TORONTO – Seamless customer care experiences directly correlate with a consumer’s view of their wireless provider and appetite to remain a loyal customer, says an annual study by J.D. Power & Associates released Thursday.

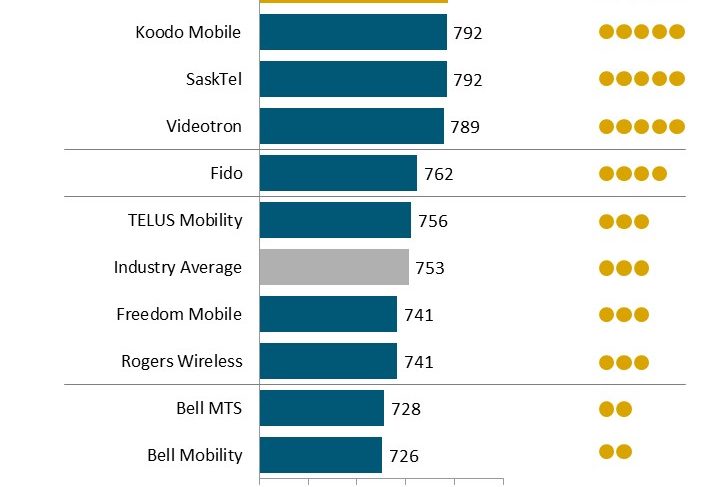

According to the J.D. Power 2018 Canada Wireless Customer Care Study, Bell’s Virgin Mobile ranks highest in wireless customer satisfaction for the second year in a row, followed closely Telus’ Koodo Mobile, SaskTel, and Videotron.

The study measured wireless customers’ perceptions of their carrier’s performance and is based on an online survey of more than 5,500 wireless customers in February-March 2018. Satisfaction is measured in two factors: assisted care and unassisted care. The assisted care channels include phone customer service representative (CSR); in-store; online chat; email; post to social media; and carrier’s mobile app to ask a question or make a request. The unassisted care channels include automated telephone system (ARS); website to look for information; social media site to look for information; and user forums.

The study shows that the amount of effort required from a customer to resolve an issue significantly affects their satisfaction with, and impression of, their provider. Overall satisfaction among customers who faced challenges dealing with their wireless provider is 186 points lower (on a 1,000-point scale) than among those who had a seamless experience (652 vs. 838, respectively). Furthermore, customers who experienced an onerous problem-solving process viewed their wireless provider less favourably, perceiving the carrier to be more focused on the bottom line than customer service, unreliable and providing poor value.

One third (32%) of customers said that it took a lot of effort to resolve a recent problem with their wireless carrier, while 41% who encountered hurdles in the resolution process are considering – or have decided – to switch their provider.

Nearly two-thirds (62%) of customers reported using their phone as a channel to resolve an issue with their wireless service provider in the past six months. While a phone call is still the most common channel among customers, the use of social media as an option for problem solving is on the rise, especially among younger customers. Nearly one-fourth (23%) of Gen Z wireless customers (defined as those born 1995 or later), have used social media to post a question, compared with only 4% of Boomers (born 1946-1964). Similarly, 24% of Gen Z customers – but only 7% of Boomers – have researched social media for an answer.

Posting on social media to resolve an issue results in lower satisfaction levels (696), compared with using social media to independently research a problem (765). Among the unassisted channels, watching a carrier video increases satisfaction (769), compared with the unassisted care average (718).

“With generational shifts, social media’s role as a preferred channel for problem resolution continues to grow, but the study shows that wireless carriers are not fully able to handle the task yet,” said Adrian Chung, J.D. Power’s director of the technology, media & telecom practice, in the report’s news release. “Customers who do their own research on social media platforms are able to solve issues faster than those who post a question and have to wait for answers.”

Other key findings include:

– The virtual hold keeps customers on hold: Customers who called for assistance and opted for a virtual hold waited 59 minutes, on average, for a call back, compared to the 12 minutes it took customers who waited on hold to speak to a representative. Virtual holds drag down satisfaction with the phone channel, which is 47 points lower than when not using virtual hold (719 vs. 766, respectively).

– Talking to a manager doesn’t guarantee resolution: Customers who phoned their wireless carrier with an issue that was escalated to a manager were less satisfied with their phone channel experience, compared with industry average (650 vs. 757, respectively). Also, only 73% of such customers were likely to resolve the issue, compared with the industry average of 83%.