higher volumes of wireline voice calling, significantly increased Internet data usage and decreased mobile roaming, the report explains.

The 1.4% total revenue decrease for telecommunications in 2020 is the largest drop since the first CMR was published. “The only other decrease was recorded in 2002 at the end of the dot-com bubble, which resulted in a less significant 0.3% revenue drop,” the report reads.

Bell, Rogers, Telus, Shaw and Quebecor (and their affiliates) account for 86.9% of the $53.4 billion.

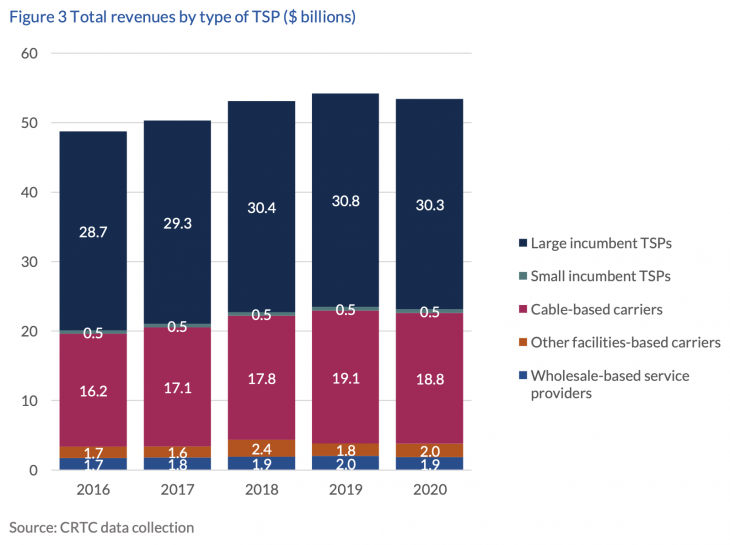

Looked at based on types of providers (see chart above), large incumbent telecommunications service providers (TSPs) such as Bell, SaskTel and Telus, which make up 0.6% of all Canadian TSPs, accounted for 56.7% of the revenue in 2020, down 1.5% from 2019.

Cable-based carriers, which the CRTC defines as former cable monopolies such as Rogers, Shaw and Vidéotron, which also provide telecommunications services, had 35.1% of the revenue share down 1.8% from 2019.

Other facilities-based carriers such as Allstream Business and Xplornet had 3.7% of the revenue share in 2020, which is an increase of 9.3% from 2019. Wholesale-based service providers such as Distributel and TekSavvy had 3.5% of the revenue for 2020 and the largest decrease at 8.4%. Small incumbent TSPs such as Execulink and Sogetel had a revenue share of 1%, an increase of 2.8% from 2019.

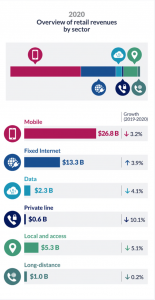

The CMR divides telecommunications services into six sectors: mobile, fixed Internet, data, private line, local and access and long distance.

“In 2020, nine company groupings offered services in all six telecommunications sectors, accounting for 85.7% of total telecommunications revenues in Canada,” the report says. Smaller entities that provide one to three services represent 72% of TSPs and 4.7% of the 2020 telecommunications revenues.

Many of the sectors saw declines in retail revenue in 2020 compared to 2019 (left). Data was down 4.1% to $2.3 billion, private line was down 10.1% to $0.6 billion, local and access was down 5.1% to $5.3 billion and long-distance was down 0.2% to $1 billion.

Mobile was the largest contributor to a 1.7% overall decrease in retail telecommunications service revenue in 2020.

“For the first time ever, mobile reported a negative growth rate which saw the sector shed approximately $900 million or 3.2% in 2020,” the CMR reads.

Later in the report, the CRTC explained this may “be attributed to several key factors such as more people worked from home who may have resorted to alternative voice solutions i.e. home phone service, skype, zoom, MS Teams, etc. and the drop in international roaming revenues as global travel restrictions were imposed and enforced throughout 2020.”

The restrictions and closures of retail stores and malls during the pandemic also had an impact “on mobile equipment and device sales as store traffic was severely reduced or halted altogether,” the report says.

“Despite all these challenges, mobile still remained the largest sector, representing over 54.2% of all retail telecommunications revenues in 2020 and the average subscriber consumed more data than ever; this illustrated the resilience of Canada’s mobile operators and Canadians reliance on mobile communications.”

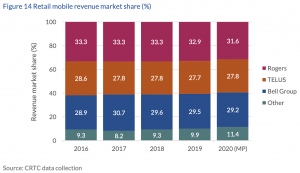

Bell Group (including Bell Canada, Bell Mobility, KMTS, Latitude Wireless, NorthernTel, Northwestel Mobility, and Télébec), Rogers and Telus accounted for 88.6% of revenues (right) for retail mobile phone revenue.

The only retail telecommunications sector to record a growth in revenue in 2020 was fixed Internet services, which increased 3.9% to $13.3 billion, according to the CMR.

“This growth is mainly attributed to the increase in residential Internet access revenues which grew from $10.0 billion in 2019 to $10.6 billion in 2020 (or 5.7% growth). Residential Internet revenues increased as households increasingly subscribed to Internet packages with faster speeds and higher usage limits,” the report reads.

Business Internet revenues, however, “were impacted by closures of small-medium sized businesses during the pandemic,” the CMR says. Total business fixed Internet revenues experienced “a negative growth rate for the first time in the past ten years, decreasing from $2.3 billion in 2019 to $2.2 billion in 2020 (or -4.9% growth).”

In terms of wholesale, 2020 saw a 1.5% revenue increase to $4.12 billion. Of the $4.12 billion, “28.7% was for the provision of mobile services and 71.3% for wireline services,” according to the CMR.

For the full report, please click here.

Charts and image borrowed from the CMR.