OTTAWA – Back-to-back quarters of collective subscriber losses by Canadian cable, satellite and telco TV companies means the cord-cutting phenomenon, however small, is real, says a new report released today by research and consulting firm Boon Dog Professional Services.

Publicly traded TV service providers lost an estimated 5,394 TV subscribers combined in the first quarter of 2013 (November/December 2012 to February/March 2013). This followed a combined decrease of an estimated 8,175 in the fourth quarter of 2012 (August/September to November/December 2012), reads the report.

Given that the largest and best capitalized TV service providers lost customers as a whole in each of the last two quarters, Boon Dog estimates that the entire traditional TV service market also shrank by similar levels in the same periods. “This marks the first time that the traditional TV subscription market has declined in size since essentially the launch of cable TV in the early 1950s,” says the report.

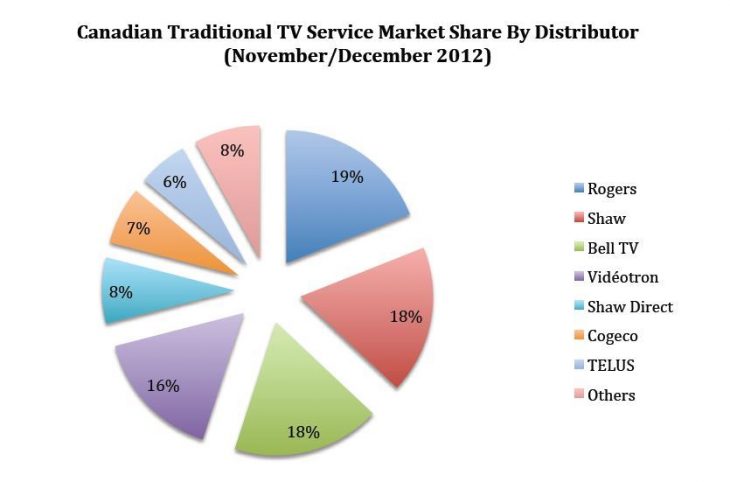

The analysis is contained in Boon Dog’s the Canadian Digital TV Market Monitor research series, which estimates the size of the Canadian traditional TV service market at 11.8 million households.

“A report earlier this week by well known U.S. analyst Craig Moffett of Moffett Research concluded that cord-cutting is real in the U.S. market,” said Mario Mota, Boon Dog Partner and principal author of the Canadian Digital TV Market Monitor research series. “While the recent decline in subscribers in Canada is small relative to the size of the total TV market, we now have two consecutive quarters of data for the Canadian market that confirms that cord-cutting is a reality here too.”

Other findings of the report include:

* At the end of 2012, 88% of all TV subscription households in Canada received a digital TV offering (10.5 million households);

* At December 31, 2012, cable had a 61% share of digital TV households, followed by satellite at 27%, and IPTV at 12%, compared to 62% for cable, 29% for satellite, and 8% for IPTV a year earlier; and

* By the end of 2015, digital TV market shares are forecast to be 58% for cable, 21% for satellite, and 21% for IPTV.