Largest drop seen in Canada

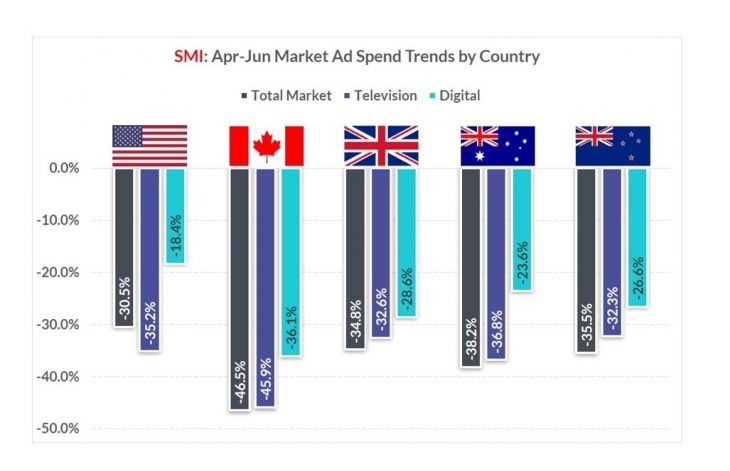

NEW YORK – The global Covid-19 pandemic has inflicted further damage on U.S., U.K., Australian, New Zealand and Canadian ad markets, according to Standard Media Index, whose data shows second quarter ad revenues fell on average 37.1%.

SMI collects and publishes media agency payment ad spend data and based the analysis on its collection of that information from those markets from April to June.

“When we first looked at the multi-market impact of Covid a few months ago the average decline for the first three months of the crisis was 28.2% but the continuation of the pandemic into May and June has seen the average second quarter decline soar to an astonishing 37.1%,” said SMI CEO James Fennessy, in a release.

“In each country, the ad markets hit the bottom in the April/May months with declines of 40% or more and that has pulled the average Q2 decline across the five countries down by almost nine percentage points.”

By individual country, the largest Q2 decline has been reported in Canada (over 40%) while the smallest decline is in the U.S. “The Covid pandemic has sparked a global advertising recession, but the good news is the worst is over and across all markets we’re reporting lower declines and also the first signs of market growth,” Fennessy said.

Also, a trend similar across all markets has been the resilience of the major TV and digital media relative to others (outdoor, radio, press, magazines). The average collective decline for these other media over the second quarter has been 57.1%.

Digital media is reporting the lowest declines in each national market. “TV and digital are clearly emerging as the media likely to bounce out of the Covid market in better shape as they’ve both experienced audience growth during this lockdown period,” continued Fennessy.

“Already the early U.S. data for August is showing us that TV looks to be stabilizing with bookings back just 0.5%, and in Australia and NZ the early August data also shows television is delivering the lowest year-on-year declines of any major media.’’

The SMI data also highlights trends among key ad segments. The value of advertising from travel-related companies has unsurprisingly fallen by more than 80% in each of the five countries, while pharmaceuticals are reporting growth in ad spend in the U.S., for example. Spending from tech companies on advertising also held up well during Q2, says the SMI data.

Early Q3 data also shows stronger ad spends in the consumer-packaged goods and financial services categories in most countries, according to the company.

“There is still immense caution in the business community, but these category trends show there remains a willingness to spend on personal goods and smart advertisers are moving to capitalize on those demands,” said Fennessy.