TORONTO – With the national dialogue stuck on familiar battle lines of lower prices versus network investment, Boston Consulting Group’s Centre for Canada’s Future published a new report today reminding the industry, the public and especially policy makers there are no simple black and white decisions here.

It’s complicated. Government and the CRTC must balance affordability with the need for quality, availability, investment, and innovation to enable the best outcome for Canada’s digital infrastructure. It isn’t easy.

The report estimates the benefits of what its authors see as the coming digital revolution could add $200 billion or more per year to Canada’s GDP by 2040, or roughly $4,500 per Canadian, as long as bad policy doesn’t get in the way.

New consumer services, such as remote health care and driverless vehicles will improve quality of life and economic opportunities for Canadians and policies simply bent on dropping prices in the short term may also short-circuit such consumer gains.

“An advanced digital infrastructure will also help Canadian businesses generate massive productivity improvements, accelerate Industry 4.0, and allow innovators to develop and sell new solutions globally. These advances will require significant investment in Canada’s wireless networks and wireline broadband systems. Policymakers will play a critical role in incentivizing private investment,” reads the report, entitled In the Balance: Future-Proofing Canada’s Digital Infrastructure to Unlock Benefits for All.

“Disruptive regulation-driven downward pressure on prices could lead to an investment gap of up to $15 billion over the next five years, which could damage digital innovation in Canada,” said Vadim Gouterman, a BCG managing director and partner based in Toronto, and a co-author of the report.

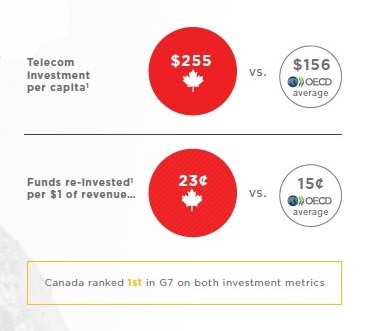

Canada already leads the G7 in telecom investment per capita and Canadians benefit from that with near ubiquitous coverage and quality service. This advantage must be maintained and grown, say the authors.

The report also recognizes affordability is an important policy objective which must be pursued, but the telecommunications services pricing debate is often portrayed as a binary choice between low costs for consumers versus high profits for industry.

“Reality is more complicated. Quick-win policies to lower prices in the short term have the potential to be damaging to long-term investment,” it says. For example, “a scenario where a 25% drop in wireless prices and low mandated wireline wholesale rates could lead to a $2B+ annual CapEx gap. A gap of this magnitude is unlikely to be filled by Canada’s governments, and would have significant effects on the speed and geographic coverage of 5G and fibre networks.”

(Ed note: Hmmm… 25%… where have we heard that number before?)

The research, which also analyzes moves made abroad, cautions Canadian policy makers to first do no harm.

How should those making policy “weigh a reduction of, say, $10 per month in an individual’s bill against a subsequent pullback in industry investment when considering interventions? The answer is not obvious.”

“According to an assessment of global peers, policy interventions singularly focused on affordability have had significant long-term negative impacts on network investment and quality,” reads the report, where Canada’s regulatory environment has resulted in strong quality and availability in wired and wireless networks.

“Investment per capita in wireless and wireline networks was almost two-thirds higher than the OECD average over 2005–2015. Since then, mobile investment per capita has continued to outpace leading economies such as Germany, France, Korea, and the U.K., although it was lower than the U.S. and Australia,” says the report.

“The case studies on how peer countries have tackled affordability challenges are particularly interesting,” added Lawrence Kuo, a BCG managing director and partner based in Toronto and a co-author of the report. “We found that short-term affordability wins often come at the detriment of infrastructure investment levels, which impact consumers in the medium and long terms. While these policies can be easy to implement, it can be quite challenging to undo their consequences.”

The research shows that policies that were too interventionist in places like Israel, France, Spain and Japan saw network investment plummet and network quality suffer.

How should those making policy “weigh a reduction of, say, $10 per month in an individual’s bill against a subsequent pullback in industry investment when considering interventions? The answer is not obvious,” says the research.

The report recommends that Canada addresses affordability concerns through a number of suggestions which make sense, like offering targets tax incentives for companies in specific geographies, revisiting foreign ownership restrictions, reducing the fragmentation in the various funding and government investment plans so that a single body oversees it, and fostering “greater sharing of infrastructure to optimize capital spend, accelerating next-gen rollouts and widening its geographic reach.” BCG would “encourage network sharing agreements, ‘neutral host’ structures in marginal spaces,” and “consider Tower Co. structures,” says the report.

It also notes that thanks to delays in spectrum auctions, Canada already lags behind others in 5G deployment so far.

For the whole report, click here.