Traditional TV cord-cutting has accelerated through the pandemic

By Greg O’Brien

TORONTO – It will surprise no one the 18-35 year-old age group loves to stream their content. Watching via Netflix or YouTube or Prime or Disney+ or Club Illico or Crave or CBC Gem or DAZN or Sportsnet Now or TSN Direct or Tou.tv or CBS All Access or Britbox or RDS Direct or AppleTV+ is old hat to them.

However, according to a Charlton Research online presentation to CTAM Canada members last week, what’s not old hat is trying to manage the massive and growing list of streamers (Heck, two more were announced just today) and trying to pay for all those streamers.

That cohort is starting to say it would be great, Charlton’s Gord Hendren told delegates, if there was a place to bundle all of that content together for a price that approximates what it costs per month for a traditional TV service. Seriously, they want a bundle of video content. Now where have we seen that before?

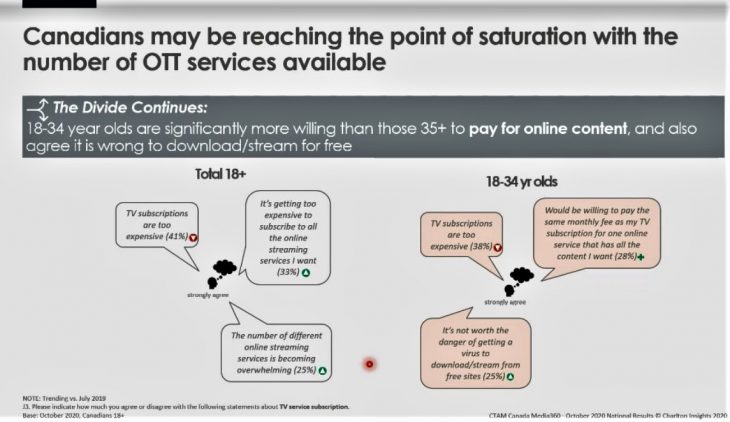

“Canadians are more likely to agree that it’s too expensive to subscribe to all the online services,” he said. “18 to 34 year-olds are more likely to say that they’d be willing to pay the same as they’re paying for a television subscription for an online service with all the content they want.”

Thirty-three percent of the 1,536 Canadians surveyed by Charlton in October reported it’s becoming too expensive to subscribe to all the online content they want to see. And, while 41% say a regular TV subscription is too expensive, the research shows the number complaining about that is actually falling while reporting increased satisfaction with their traditional TV package.

“We’ve been tracking satisfaction for a long time,” said Hendren, “and as you can see in May we hit an all-time high at 75% satisfied. In October, 66% is our satisfaction number… still the highest satisfaction number we’ve ever had.

Back to the 18-34 group which, despite some growth in satisfaction with TV are still cord-trimming, “looking at the results that we see, given that the trend among this cohort is to increase their OTT engagement and to decrease their paid television engagement, then I think this OTT piece is one that needs to be seriously considered in terms of a bundling approach.

“I know it’s already being done with Netflix and so on, but I think it needs to continue and… particularly be targeted to this group. Gen Z would be on this track, as well as the even younger emerging new clients,” Hendren predicted.

Surely, Canadian BDUs know this, otherwise why would they each be pushing so hard selling platforms (Ignite TV, BlueCurve, Helix, Fibe, Optik, etc.) that combine linear TV and OTT content. The linear lineup is the one slice of content where the traditional pay TV providers have a leg up over the likes of Amazon, Netflix, Roku, and Disney+, where marginal to no live content is available.

Some other highlights to the presentation:

- The 2021 outlook for sports TV looks good, especially with the NHL likely creating a Canadian-only division during the ongoing Covid crisis driving viewers to “a real hockey night in Canada,” said Hendren.

- More Canadians want to bet on sports. The federal government is moving to expand how they can (as we reported this week), and this can be good for broadcasters. In a separate study, Charlton found sports betting is a $6 billion/year industry, with $2 billion going offshore. “So the Canadian government is realizing that and saying, ‘Hey, why don’t we make it legal so that that revenue can be retained in Canada’?”

- Cord cutting has accelerated during the pandemic. According to the research, 73% of Canadians reported they subscribe to a pay TV service in October. That’s down from 91% in 2013, said Hendren. “What is up is having cut the cord in the last two months. We noticed that that went from a 4% in May of 2020 to 8% (of survey respondents reporting it in the October survey). So there definitely is a push in that regard. What we’ve been seeing over time is an erosion of one to two points per year. I’m not sure if this indicates a big acceleration, but it’s definitely a concern.”

- Once lost, or never gained, those folks are hard to convince to get a pay-TV package. The likelihood subscribe to TV service remains low among non-subscribers as 16% say they would be likely to do so in the next 12 months, and only 3% say “very likely.”

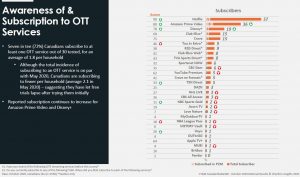

- 50% of Canadians subscribe to a pay TV service as well as to at least one OTT provider. (See below for the lengthy list of OTT brands to which Canadians report they subscribe.)

- Many Canadians share their passwords, so the 57% of Canadians who report they have a Netflix subscription is likely far lower than the real total since so many are using others’ credentials to watch.

- 45% of Canadians would prefer to watch all new release movies at home, rather than go to a theatre, while 34% say it would depend on the movie. Only 21% say they prefer the movie theatre and just 4% have gone to a movie theatre since the start of the pandemic, says the report.

For the full 101-page report, it is available online for CTAM Canada members. Please click here to join.