AS REGIONS ACROSS Canada begin to lift their stricter lockdowns, the severe drop in media investment experienced since the beginning of the mid-March pandemic is starting to flatten out – and when it came to ad spending on digital media in May, it’s begun a small uptick, according to Standard Media Index.

“Over the past three months we have seen the enormous impact Covid-19 has had across most facets of our lives. For the media and advertising industry specifically, we saw media investment in April drop to less than half of last year’s,” said James Fennessy, CEO of SMI. Ad booking from some sectors fell even further as the travel services segment spent 78% less, entertainment segment 60% less and automotive 58% less.

In May, however, SMI “began to see some slight recovery in the market,” but more traditional media like TV, out of home and radio had not yet experienced it.

“Digital is the one area that has shown early signs of picking up, which we expect to accelerate in the coming months,” added Fennessy. “E-commerce has helped to fuel this pick up in digital, as more shoppers shifted to online purchases. We will be keeping a close eye on trending across media type and category in the coming weeks and months.”

Other highlights from the report include:

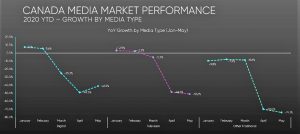

- The Canadian agency media marketplace grew +2.8% in the initial two months of the year. The impact of Covid-19 in the second half of March caused a 40% decline in media investment between March and May, for an overall drop of 26.6% compared to the same period last year.

- As lock-down measures began to lift, May saw a slight increase in investment from April, which experienced the biggest decline in market performance of -52.5%.

- Digital media continues to see the strongest recovery month-over-month. May saw a reduction of 8 percentage points, going from -49.2% in April to -41.2%. Other traditional media, which includes out of home, print and radio, continues a downward trend month-over-month sitting at -74.1%. Television saw a slight decline since April to -51.2%.

- The most significant changes in media type share – beginning in March 2020 – affected television and radio (with +1.4% and +1.3% share points, respectively), at the expense of Out of Home with a decline from +6.2% to +4%.

- Both television and digital actually began the year with an increase in spend of +2.6% and +6.5%, respectively.

- In Television – specialty TV had a significant decline of -44%, between March and May, year over year. This decline can be attributed to the cancellation of sports programming in March, says SMI. Sports programming declined -81% year over year, between March and May.

- Conventional TV fared better than specialty TV, with a decline of -27.4%, aided by the positive performance of news programming.

- When looking at the impact Covid-19 had across all media sub types, there was a significant drop across the board. Social held up best with a decline of -31% year over year, between March and May.

- Personal care and prescription drugs continued to advertise through the pandemic, with the personal care segment growing 6% year over year.

- Toys and health & fitness were impacted, but still managed to remain among the 3rd and 4th least impacted categories.

When comparing to the U.S. market, although the pandemic hit the U.S. harder and continues to reverberate, due to the nature of their media market being stronger, Canada saw steeper declines in spend between March and May of 40.1% compared to the U.S. which saw a decline of 28.3%..

Digital media performed much stronger in the U.S. than in Canada with the U.S. market declining -18.4% vs Canada declining -38.3%. Television and other traditional media market reactions to Covid-19 were similar.

For more on SMI, please see our story here and for more on this report, please click here.