GATINEAU – An annual report commissioned by the CRTC confirms what the telecom industry has been saying for a while about their broadband and wireless plans: It ain’t so bad here…

Prepared for the Commission by Ottawa’s Wall Communications, the annual “Price Comparisons of Wireline, Wireless and Internet Services in Canada and with Foreign Jurisdictions” report combines and averages wireline, wireless, broadband and bundled rates in Canada and compares them with plans with other international jurisdictions. The report found that while Canadian rates aren’t the most expensive, they aren’t the cheapest either, that while Canadian broadband speeds aren’t the fastest, they aren’t the slowest either, that while Canadian bit caps aren’t the most restrictive, oh wait…

Anyhow, Wall Communications has compiled this report every year since 2008 and it reveals that for many Canadians, their rates have actually dropped for some services – and that for most telephone, wireless and broadband plans, we are far cheaper than the folks who live across our southern border.

Unlike other reports, such as recent Organisation for Economic Co-operation and Development (OECD) releases that only look at some bare bones marketing materials from just two of the major Canadian firms, the Wall report studied plans available to customers in five major Canadian cities (Halifax, Montreal, Toronto, Regina and Vancouver) available from a dozen companies (Bell Canada, Rogers, Telus, EastLink, Videotron, Primus, Wind Mobile, Public Mobile, Mobilicity, SaskTel, Access Communications and Shaw Communications).

It then compared the Canadian average data it the same it gathered from numerous companies in the U.S. (in Boston, Kansas City, and Seattle); Sydney Australia; London, England; Tokyo, Japan; and Paris, France.

WIRELINE

When it comes to local wireline telephony, we Canadians have it pretty good. Among the three levels, or “baskets” of services, as the report calls them, it’s pretty cheap in Canada as we are either the lowest or second lowest in tandem with London and generally far cheaper than the U.S., Australia and Japan.

Plus, rates have basically not moved at all since 2008 when Wall first undertook this study for the Commission.

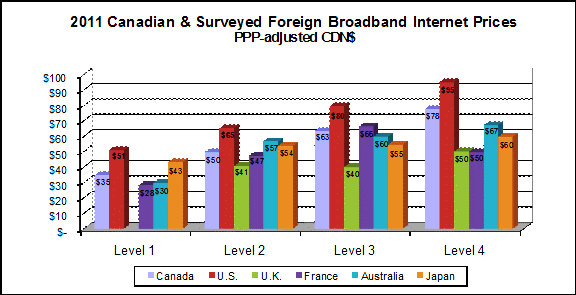

Turning to wireline broadband, however, the story is much different. Here, the report looked at four “baskets”: 1) Basic Internet access service with advertised download speeds of up to 1.5 Mbps and data usage assumed to be 2 GB per month. 2) Average high-speed Internet access service with advertised download speeds of between 1.5 and 9 Mbps where data usage per month is assumed to be 15 GB per month. 3) High-speed Internet access service with advertised download speeds of 10 to 19 Mbps with data usage per month assumed at 30 GB. 4) Highest-speed Internet access service with advertised download speeds of 20 Mbps or faster – with the targeted speed in the 20 to 40 Mbps range. Data usage per month is assumed to be 50 GB.

The report also acknowledges and explains that advertised speeds do not measure up with actual average speeds. For example, the report says: “The service speeds included in the Level 4 basket in the case of the U.S. range from 20 to 40 Mbps – the average speed is roughly 26 Mbps.”

Canada falls about in the middle of the pack of the jurisdictions covered even though the cost of the Level 1 basket is now $35/month on average, a 13% increase over the prior year. And while that cost is 25% higher than France, it’s 18.5% lower than in Japan and 45% cheaper than in the States (see graph).

“It should also be noted that most of the foreign broadband service plans included in the study do not have monthly usage caps. The principle exceptions in this respect are the Australian broadband service plans included in the study, all of which have usage caps. As well, there are some plans in the U.K. which also include usage caps,” reads the report.

The report also notes that as the world spends more time with the Internet, the lower-speed and lower-priced Level 1 basket is disappearing. “The general trend has been to offer higher speed broadband services, which often has the effect of reducing or eliminating the availability of lower speed alternatives,” it reads. “For instance, some service providers surveyed no longer offer a broadband service that falls into the Level 1 service basket. On the other hand, some service providers such as Optus in Australia offer a single speed service (8 Mbps) with optional monthly usage levels (e.g., 120, 150 or 500 GB per month). Once the usage cap is reached, service speed is throttled to 256 kbps.”

Canada fares less well among the jurisdictions studied as the basket levels go up in speed so that by level 4, the Canadian average cost is only less expensive than the Americans, but it’s 18% less.

