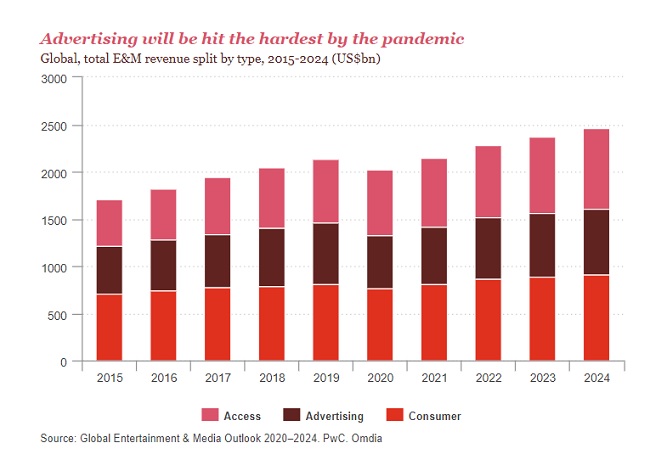

NEW YORK — In case anyone needs more proof the entertainment and media industry has been hit hard by the Covid-19 pandemic, New York-based PwC’s Global Entertainment & Media Outlook 2020-2024 report says 2020 will see the sharpest fall in global E&M revenue in the 21-year history of PwC’s research, with a decline of 5.6% from 2019, or more than US$120 billion.

By comparison, in 2009, the last year the global economy shrank, total global E&M spending fell by only 3%, says PwC in its news release announcing availability of the report.

However, according to PwC’s forecast, the industry’s fundamental growth trajectory remains strong, and based on its projections, E&M spending will grow by 6.4% in 2021 (assuming the pandemic does subside). Looking across the five-year forecast period (from 2019 to 2024), PwC is forecasting overall E&M revenue growth will increase at a 2.8% compound annual growth rate.

Not surprisingly, advertising will be hit the hardest by the pandemic, with PwC estimating global spending on advertising will fall by 13.4% in 2020 to US$559.5 billion. PwC says advertising will be the slowest segment to recover and is not expected to exceed 2019 figures until 2022. Among some of the advertising trends noted in PwC’s report, Internet advertising has emerged relatively unscathed during the pandemic, as compared to print advertising. In addition, some advertisers are turning away from traditionally channels hit hard by Covid-19 disruption (such as cinema or out-of-home advertising) to podcasts, which are proving resilient, according to the PwC report.

The Covid-19 pandemic has accelerated ongoing shifts in consumer behaviour, pulling forward digital disruption and transforming some E&M segments much earlier than was originally projected, says PwC. For example, OTT is expected to thrive in 2020, at the expense of cinema and traditional TV. According to PwC’s forecast, subscription video-on-demand (SVOD) revenue is expected to overtake box office revenue in 2020 and is projected to surge away in the next five years, reaching more than twice the size of box office in 2024. The pandemic will also accelerate cord-cutting, particularly in major traditional TV markets such as North America, PwC predicts.

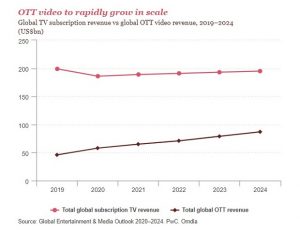

According to PwC’s forecast, OTT video will see global revenue surge by 26% in 2020, and is expected to almost double in size from US$46.4 billion in 2019 to US$86.8 billion in 2024.

“The launch of the Disney+ streaming service in late 2019 could hardly have been better timed: having projected between 60 million and 90 million paying subscribers by 2024, Disney+ reached 60.5 million in early August 2020,” reads the PwC news release.

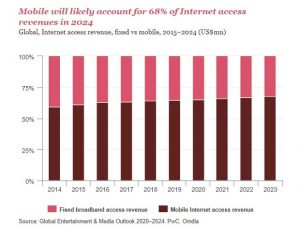

PwC says the rise of streaming will see global data consumption jump by 33.8% in 2020. Data consumption will more than double from 1.9 quadrillion megabytes in 2019 to 4.9 quadrillion MB in 2024, according to PwC’s forecast. Looking at smartphones and data consumption, PwC says the smartphone is now set to pull away as the leading individual device used by consumers to access the Internet globally. However, despite global disruption, fixed broadband is on course to reach one billion households globally in 2020, with unique mobile Internet subscribers approaching 3.4 billion by the end of the year, PwC says.

“It’s clear that Covid-19 has accelerated consumers’ transition to digital consumption and triggered disruptive change — both positive and negative — across many forms of media. Yet it’s equally evident that the E&M industry’s underlying strengths and appeal to consumers remain as strong as ever. While there will still be challenges for E&M companies as we move beyond the pandemic, the digital migration that it has pulled forward will also generate opportunities in all segments — not only those that have benefited from its impacts to date,” said Werner Ballhaus, global entertainment and media industry leader at PwC, in the news release.

For more information about PwC’s Global Entertainment & Media Outlook 2020-2024 report, please click here. Information about the report’s individual segment findings can be accessed here.