But, they’re ready to spend when the crisis is over

By Ken Kelley

TORONTO – A Corus Entertainment survey examining the still-early impact of Covid-19 on Canadians shows people believe the effects of the pandemic may well be more profound than the financial markets crash of 2008-2009.

Released on Thursday, Canadians In Isolation: Exploring the Impact of Covid-19 on Canadian Consumers polled a sample of 3,000 English-speaking Canadians aged 18 to 54 over an approximate one-month span, beginning March 27.

Not surprisingly, the study showed Canadians are primarily concerned with how long the pandemic will last, the Canadian and global economies, and their family finances. But they also remain concerned about the state of their mental health during the crisis and the unknown surrounding exactly how long they expect it to last. Despite early sentiment showing many Canadians expected the pandemic to be finished with by July, respondents polled toward the conclusion of the one-month sample period said they were uncertain when exactly things would get back to normal (which is more or less in step with what our governments are telling us).

“When it comes to how long this is going to last, that’s where we see this uncertainty really continue,” said Shauna Houlton, director of consumer insights at Corus during a webinar to release the report. “In wave one of our survey, we had some very optimistic folks who thought we would be back to normal in April or May. And what we’ve seen, as this has gone longer, the direction has shifted to ‘I don’t know when things are going to be back to normal’.”

While the percentage of Canadians who lost their job due to the pandemic jumped from 12% to 19% from the first to secon d wave of the survey, that figure subsequently dropped to 16% during the third wave. It also found an average of 26% of Canadians moved from working outside of the home to inside, while 6% said their job was home-based before the pandemic and continues to be.

d wave of the survey, that figure subsequently dropped to 16% during the third wave. It also found an average of 26% of Canadians moved from working outside of the home to inside, while 6% said their job was home-based before the pandemic and continues to be.

Slightly more than half of respondents (52%) replied they haven’t seen any significant changes to income due to the pandemic. While 43% say their income has dropped, just 4.6% of Canadians have seen their income increase. For those who had seen a decrease in income, they also said they expected to be able to sustain their household for a few months, while 21% said they could last just a few weeks and approximately 18% said they would classify their current situation as “desperate.”

Of course, the biggest shift caused by the pandemic is towards e-commerce. In addition to a sharp increase in the number of consumers that have moved to online shopping because of the pandemic, Houlton said the data also revealed Canadians are engaging in e-commerce in new ways, too.

While just 17% said they normally shop for groceries online, approximately 40% said they have done their grocery shopping from home since the start of the pandemic. Similar increases were also noted across other industries, including clothing, books, technology, and home renovation materials. Among the biggest challenges facing retailers from the flood of online shoppers has been around product availability and delivery.

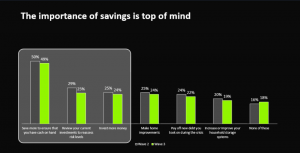

Canadians seem eager to take advantage of the current low interest rate environment, too, with 37% of respondents expecting to make a big-ticket purchase within weeks, while 51% said they will hold off until things have gotten back to normal.

“We are seeing an increasing number of respondents who feel they will be able to benefit from low interest rates environment and an increasing number thinking about large purchases and thinking about them across multiple categories.” – Shauna Houlton, Corus

“We see it in car, home, furniture, appliance and home renovations. We’re seeing this across all major categories,” Houlton said. “We have 54% of respondents saying they expect to be spending within the next few weeks and are seeing an increasing number of respondents who feel they will be able to benefit from low interest rates environment and an increasing number thinking about large purchases and thinking about them across multiple categories.”

When it comes to marketing during these unprecedented times, almost 58% of Canadians said they would create a message highlighting what their company is doing for their workforce and customers, while 52% felt a company should highlight how consumers are able to access their products. But the data also showed an advertiser tie-in to the Covid-19 pandemic was not required in order to have a positive impact on the consumer.

Despite the somewhat gloomy nature of the current world environment, the study did highlight a number of bright spots:

The data showed Canadians feel their personal relationships have showed signs of improvement, with 25% saying the relationship with their spouse/partner is better. Twenty-nine per cent of respondents stated the relationship with their children has improved, with the closeness between extended families, friends and co-workers also showing signs of improvement.

The study also revealed safety and family as the most important values, cited by a respective 84% and 70% of respondents. As for whether they feel overwhelmed by the amount of information they are receiving with respect to Covid-19, an average of 52% said yes, while 48% said no.

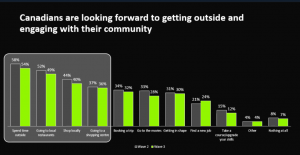

Additionally, Canadians are looking forward to re-engaging with their communities in the post-Covid world. Topping the to-do list of most Canadians? Simply getting back outside.

“[Canadians] want to get outside again, but after that, we want to go to restaurants and go to shops and shopping centres,” Houlton said. “We’re thinking about booking trips and we’re thinking about going to the movies. We really are thinking about when life returns to normal and all the things we want to do when that happens.”