FIXED WIRELESS ACCESS (FWA), connections will grow to around 88 million in 2022, increasing from about 60 million in 2020, Deloitte Global has predicted.

The economics as well as the data rate performance of FWA, “which uses radio waves to deliver internet service between two stationary locations such as a mobile tower and a customer’s home or office, are finally becoming competitive with that of wired internet services,” reads Deloitte’s 2022 Technology, Media, and Telecommunications (TMT) Predictions report.

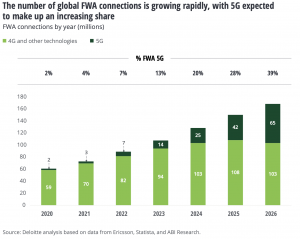

Along with predicting the increase in FWA connections from 60 million to 88 million, Deloitte is predicting 5G FWA will represent nearly 7% of the total (shown right). “While our analysis reveals a 19% 2020-2026 CAGR in total FWA connections, 5G FWA connections will grow even faster, at a CAGR of almost 88%, over the same period,” the report says.

During a virtual presentation on the report yesterday, Duncan Stewart, Deloitte Canada’s director of research, technology, media and entertainment, and telecommunications, provided an example of how FWA is rolling out in Canada by discussing a telco he left unnamed.

“That telco is deploying fibre to millions and millions and millions of Canadians in relatively dense urban and suburban areas,” Stewart said.

“But when you start getting to the edge of those suburbs all of the sudden the density is maybe not high enough for fibre. This telco, this Canadian telco, and many others around the world are now explicitly saying, if you don’t have fibre and you’re not eligible for fibre, hook yourself up with fixed wireless access.”

According to the TMT report, “Many operators have deployed FWA selectively for decades to offer customers internet service, typically in underserved areas where wired internet connections are unavailable.”

At this point, “FWA has not achieved widespread operator adoption outside of a few countries such as Austria or Finland,” the report says. “However, with more governments providing broadband funding and more regulators viewing wireless as an acceptable alternative to wireline connections, more operators are considering FWA, especially the enhanced 5G version, for delivering broadband internet services.”

The most important impact of the growth of FWA connections, Deloitte says may be its contribution to narrowing the digital divide.

“It can be challenging to justify broadband investments in sparsely populated areas with few paying subscribers or inaccessible terrains such as mountains or islands, or even in cities where local ordinances and permitting make it challenging and expensive to connect to customer premises,” the report says.

Being wireless, FWA “can reduce the massive upfront cost and time needed to secure permissions, dig trenches, lay last-mile fibre, and deploy technician-installed equipment at households and businesses. Moreover, operators can often roll out FWA using their existing mobile wireless networks and fibre backhaul infrastructure, further reducing costs.”

Deloitte Global is also predicting more Wi-Fi 6 devices than 5G devices will ship in 2022.

“5G may get the lion’s share of the publicity, but Wi-Fi 6 devices are quietly outselling 5G devices by a large margin and will likely continue to do so for the next few years at least,” the TMT report says.

Deloitte predicts at least 2.5 billion Wi-Fi 6 devices will be shipped this year compared to around 1.5 billion 5G devices.

As Stewart noted in his presentation, however, Wi-Fi 6 and 5G “are complementary technologies – they are not perfectly substitutive.”

“… people are churning their socks off” – Duncan Stewart, Deloitte Canada’s director of research, technology, media and entertainment, and telecommunications

Deloitte further made several predictions regarding television, including that subscription video-on-demand (SVOD) churn will be high for 2022.

“As leading streaming providers expand globally while national media companies spin up their own domestic streaming services, the amplified competition is creating abundant consumer choice – and churn is accelerating as a result,” the report says.

Deloitte, conducting research in multiple countries, found “people are churning their socks off,” Stewart said.

The organization is predicting in the next year, there will be at least 150 million paid subscriptions cancelled worldwide “with churn rates of up to 30% per market,” according to the TMT report.

“Don’t freak out, 30% is high,” Stewart said. However, “more people are adding subscriptions and in markets with the highest churn, those cancelling are going to resubscribe.”

Deloitte predicts “that, overall, more subscriptions will be added than cancelled, the average number of subscriptions per person will rise, and, in markets with the highest churn, many of those cancelling may resubscribe to a service that they had previously left,” the report says. “These are all signs of a competitive and maturing SVOD market.”

“The interest in SVOD is becoming less and less about pure subscribers and looking more and more about revenue and retention and other stuff like that,” Stewart said.

Another prediction Deloitte made this year is that addressable TV advertising will generate around US$7.5 billion globally, which is around 40 times more than Deloitte forecasted it would in 2012, according to the report.

Addressable TV advertising “allows different ads to be shown to different households watching the same program,” the report explains. It is still a small part of the global TV ad market forecast for 2022, even with the 40-fold growth in 10 years.

Addressable TV advertising is not likely to grow “through individual advertisers making different ads with which to target different households,” the report explains.

“For the next five years, Deloitte expects major advertisers – which will continue to be the major buyers, in monetary terms, of TV ads – to value addressable advertising more for its ability to extend reach, and so spread their message to the majority of each market, rather than for its capability to differentiate messages by household or individual viewer.”

For more, please click here.

Image and chart borrowed from Deloitte’s TMT report.