CANOE VENTURES IS hoping 2019 is the year where it begins to help build video on demand advertising together with BDUs and broadcasters into a $200 million marketplace.

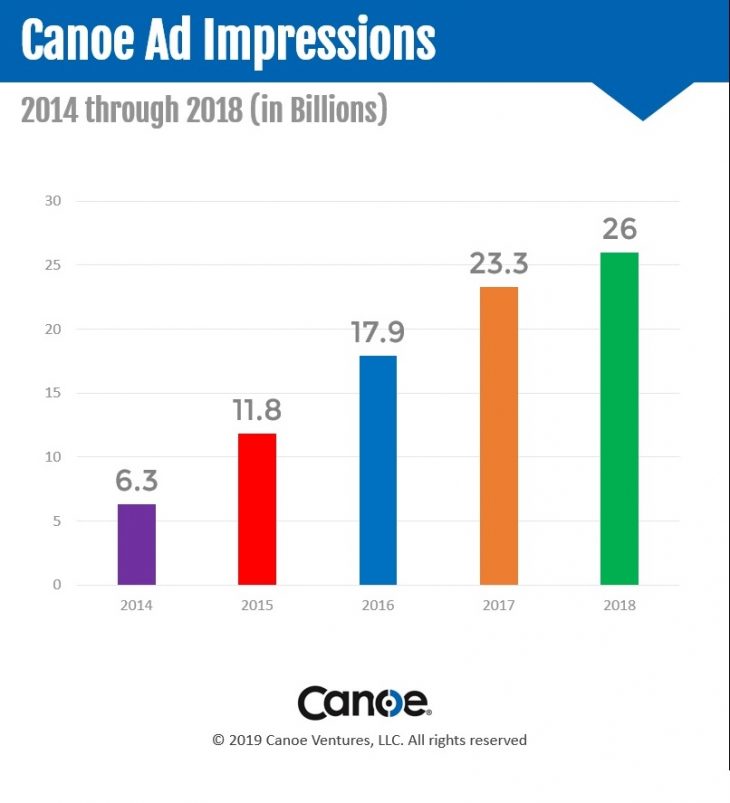

The U.S. company (which is co-owned by MSOs Comcast, Cox Communications and Charter Communications) has been the driver behind huge success Stateside, where the VOD ad business is already a US$1 billion market. Canoe alone delivered 26 billion ad impressions in 2018 on 7,476 ad campaigns. It delivers VOD ads to 36 million American households for broadcast clients such as ABC, A+E, AMC, CBS, Discovery, MTV, NBC, Showtime, Univision and others.

Now, the company has turned its sights to Canada. It has hired long-time sales rep Peter Fousas (former Nokia, Casa Systems and Wind Mobile) to convince Canadian carriers and broadcasters their VOD offerings are underutilized and ripe for ad revenue growth.

“Our plan is to take the same tried-and-true techniques that got us to achieve 26 billion impressions here in the States, and just apply all of that learning, and all of those techniques up there,” said Canoe’s VP global sales Chris Pizzurro, in a recent interview with Cartt.ca.

Right now, most of the limited ads carried in Canadian broadcaster VOD streams made available to BDU customers are generally promos for future or existing programming and are not dynamically inserted (new ads into library VOD content). In Canada VOD ad space mostly hasn’t been sold time and Pizzurro believes it can be done for minimal upfront investment since Canoe’s software works with VOD servers already in place – and with all generations of carrier end-user and headend gear. This includes well-worn Motorola-branded cable set tops as well as new technology such as Comcast’s X1 platform (being deployed by Shaw, Rogers and Vidéotron) and MediaKind (in use at Bell and Telus and about to be launched at Cogeco). Basically, he explains, while there is an upfront commitment to launch its ad services, there isn’t a lot of work to do at the cable/IPTV headends to make it pay off – and soon.

“It can literally take just a year. We have the road map… We think if everyone just follows these techniques we can get to that $200 million pretty quickly.” – Chris Pizzurro, Canoe Ventures

“It can literally take just a year. We have the road map,” he says. “We think if everyone just follows these techniques we can get to that $200 million pretty quickly… We’re not saying ‘buy our widget’. What we say, is, ‘use whatever you want,’ and we only really have our engineers to interconnect things, and make sure those things are working."

Pizzurro does admit, however, that in order to make this work properly, Canoe needs scale – and that means it needs the biggest three pay TV carriers (Shaw, Bell and Rogers) to come on board together. That way there is meaningful VOD ad inventory on offer for Canadian broadcasters to sell into their shows sitting in those VOD servers.

It’s worth noting here that Canoe does none of the ad sales. All of that would remain in the broadcasters’ hands (something CRTC regs require anyway). “What we’re doing is leveraging the equipment already in the cable headend. That’s where we work our magic… We don't get in the way of the sales process… We'll do everything to support the sale, both technically and from a education point of view, but we don't get in the way of the sale.”

Let’s say, for example, there is a Toyota campaign running on the Food Network (linear and VOD) and Canoe is running on Rogers Cable systems. Canoe will make certain those ads run where they are supposed to and in the frequency they are supposed to in the correct Food Network shows – and tracks all that data so that the broadcaster can report to the client and earn its new VOD ad dollars.

" “You have this underperforming asset just sitting there." – Pizzurro

When it comes to the business model for this, Canoe leaves it up to the broadcasters and carriers to negotiate. Stateside, the bulk of the revenue stays with the broadcaster. “The programmer is going out and selling the total footprint and VOD, and inserting the ad from the Toyotas of the world, so they are the ones taking in the money.

“Then, yes, from there, they would decide whatever percentage of value goes back to the MSO, whatever percentage of value comes to Canoe… or anyone else they need to,” adds Pizzurro. “We don’t get involved in the business terms, we just manage the implementation.”

What about how there are already an uncountable number of places where brands can advertise and that TV advertising seems to be at a plateau at best? Won’t VOD ads just dilute the sales to the mass-market linear television platform? “We think we're actually bringing impressions back to the television ecosystem by allowing the consumer to watch a program on VOD and for the programmers to monetize that,” counters Pizzurro. “What we're actually doing is bringing the money back to TV, or keeping it from leaving TV.

to TV, or keeping it from leaving TV.

“The worst thing that’s happening, is the consumer is leaving the ad-supported ecosystem, going to Netflix, watching a show for ‘free’, then Netflix is making the money, and (the broadcasters and carriers) are actually cut out.”

What Canoe is trying to say (while hoping our competing vertically integrated companies can co-operate on something like this) is: “You have this underperforming asset just sitting there. Just give us the ball to take it over the goal line and we can squeeze more revenue out of every single one of those old Motorola boxes. And those new X1 boxes."

Watch for stories in the coming weeks on other new TV advertising platforms in Canada.