NEW YORK — Even though the streaming options available to media consumers is growing and leading to fragmented audiences for advertisers, linear television remains the top medium for reaching audiences globally, according to a new report from market research firm Nielsen.

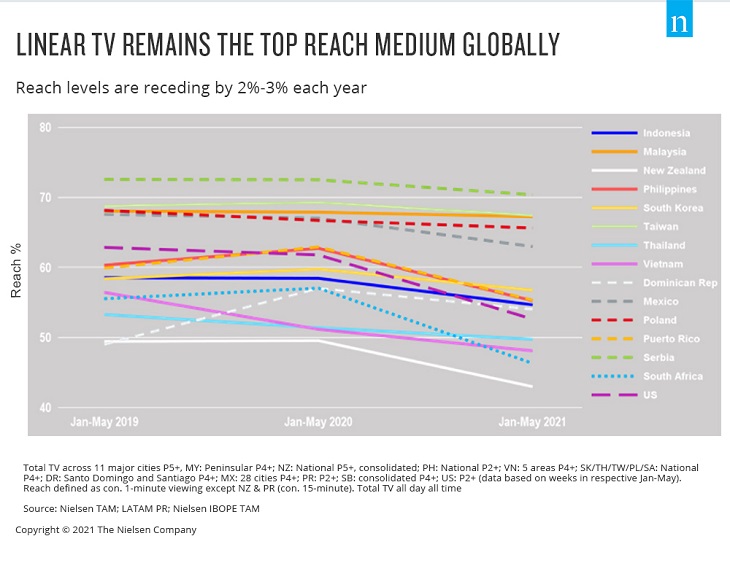

“In aggregate, linear television remains the best way to reach mass audiences, but reach levels are dropping between 2% and 3% each year as viewing behaviors fragment across the growing variety of streaming content,” reads the Nielsen report, published last week.

“Despite fragmenting viewership, and in contrast to what many marketers say about their planned spending, global ad spend on linear TV has bounced back stronger than spending across all media following the global ad pullback last year. The revitalized commitment speaks to the enduring influence of linear TV, even though the pandemic viewing gains of last year have receded,” the report continues.

Nielsen’s research found global ad spending on linear TV, which saw a 23% year-over-year decrease in Q2 2020, had started to rebound by the end of last year, achieving a 4% YoY increase in Q4 2020 and 7% YoY increase in Q1 2021. In comparison, global ad spending across all media grew by only 5% in Q1 2021, compared to the same quarter of 2020.

Furthermore, the adoption of connected TV (CTV) globally is changing how consumers spend their TV time, the report says. For example, in the U.S., streaming video accounted for 27% of viewers’ total TV time in June 2021, according to Nielsen.

“CTV, which facilitates everything from streaming video to addressable advertising to skinny TV bundles, is transforming the viewing experience — and opening new advertising opportunities in the process,” the report says.

Research from IAB in Europe shows more than 50% of advertisers and almost 100% of agencies say CTV/addressable advertising is a key growth area for digital video over the next 12 months, according to Nielsen’s report. “That growth expectation is backed by growing consumer demand, with the IAB citing eMarketer forecasts that over-the-top (OTT) subscribers in Western Europe will increase from 133 million in 2019 to 159 million by 2023.”

As streaming platforms grow their libraries, “there’s no question that the TV screen will remain the most valuable media real estate in the household, with rapidly expanding content options,” the report says.

“And just as we’ve seen in the U.S., large media companies with established footholds in the global TV space are innovating to build broadcast video-on-demand (BVOD) libraries to give audiences the opportunity to view premium content at their convenience and drive incremental ad sales. Media companies are also experimenting with dynamic ad insertion to provide addressability and personalized messaging within their linear TV programming.”

In addition, multichannel video programming distributors (MVPDs), which we call BDUs in Canada, and virtual MVPDs (vMVPDs) have started to offer viewers “tailored content flexibility without a commitment to a cable or satellite subscription,” the report says.

According to Nielsen streaming data for the U.S., ad-supported video-on-demand (AVOD), MVPDs and vMVPDs accounted for 36% of the total minutes streamed in June 2021.

For more on Nielsen’s report, please click here.