Traditional video still to be the majority of the market

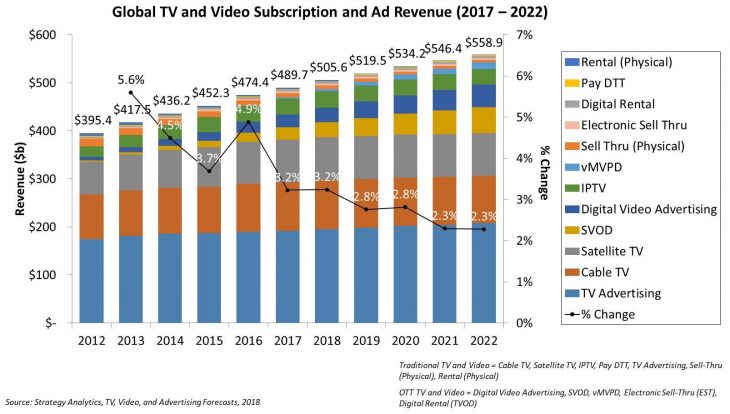

BOSTON – American researcher Strategy Analytics said Tuesday that the global consumer and advertising spend on TV and video will grow 14%, from US$490 billion in 2017 to US$559 billion in 2022.

Spending on over-the-top video will account for 90% of this growth, according to the company’s latest Television & Media Strategies (TMS) report. For a breakdown of spending, see the chart at right (click to enlarge).

Consumer spend and digital video ad revenue from OTT video services such as YouTube, Facebook, iTunes, Google Play, Netflix, Amazon Prime Video, Hulu, and others will double over the forecast period, reaching US$123 billion in 2022.

“OTT TV and video services will be the driving force behind future revenue,” said Michael Goodman, director, television and media strategies, in the press release. “However, traditional TV and video services should not despair too much, as they will continue to account for the majority of consumer and advertising spend for the foreseeable future.”

By 2022, consumer and advertising spend on traditional TV and video products and services globally will still be over US$435 billion, an increase of $7B from 2017, and account for nearly 78% of all TV and video revenue.

In 2022, North America will continue to be the largest TV and video market; accounting for 38.7% of global consumer and advertising spend on TV and video.

Also by then, the Asia Pacific region will account for 23.4% of global consumer and advertising spend on TV and video, says the report.

“With all the reports about the growth of OTT video and the demise of linear TV it is understandable for legacy pay TV providers and programmers to feel some level of anxiety. There is no doubt consumer viewing patterns are changing as a result of the growth of broadband (fixed and mobile) and connected devices, As a result, companies are trying to figure out the correct business model as long-standing relationships between studios, programmers and pay TV providers are in flux. Despite all this uncertainty there is one certainty – video revenues will continue to grow,” it reads.