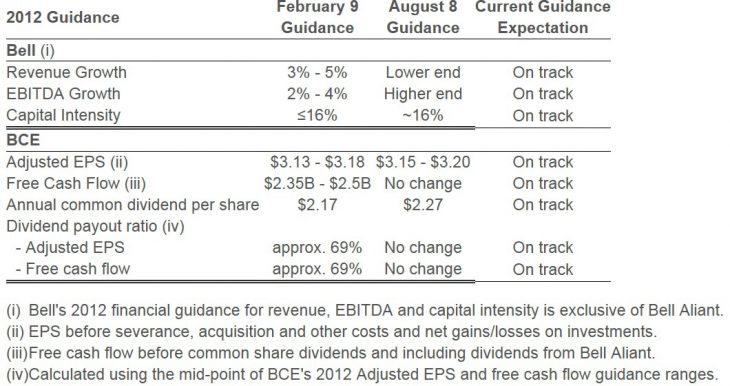

MONTREAL – BCE Inc. reports profits slipped 12% in the third quarter to $569 million compared with $642 million a year earlier, but is still on track to meet the 2012 financial guidance it issued in August. It attributed the drop “mainly due to lower income tax expense in Q3 2011 from the favourable resolution of tax matters.” Revenue increased 1.8% to $4.3-billion, while operating revenue rose 1.5% to $4.98 billion. Bell EBITDA was up 5.2% in Q3 on growth of 15.2% at Bell Wireless and 92.6% at Bell Media, partly offset by a 6.2% decline at Bell Wireline.

The company’s Bell Media division, which recently had its $3.4-billion bid for Astral Media rejected by the CRTC, reported that overall revenues rose nearly 26% to $546-million. It attributed the gains to ad revenues from broadcasting the London 2012 Games and higher subscriber fee revenues for certain Bell Media specialty sports and non-sports TV services.

Its Bell Wireless operating revenues increased 7.1% in the third quarter to $1.43 billion. Service revenue was up 6.4% to $1.3 billion due to the larger postpaid subscriber base and growth in wireless data usage. Product revenue increased 10.8% in the quarter to $113 million as a result of a higher percentage of smartphones in the sales mix.

Bell Wireline revenues were down 4% in the quarter to $2.51 billion and EBITDA was $978 million, a decrease of 6.2%. But margins were maintained at 39.0%, reflecting lower wireline operating expenses as a result of “rigorous cost control and productivity improvements.” Bell Fibe TV activations also continued to accelerate and helped offset the losses in the division by adding 42,973 net new customers compared to 20,297 in the third quarter of 2011. Total Bell Fibe TV subscribers passed the 200,000 mark in the past quarter.

"Bell is making unparalleled investments in the best new networks, products and content, and we're seeing the results in strong growth across our wireless, TV, Internet and media businesses. Bell's robust 5.2% EBITDA growth was driven in large part by outstanding performance at Bell Wireless and Bell Media, both of which posted exceptionally strong revenue and EBITDA growth," said George Cope, President and CEO of BCE and Bell Canada.

Bell added 148,502 wireless postpaid net subscribers, 17.1% more than the same quarter last year, that’s nearly double the 76,000 subscribers that Rogers reported adding in the same quarter. Its wireless EBITDA growth of 15.2% to $554 million is Bell’s best Q3 performance in 5 years. Bell attributed the growth to “high-value postpaid customers and upgrade existing customers to smartphones, while exercising discipline in postpaid customer acquisition and retention spending.”

Bell Wireless’s service margin expanded to 42.4% from 39.2% last year, and it noted that smartphone users now represent 60% of postpaid subscribers, driving 4.2% higher wireless ARPU and data revenue growth of 29.5%.

Bell Media EBITDA increased 92.6% in Q3 2012 to $156 million, reflecting the flow-through of higher subscriber fee revenue and lower non-Olympics-related operating expenses. It added that despite the positive impact on revenues from the Olympics during Q3, advertising sales across Bell Media's properties “continued to be impacted adversely by a soft advertising market.”

