TORONTO—As might be expected, Canadian telecom executives are already choosing up sides for the forthcoming battle over the CTRC's proposals for reshaping how the feds regulate and tax traditional and new media across the country.

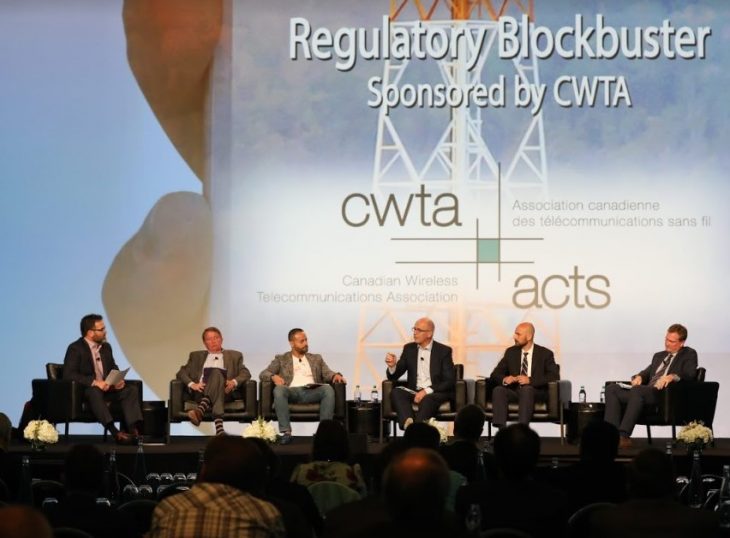

That much was evident at the Canadian Telecom Summit here late Tuesday. Speaking during the annual "Regulatory Blockbuster" panel moderated by Cartt.ca editor and publisher Greg O'Brien, execs representing industry incumbents and upstarts battled it out over the Commission's new recommendations to "develop better regulatory approaches that engage all audio and video services and for each to participate," producing plenty of verbal fireworks.

Generally backing the proposals outlined in last week's CRTC report, BCE, Rogers and Telus officials argued that it makes sense for regulators to spread the tax and revenue burdens around. They noted that media players such as Netflix now make billions of dollars in revenue in Canada but don't collect any sales taxes here.

"We thought the report was fairly forward-looking," said Robert Malcolmson, SVP of regulatory affairs for BCE. He contended that the current regulatory system — which levies fees on incumbent cable operators, satellite TV providers, broadcasters and telecom operators but not on ISPs, resellers, wholesalers, OTT video providers and other newer players – is simply unsustainable for the future.

Representing the interests of the industry upstarts, however, execs from TekSavvy Solutions and Iristel and Ice Wireless said the rules should still be different for vertically integrated giants like Bell, Rogers, Shaw and Telus which have the great power of incumbency. They argued the government should not lump relatively small ISPs into the same category as major media players because their assets and purposes are quite different.

"[The CRTC report] ignores the reality of other players in the market," said Andy Kaplan-Myrth, VP of regulatory and carrier affairs for TekSavvy. "It describes the Internet as a content delivery platform, which is not its primary value."

Samer Bishay, president and CEO of Iristel and Ice Wireless, suggested the federal government simply slap the sales tax on Netflix and call it a day. Calling the issue "definitely the elephant in the room," he sees a Netflix sales tax as far more effective and fair than trying to impose a tariff on ISPs to somehow even the regulatory score across the media landscape.

"I'm not sure why Netflix got away without a sales tax," Bishay said. "They should have one like anybody else… Why can't it just be passed on [to consumers]?'"

Taking Bishay's idea further, Ted Woodhead, senior vice president and strategic policy advisor for Telus, proposed the government indirectly tax Netflix and other OTT video providers by making changes to the Bank Act, not the Telecommunications and Broadcasting Acts now under review by the feds. He would amend the Bank Act to place a levy on consumer credit card payments made to foreign OTT players.

"That's the easiest way to tax the OTT video services," Woodhead said. "That would fix it overnight."

David Watt, SVP of regulatory for Rogers, said the true elephant in the room is not the lack of sales taxes on Netflix but the fact that OTT video providers are steadily drawing video customers and revenues away from traditional broadcasting distribution undertakings (BDUs) like Rogers and Shaw but aren't contributing to the government's Canadian content pool like everyone else in the system must. Noting Canadian Internet services generated about $40 billion in revenues last year, he said it would take just a 0.5% tax on those services to match the $220 million in payments that cable operators make to the CRTC each year.

"That would be the equivalent tax," Watt said. He argued that such a relatively small levy shouldn't be too much to ask.

