Canadian consumers seek affordability and are open to ad-supported streaming options to save money, but nearly half of them are likely to cancel those subscriptions if prices continue to climb, according to a recent study by media agency Horizon Media Canada.

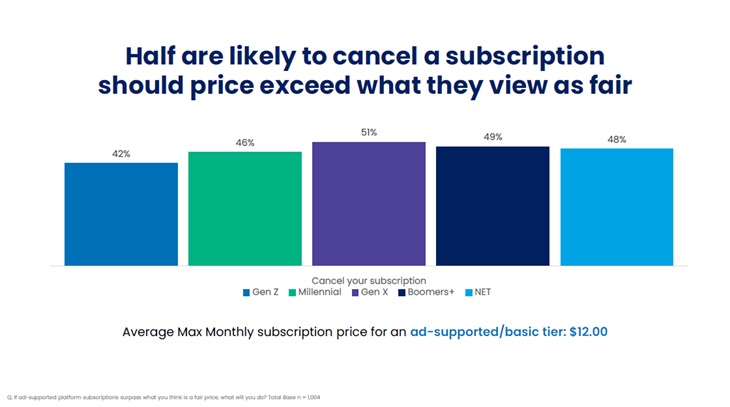

Forty-eight per cent of survey respondents, spanning across all age demographics — Gen Z (42 per cent), Millennials (46 per cent), Gen X (51 per cent) and Boomers (49 per cent) — said they would cancel ad-supported streaming if the price exceeds what they consider to be fair. The average maximum monthly subscription price for an ad-supported basic tier is $12, according to the study.

Of those surveyed, 36 per cent were subscribed to an ad-supported streaming platform, 39 per cent to an ad-free service, and 26 per cent were subscribed to both types.

Horizon Media conducted its nationwide survey of 1,004 Canadians from March 14 to 26, 2024. The purpose of the survey was to better understand Canadians’ views on ad-tiers and streaming platforms, and relevant topics such as value perception, user satisfaction, platform perception and viewing preferences, Horizon Media said in a press release.

“Many Canadians facing financial pressures have switched over to ad-supported tiers to save money, but they’re ready to abandon streaming if prices continue to increase,” Simon Ross, vice president of strategy and insights at Horizon Media Canada, said in the release. “And while some are seeking affordability, most still prefer ad-free options and are willing to pay extra for them. This highlights the need for streaming platforms to strike a balance between offering cost-saving options and catering to the demand for ad-free experiences.”

Horizon Media found survey respondents were more receptive to ads targeted to their interests. Sixty-two per cent of Gen Z, 71 per cent of Millennials, 78 per cent of Gen X and 87 per cent of Boomers indicated they were annoyed by the lack of relevant ads they see on their streaming platforms of choice. In addition, 84 per cent overall said they were either dissatisfied or unsure with the variety of ads they are seeing, and 78 per cent said they have never taken any action after seeing an ad while on a streaming platform.

Netflix is the preferred streaming service in Canada, except in Atlantic Canada where Amazon’s Prime Video leads, according to the study. Of those surveyed, 73 per cent are subscribed to Netflix, 61 per cent to Prime Video, 35 per cent to Disney+, 22 per cent to Crave and 14 per cent to Apple TV+. Other streaming platforms mentioned by survey respondents include Pluto TV and Tubi.

When it comes to Canadian content on streaming platforms, 53 per cent of survey respondents stressed the importance of streaming platforms offering content produced in Canada or by Canadian creators. And while 64 per cent said streaming platforms do a good job in representing diverse voices and perspectives in their content, 61 per cent said they feel there is room for improvement on current Canadian content offerings, according to the study.

“Canadians prioritize platforms with extensive content libraries, particularly those featuring Canadian content,” Ross said. “This emphasis on content depth underscores the importance for brands to prioritize advertising on platforms that offer diverse and locally relevant programming.”