Amazon and Pinterest actually saw YoY growth

WHILE THE CANADIAN media market continues to struggle with unprecedented decreases in advertising revenue, June was a little better than May, according to Standard Media Index.

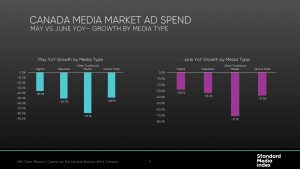

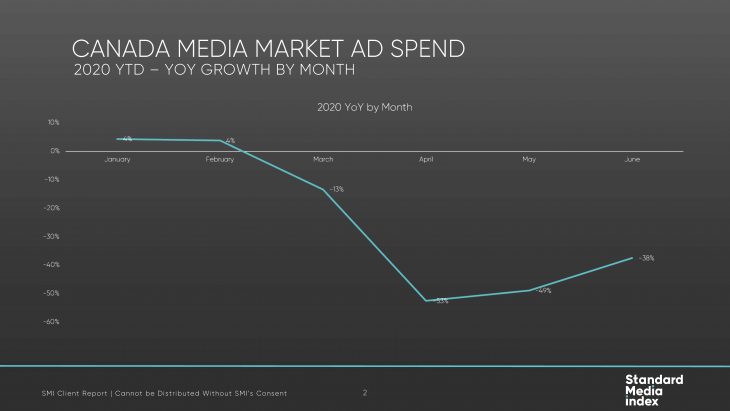

The company’s data shows June saw an 11% improvement in dollars invested in ad spend over May. “June ad spend was down by (only) 38% YoY, in comparison to a 49% YoY drop in May,” said the company’s June report on the Canadian market. The data covers all media types, media owners and product categories.

“Not surprisingly, the vast majority of publishers have experienced significant decreases in revenues due to Covid-19. Bucking this trend was Amazon and Pinterest, both actually reporting growth in June 2020, when compared to June 2019,” said James Fennessy SMI’s CEO.

“Amazon had an increase in ad revenue from national brands of +24% and Pinterest had more than doubled their revenues, albeit off a low base. With shopping behaviour shifting from in-store to online, these results aren’t too surprising,” he added.

Of all the major TV networks, CBC performed the best with a drop in ad revenue of 16% in June 2020, compared to June of 2019. “The lack of sports programming and pull backs from marketers across the board had the television sector in June dropping by -33%,” continued Fennessy.

“We know there is a lot of pent up demand for live sports as fans and advertisers are waiting for the return of the NHL scheduled for August 1, with all games originating from Toronto and Edmonton, and the NBA on July 30th, where the reigning champions, Toronto Raptors will play out of Orlando, Florida. This will give a much-needed shot in the arm for the industry,” he said.

Sadly for marketers, the Covid-19 crisis bludgeoned what had started as a pretty good year as the beginning of 2020 saw the Canadian media market increase ad spend by 4% before the pandemic hit, says the SMI data.

Other key data from the report include:

- At the height of the Covid-19 crisis in April, ad spending had declined by 53%, year-over-year. The ad market improved only slightly in May with an ad spending drop of 49%, as compared to May 2019.

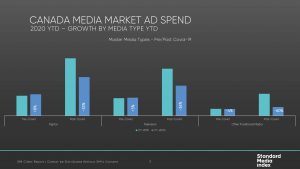

- In January and February, digital media ad spending saw an 8% increase over 2019. Between March and June, digital ad spending had dropped by 33%.

- Television is reporting a decrease of 36% in ad revenue from March through June.

- Other traditional media (Radio, Print, Out of Home), recorded the most significant declines with revenue, dropping by 60%. This media group began the year with a 4% decrease.

- Overall, digital is reporting the quickest recovery, increasing eight points, to -28% in June.

- In the month of June, Television saw the biggest recovery to -33% vs -51% in May.

- In June alone, Amazon saw an increase in revenue of +24%. “The strength of Amazon can be attributed to the necessity of e-commerce during the pandemic and shifting consumer behaviours,” explains the report.

- All other media owners experienced a decline in ad revenue in June of between -14% (Microsoft) to Jim Pattison Group, which had the largest drop of -69%, compared to June of 2019.

When it comes to the product categories being advertised, technology (telecom, consumer electronics, software, internet products) was the only one that experienced growth in June, showing a 5% YoY increase in June.

The pharmaceutical and packaged goods categories, though still in decline, are performing okay. Pharmaceutical ad spending was down by only 4% while CPG was off by 9% in June, compared to 2019.

Of course, the travel category continues to struggle, falling 93% in June. It had been down by 81% in May.

SMI’s data captures 94% of all national brand spend in Canada, collected through relationships with all major agency holding groups. We profiled the company here.