“On balance, Canadian broadband service rates tend to fall within the middle of the pack of surveyed countries for the Level 1 (sub 1.5 Mbps), Level 2 (1.5 – 9 Mbps ) and Level 3 (10 – 19 Mbps) broadband service baskets. In the case of the Level 4 (20 Mbps and faster) broadband service basket, Canada’s rates are relatively high compared to most of the other surveyed countries (other than the U.S.), despite that fact the average service speeds for the surveyed services in the lower priced countries are higher than in Canada,” reads the report.

MOBILE

When it comes to mobile, the report shows that Canadians perhaps should be taking a closer look at the rates offered by the wireless newcomers Wind, Mobilicity and Public Mobile.

The report looked at three baskets of service (low, medium and high volume usage) and found that except for Montreal, the new companies offer far lower rates than their more established competitors (see chart).

When it comes to international comparisons the Wall report notes the difficulties comparing apples to apples, given the vagaries of each jurisdiction but despite that, Canadian wireless rates do end up on the high side.

“(T)he mobile wireless service plans in the U.K., Australia, France and Japan differ significantly from those in Canada,” notes the report. However, “(i)n the case of the Level 1 wireless service basket, the Canadian average monthly price of roughly $34, while close to the rate in the U.S., is higher than the rates found in all five selected foreign jurisdictions. Moreover, the rate is significantly higher than the rates found in the U.K. and France (i.e., over 60% higher).”

The comparisons get better in the level 2 and level 3 baskets but those in the U.K. appear to have it pretty good with level 3 basket rates 37% better than in Canada and far less than half what Americans pay (see graph).

On the mobile broadband front, the rates offered by the newest wireless players are again far lower than the incumbents (a 24% to 34% discount, depending on the city). The report breaks out just a single basket and finds “the current 2011 national average monthly price for the mobile Internet service basket is $52.41, which is slightly lower than the rate measured in last year’s study of $54.02. The average advertised speed of the services included in this year’s study is roughly 18 Mbps – i.e., reflecting the fact that most service providers are offering 3G+ mobile Internet access services in Canada (last year the average advertized speed was roughly 6 Mbps). The average data usage cap, where applicable, for the mobile Internet services included in the study is 2.4 GB per month,” reads the report.

Canadian rates for mobile Internet are less than both the U.S. and Japan but far higher than Australia (93%) and England (116%) (see graph).

“On balance, Canadian mobile Internet service rates tend to fall within the middle of the pack of surveyed countries. At the same time, however, while the advertised service speeds of the services in Canada are faster than those in the other surveyed countries, the data usage caps are in Canada are lower.”

However, “(t)he average advertised speed of the services surveyed in the five surveyed foreign jurisdictions are all lower than the average Canadian speed,” reads the report. “For instance, at the low end, the average advertised speed in the U.S. was 2.6 Mbps while, at the high end, advertised speeds in France and Japan are just over 13 Mbps. On the other hand, the average data usage caps, where they exist, are currently higher in all of the five surveyed foreign jurisdictions compared to Canada. The surveyed foreign plans included average monthly usage caps ranging from 2.7 GB in the U.K., to 5 GB in the U.S., to unlimited plans in France and Japan.”

BUNDLES

Prices are dropping in the bundled world – a place where real savings are still happening. The report looked at three bundles: 1) Wireline, Internet and Wireless; 2) Wireline, Internet and Digital TV; 3) Wireline, Internet, Wireless and Digital TV.

“The average monthly price for Bundle 1 has declined significantly since 2008 (i.e., by roughly 9% in total), although the current monthly price of $134 is roughly the same as last year. Similarly, the average monthly price for Bundle 3 has also declined noticeably since 2008 (by roughly 7% in total),” according to the report. “The current Bundle 3 average monthly price of $168 is very similar to last year’s rate. On the other hand, the average monthly price for Bundle 2 has generally increased slightly over the last four years. Generally, for 2011, the bundling discounts for all three bundles fall into the 8% to 12% range on a national average basis relative to the sum of the individual stand-alone prices.”

And again, apples are not apples in some of these comparisons. “Some basic digital TV service offers provide only a relatively small number of channels, whereas others are more comprehensive in scope and, accordingly, are more expensive. Moreover, in some cases, basic digital TV services are included with broadband services for little or no additional cost (e.g., in the U.K. and France), whereas satellite and cable basic digital TV packages in the U.S. typically start at US$60. This fact tends to inflate differences in rate comparisons across foreign jurisdictions for bundles which include digital TV services,” says the report.

“It is noteworthy that Canadian bundled service rates continue to compare very favourably to those in the U.S., where service pricing and provisioning practices are similar to those in Canada.”

For the full report, click here.