Bell invested $688 million in new capital this quarter, a $36 million increase compared to Q3 2011. It says the investments support the continued deployment of broadband fibre to residential homes, neighbourhoods and businesses in Ontario and Québec and expansion of the Fibe TV service footprint, enhancement of customer service systems, the ongoing rollout of the 4G LTE network in markets across Canada, and the addition of new Bell and The Source stores, particularly in western Canada.

Bell Wireless

- Cost of acquisition per gross activation increased to $397, up 1.3% from Q3 2011, due to increased spending on advertising and higher sales-related costs.

- Postpaid gross activations increased slightly to 372,574 this quarter compared to 372,346 in Q3 2011. Activations in western Canada increased due to more points of distribution and increased advertising, even as some customers delayed purchases in anticipation of the Apple iPhone 5 launch on September 21.

- Prepaid gross activations decreased 23.0% to 118,122 due primarily to aggressive acquisition offers from competitors targeted at lower-ARPU subscribers and Bell's continued focus on acquiring postpaid customers.

- Blended churn rate improved to 1.6% in the quarter from 2.0% in Q3 2011. Postpaid churn decreased to 1.2% from 1.5%, reflecting the positive impact of retention spending and lower customer deactivation rates on smartphones compared to other devices. Prepaid churn declined to 3.3% from 3.9% as a result of fewer customer deactivations.

- The Bell Wireless client base reached 7,576,027 at the end of Q3 2012, a 2.8% increase over last year.

- Bell’s 4G LTE network now reaches more than 61% of the Canadian population in more than 40 markets across 7 provinces and territories. LTE complements Bell's 4G HSPA+ and enhanced 4G HSPA+ DC (Dual Cell) networks, offering coast-to-coast coverage to more than 97% and more than 83% of the Canadian population, respectively.

- Bell introduced several new smartphones, including Apple's iPhone 5, Motorola's ATRIX HD LTE and RAZR V, and the Sierra Wireless 763 4G LTE Turbo Hotspot.

Bell Wireline

- Data revenues increased 0.1% to $1.39 billion due mainly to higher TV revenue driven by strong subscriber growth in Fibe TV.

- Local and access revenues declined 7.9% to $654 million. Total NAS at the end of the quarter was 5,768,609, a 7.0% decline year over year, attributable to increased competition and a reduction in access lines and digital circuits as customers continue to adopt wireless and IP-based technologies.

- Long distance revenues declined 13.9% to $192 million. The year-over-year decline reflected fewer minutes of use by residential and business customers resulting from NAS line losses and technology substitution, ongoing rate pressures, and decreased sales of global long distance minutes.

- Equipment and other revenue decreased 8.0% to $195 million due mainly to lower year-over-year legacy wireline telecommunications equipment sales, promotional offers on TV set-top boxes, and lower consumer electronic equipment sales at The Source.

- TV net activations totalled 15,846 compared to 26,169 in Q3 2011.

- The Bell TV subscriber base totalled 2.17 million at the end of Q3, a year-over-year increase of 2.9%.

- Bell added 13,416 new net high-speed Internet customers in Q3, compared to a net loss of 101 last year. The improvement reflects the pull-through effect of service bundle offers that include Fibe TV, enhanced competitive offers, and continued broadband fibre network expansion, all of which contributed to lower customer churn year over year.

- NAS net losses in the third quarter of 2012 decreased to 109,280 from net losses of 110,629 in the third quarter of 2011, reflecting residential NAS line losses of 84,540, 11.3% fewer than last year, as Bell continued to reduce residential NAS turnover in Fibe TV service areas. Business access losses increased to 24,740 from 15,362 in Q3 2011.

Bell Media

- The financial impact from the NHL lockout was not material this quarter.

- CTV closed the season with more Top 20 rated programs in Canada than its competitors in key demos for the summer measurement period.

- In Q3, Bell Media websites streamed more than 177 million videos, welcomed an average of more than 3.5 million unique visitors each month, and served a total of 121 billion page views.