Radio, other media, still suffering

NEW YORK – The Canadian advertising market saw considerable growth in the third quarter of the year, as compared to Q2, according to market data cruncher Standard Media Index. SMI collects and publishes media agency payment ad spend data, so its numbers come from actual invoices of ad time/space sold.

With the cancellation of sporting and other live events the ad sector suffered deep declines in Q2 ad revenue, averaging minus-47%. However, in Q3 the broadcast market a big bounce back with 39% growth, ending the quarter only 7% below the 2019 season. The return of the delayed NBA and NHL playoffs were key drivers of this lift, as marketers clamored to reach sports-starved consumers. Rogers Media confirmed this trend in its quarterly results last week where it reported a year-over-year revenue gain of 1%.

“Digital media continued to be a key driver for growth following steep declines of -31% during key months of the pandemic,” reads the SMI press release. “The medium demonstrated its strength quickly outpacing others in the remainder of Q2 and ending the third quarter at -2%. Digital accounted for 55% of the media mix between July and September.”

As for the ad spend in the “other” category, which includes radio, newspapers, magazines and out of home, the “recovery remains idle,” says SMI at minus-40%, compared to Q3 2019.

“As many Canadians continue to remain in their homes Household Supplies was the strongest preforming category with investment more than doubling year-over-year. While the Automotive Vehicles and Dealers category saw a year-over-year decline of -23%,” adds the release.

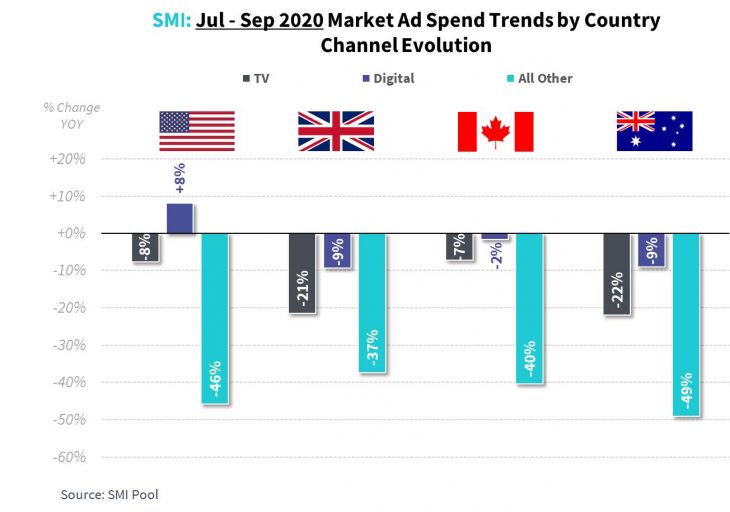

Compared to the other three major English markets in which SMI operates (U.S., U.K., and Australia), “digital media has increased its share of ad spend. In the U.S., digital ad spend in 3Q was actually +8%, driven by video and search. In 3Q, U.S. digital ad spend grew to 49% of total ad spend. For the three remaining markets, the decline in digital ad spend was under -10%. In Canada, digital media accounted for 55% of ad spend, while the U.K was at 50%. In Australia the ad spend share of digital media was much lower at 35%,” reads the research.

“With top-tier sports returning, the TV ad revenue rebounded quicker in the U.S. (-8%) and Canada (-7%). Also driving TV ad revenue in the U.S. was the record high ratings of news networks with the pandemic and upcoming 2020 election coverage. This helped to offset the delay of the upfront ad market and 2020-21 broadcast season, as TV studios were closed delaying the production of new entertainment programs. In Australia (-22%) and the U.K. (-21%), year-over-year TV ad revenue decline was steeper.”