"Because we're coming late to this marathon, we're always going to lose.” Samer Bishay, Iristel/Ice Wireless

Fearful of what the feds might do with the CRTC's recommendations, Bishay complained that the regulatory landscape is stacked against companies like his because of its relatively young status and small size. He also argued that there are much more important telecom issues for the government to tackle.

"Because we're coming late to this marathon, we're always going to lose," he said. "There are so many other rules to change. I'm perplexed hat we're focusing on something so miniscule."

But Woodhead countered that addressing the cross-subsidization of Canadian content is a major concern for the government because "traditional content companies are suffering.”

The telecom incumbents and upstarts also tangled over several other contentious issues, including net neutrality regulations, broadband competition rules, skinny wireless data plan and FairPlay Canada's web site blocking proposal. They also debated the government's plans to review the Broadcasting and Telecommunications Acts.

“Why can't you get our customers online the same day!? You do that with your own customers." – Marc Gaudrault, TekSavvy

In particular, the debate over broadband competition and interconnection issues on the ground grew heated. TekSavvy officials took Bell and Rogers to task for not responding to their customer requests for new connections and service fixes in a timely fashion, allegedly taking up to two weeks to carry out the work in some cases when the incumbents can often offer same day service when connecting a new customer.

"Get the damned customer online!" a clearly frustrated TekSavvy CEO Marc Gaudrault exhorted from the audience during the discussion. "Why can't you get our customers online the same day? You do that with your own customers."

Watt calmly retorted that incumbent providers like Rogers do their best and stressed how many billions of dollars they have invested to build and upgrade their networks. "It's much less than 14 days usually," he said. Woodhead added that alternative ISPs like TekSavvy have been growing steadily without having to build their own networks and facilities.

But Gaudrault and Kaplan-Myrth would have none of that. They stressed TekSavvy has plowed millions of dollars into network interconnections and service improvements for its customers. "Nobody's freeloading off the investments you make," Kaplan-Myrth said. "We spend a lot of money too. We're not simply re-selling."

The debate over Canada FairPlay's proposals on content piracy set off some fireworks as well. Questioned by Public Interest Advocacy Centre general counsel John Lawford about why Canadian consumers should trust their service providers to block web sites that allegedly violate content copyright rules, Malcolmson emphasized the size of the content piracy challenge for media companies, terming it "a significant problem in Canada." Watt agreed, fully endorsing the proposals.

"Let's call it what it is: It's content theft, it's stealing.” – Dave Watt, Rogers Communications

"Let's call it what it is: It's content theft, it's stealing," Watt said. "Who is going to create content if they're not compensated for it? It's not a topic that should be taken lightly."

Bishay and Kaplan-Myrth, however, poohpoohed the need for the CRTC to take on this issue and adopt the FairPlay proposal. Bishay wondered why Canadian media companies couldn't just lower their prices for content or break down their programming into smaller, less costly chunks like music producers did when faced with similar challenges. And Kaplan-Myrth questioned why the CRTC was even weighing the issue.

"This is copyright policy," Kaplan-Myrth said. "This isn't about telecom policy."

Malcolmson, however, had no patience for that argument. "It is about telecom policy," he said. "Piracy is happening over telecom networks and the CRTC has a mandate to deal with it."

Turning to another hot-button issue, skinny wireless data plans, the upstarts and incumbents disagreed sharply over the value of the plans that Rogers, Bell, Shaw and Telus created at the CRTC's request. Calling the various budget plans "a joke" and "more of a stopgap than a fix," Bishay questioned why they didn't offer data caps as high as 1 GB for lower prices.

Malcolmson and Woodhead defended their companies' respective plans as sensible and reasonable. For instance, Woodhead noted, some of the new low-cost packages offer speeds as high as 600 Mbps. "Everybody wants something for a lower price but there's a cost to these services," Malcolmson said. "I don't think they [people] see the cost of providing these services."

Bishay countered that there are over 250 independent MVNOs in the U.S. offering competitive wireless services while there are none in Canada. "Here there's no choice," he said. "Let's compare apples to apples, not apples to bananas."

Woodhead fired back that Canada has just 35 million people spread across a vast terrain, as opposed to about 325 million in the far more densely concentrated States. He noted, too, that Canadians "love to complain about the price" of a lot of things, including gas, freight charges and wireless rates.

Seeking to negate that argument, Bishay noted that he had just returned from a trip to Mongolia, which has far fewer people than Canada and even more wide open expanses. Even though Mongolia has just 3 million people, he said, wireless services cost far less there.

As laughter broke out on stage, Woodhead could hardly contain himself. "What's a home cost [in Mongolia]?" he sputtered. "This is irrelevant!"