GATINEAU – There is broad consensus among parties to the CRTC’s TV policy review that a mandated small basic package is not likely to come with a lower price tag.

A skinny basic to go along with a pure pick-and-pay channel regime could also cause some sticker shock, not only for consumers but also for broadcast distributors looking to acquire programming, according to the big content owners and the VI companies.

Bell Canada argues that broadcasters will bear the brunt of unbundling. First, because channels will have less penetration, fewer customers will share the costs of that service, driving prices skywards. Secondly, advertising revenue will go down because there are fewer viewers. Lastly, the cost of a particular service goes up further because the broadcaster will have to spend more on marketing and promotion to attract viewers.

The company acknowledges that new wholesale models will need to be developed in a pick and pay world with historical pricing, packaging and affiliation agreements no longer relevant. But rather than turning to inefficient regulation, Bell suggests a return to a policy where services without carriage rights can withhold their signal during a dispute and a BDU can take the signal down.

This “will force broadcasters and BDUs to be creative, especially where the broadcaster has the potential to lose a large number of subscribers or the BDU to lose highly desirable services for its customers. The economics of the Canadian television market are such that both programmers and BDUs are incented to get a deal done. We expect actual disputes to be rare and short-lived, if they even occur at all,” reads the Bell submission.

Content owners also question the merits of the Commission’s proposed a la carte model. Corus Entertainment argues it will only increase the unit and overall costs to consumers and decrease programming diversity in the system. The economic viability of services, under the CRTC’s approach, “is in our view non-existent,” said the company. Corus adds the Commission should leave certain practices, such as the use of penetration-based rate cards, alone. It points to Broadcasting Decision 2012-208 for evidence:

“The Commission considers that, in return for the increased flexibility, the programming undertaking may reasonably request higher wholesale rates from a BDU in recognition of the fact that lower penetration, and thus lower volume, may result under a flexible packaging option. Consequently, it would be commercially unreasonable for a BDU to expect fixed unit pricing based on fixed penetration levels while enjoying the flexibility of delivering fluctuating penetration levels.”

Independent broadcast distributors argue, however, that the current bundling environment isn’t working. It’s forcing them to pay higher rates for services individually or insert them in high-penetration tiers, instead of giving customers more choice. Both Telus and MTS TV points to sports programming as a prime example of what’s wrong with current bundling rules (something Cartt.ca has explored in detail in a previous report).

“Sports programmers have long argued that they need a cross-subsidization model in order to succeed, but with wholesale rates comparable to premium movie services, consumers who do not want sports on their channel lineup should not be required to cross-subsidize those who do.” – MTS

“Sports programmers have long argued that they need a cross-subsidization model in order to succeed, but with wholesale rates comparable to premium movie services, consumers who do not want sports on their channel lineup should not be required to cross-subsidize those who do. Consumers who do want sports on their lineup must be prepared to pay premium pricing for it, in the same way that movie services have been sold in Canada for over three decades,” says MTS.

Telus notes in its intervention that a more rational approach to the pricing of individual services is needed. In collaboration with Nordicity, the company developed a multi-stage methodology that would measure the value of a service through a number of different lenses: rates for similar services, value in the package and other factors such as carriage.

This type of “explicit framework,” says Telus, combined with greater restrictions on packaging requirements will lead to more choice for consumers. “This new framework will rebalance the fees paid to programming services, by increasing or decreasing the fees paid to programming services in accordance with actual levels of consumer demand.”

Consumer dispute resolution

In a pick-and-pay world where there is greater consumer choice for TV services, new mechanisms may need to be put in place to ensure viewers can effectively cancel and subscribe to new services and even switch providers. Writing on behalf of a number of different consumer oriented organizations, the Public Interest Advocacy Centre (PIAC) notes this might be a real headache for consumers.

“In other words, if a subscriber received a programming service on the first day of a month, but cancelled on the second day of that same month, the BDU would be obliged to pay the programmer 50% of the affiliation payment fee.” – Bell Canada

It suggests that the commission use the wireless code of conduct as a model from which to create a code for BDU customers. Termination requests, for example, could be processed immediately just as they are for wireless users. PIAC adds that the Commissioner for Complaints for Telecommunications Services (CCTS) could be the independent body to handle such complaints.

Bell, while it agrees that the CCTS could take on this additional responsibility, opposes the elimination of termination notices or charges because of the way affiliation payments are calculated.

“In other words, if a subscriber received a programming service on the first day of a month, but cancelled on the second day of that same month, the BDU would be obliged to pay the programmer 50% of the affiliation payment fee, even though the subscriber only received service for 1/30th of that month, and (under a "same day" cancellation rule) the BDU received only a partial or pro-rata payment from their customer for the two days it provided the service,” the company says.

The hearing starts September 8th with Netflix, Google and Amazon all slated to appear on day one.

ED NOTE: This is the 11th story from our ongoing, summer-long breakdown of the official submissions made to the CRTC for it's Let's Talk TV, TV Policy Review. The first 10 are linked below.

The CRTC must act to save local television

Different rules for different language markets

Genres have long been monkeyed around with. Do they still need protection?

Is basic bloated? Does it need a diet?

Pick and pay in Canada strikes out with U.S. media heavyweights

U.S. border stations want to use Let's Talk TV to wrest cash from Canadian BDUs

Should Yankee go home? The changing role of U.S. channels in the Canadian broadcasting system

No “Netflix Tax”, company warns CRTC

Snap Judgements: Everyone wants more choice – tied to a lot of ifs, ands, buts…

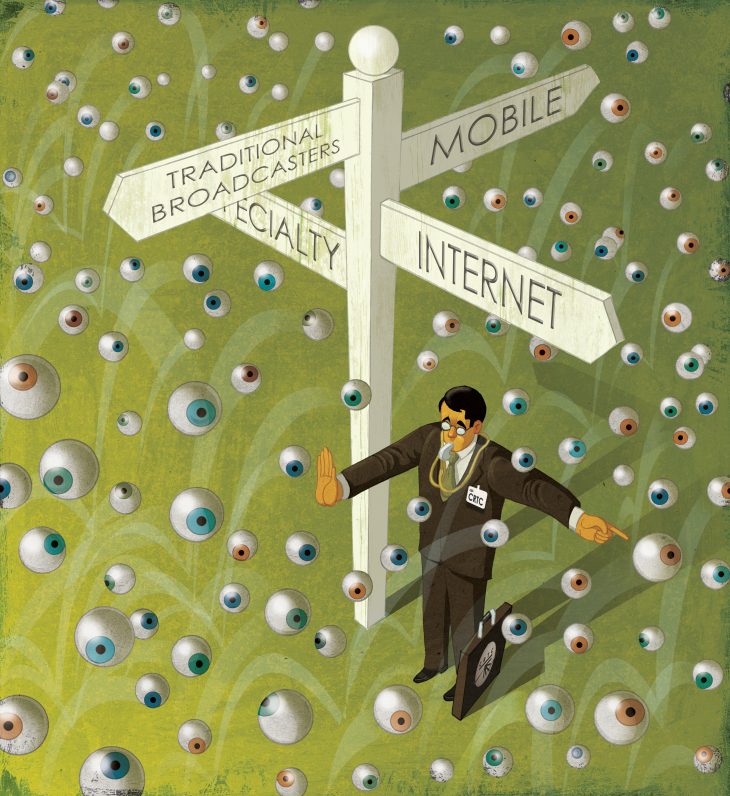

Original artwork for Cartt.ca by Paul Lachine, Chatham, Ont