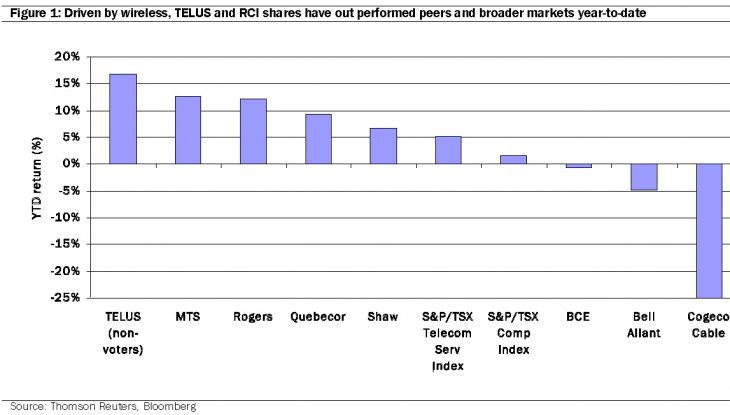

TORONTO – The past year has been a strong one for Canada’s big three telcos (see Figure 1 below), but new wireless pricing plans will cut into Average revenue per user (ARPU). In particular, a new Rogers Wireless price plan (see Figure 2) launched on November 7 and matched immediately by Telus and Bell, along with a maturing smartphone market and looming threat from Wi-Fi could combine to slow future growth. This according to research from analysts Dvai Ghose and Sanford Lee in Canaccord Genuity’s latest Daily Letter to investors.

“On the surface, one could conclude that these new rate plans could crimp Rogers Wireless’ monthly ARPU by as much as $15.00-18.00,” writes Ghose and Lee.

They explain though that while Wi-Fi could crimp cellular data ARPU, it could also reduce capex due to offload. “We view Wi-Fi as a complement more than a threat to cellular. In aggregate, we expect the Canadian wireless incumbents to generate 7-8% EBITDA [in 2013]. In contrast, Canadian wireless new entrants are finding it far tougher and still only account for 5% of the wireless subscriber base in Canada.

They add that Bell Mobility’s decision to offer unlimited long distance promotions in Western Canada and Telus’ decision to match in Central and Eastern Canada; and wireless broadband capex requirements will also impact revenues, but should be offset by a number of other positive factors.

Ghose and Lee note that lower data pricing could stimulate usage; churn may decline due to greater simplicity and family plan emphasis; shared data plans could encourage subscribers to bring your-own-device (BYOD) and this could help reduce hardware subsidies and stimulate margins; and increased rate plan simplicity could drive less call centre time. In total, they estimate a $50 million EBITDA hit for the incumbents, but added this is “immaterial when compared with our $8.2 billion aggregate EBITDA forecast for the wireless incumbents in 2013.”

In addition, Ghose and Lee write that the new Canadian rate plans seem more “ARPU friendly” than new plans that were recently launched by Verizon and AT&T Wireless in the U.S. This is because the U.S. plans eliminate domestic long distance charges, while unlimited long distance costs $10 per month in Canada; data overage charges in Canada cost up to $25 per Mb versus $15 in the U.S.; and the shared data plans in Canada seem to generate higher ARPU than in the U.S. They add that driven by superior data ARPU growth, incumbent wireless ARPU was up 1.9% in Canada in Q3/12 versus a 1.8% year over year decline in the U.S.

In addition, with only 80% total penetration, they still see “room for significant wireless subscriber growth in Canada over the medium term.”

They also view the upcoming 700 MHz spectrum and spectrally efficient LTE as key positives when it comes to future wireless capex. In particular they note that the “700 MHz spectrum offers excellent signal propagation and in-building penetration and that LTE is 4-6x more spectrally efficient than HSPA.”

“Consequently, while the incumbents are spending hundreds of millions of dollars on LTE and are expected to incur fairly large spectrum bills at the 700 MHz spectrum auction in 2013, this should reduce future network capex requirements. We also view 700 MHz spectrum and LTE as competitive advantages for the incumbents, as none of the new entrants, with the exception of Videotron in Quebec, seem well positioned to finance 700 MHz spectrum or LTE at this time.”

They maintain that increasingly a wireless network is only as good as its wireline foundation and believe both Bell and Telus have a key advantage on that front.

“In this regard, Bell and Telus should enjoy a significant advantage over Rogers, Videotron and other wireless new entrants due to the unique Bell/Telus wireless sharing agreement” and that “Bell and Telus together have the most extensive fibre networks in Canada.”