By Greg O’Brien

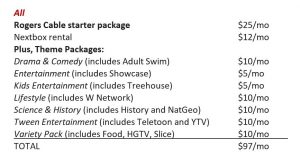

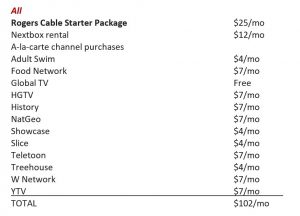

THERE ARE FOUR ways to subscribe to Corus Entertainment channels Adult Swim, Food Network, Global, HGTV, History, National Geographic, Slice, Teletoon, Treehouse, Showcase, W, and YTV through Rogers Communications.

The first three are pretty standard: They can be purchased one at a time; in certain theme packages; or part of a bundle of broadband, TV, home phone, wireless and security, or some combination of those services.

The fourth way, however, is new.

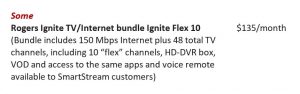

In July, Rogers launched a new video service called Ignite SmartStream. It’s a nifty little device that delivers popular video apps direct to Rogers Ignite broadband customers who don’t have a traditional TV subscription.

For an extra $5 a month, Smartstream users can get Netflix, Amazon Prime Video, Hayu, YouTube, Rogers’ Sportsnet Now and a few other applications delivered to their TV screens from a single box. It is meant to compete with Roku, Firestick, smart TVs and other streaming devices.

Since it’s an internet device, Smartstream stands outside the CRTC’s Broadcast Distribution Undertaking regulations which otherwise govern BDUs like Rogers when it comes to traditional video. SmartStream instead falls under the CRTC’s Digital Media Exemption Order, meaning its content and the revenue it earns is beyond the CRTC’s regulatory purview. While the app environment provided to SmartStream users is the same as the one Rogers Ignite TV customers see from their full-service set-top-boxes, SmartStream offers no regular, live, TV channels.

Or does it?

Amazon Prime Video customers in Canada have the opportunity to purchase and view Corus Entertainment’s StackTV, a suite of the dozen specialty channels we mentioned above, for $13/month. This means a Rogers Ignite SmartStream customer can purchase and view linear cable channels (plus VOD) delivered via Amazon through a Rogers device and service.

This scenario was certainly not something the writers of our Broadcasting Act, or the CRTC regulations which interpret that law, ever contemplated, so such services are exempted thanks to the DMEO, because they are delivered via IP.

Imagine if that wasn’t the case? With another middle company inserted, in this case Amazon, who then would be considered the BDU? Is it Rogers providing the device and connectivity to customers, or is it Amazon for packaging, delivering, and selling StackTV to its Prime customers?

I’d lean towards Amazon, since Prime subscribers can buy StackTV independent of Rogers, of course.

Video revenue earned by Rogers through its traditional cable channels are of course taxed at 5% which is spread around to the various production funds, the largest of which is the Canada Media Fund. Subscription and ad revenues earned by the Canadian specialty services delivered the traditional way are also subject to our system of cultural taxation where small percentages of the monies earned by Corus, for example, must be turned into Canadian programs of national interest.

StackTV falls outside of that, however, and it is a growing success for the company. Corus said in its last quarterly results it has more than 200,000 StackTV customers. That’s more than $31 million in annual revenue, all of which falls outside the traditional system, even though the channels being delivered are regulated entities. Some of that revenue, we assume, goes to Amazon.

“Is it fair when Food Network and the others are purchased through Rogers Cable, Cancon contributions apply, but when purchased through Amazon Prime Video, which is covered by the DMEO, there are none?”

Is it fair when Food Network and the others are purchased through Rogers Cable, Cancon contributions apply, but when purchased through Amazon Prime Video, which is covered by the DMEO, there are none? Is it fair Rogers has to send 5% of its video revenues to production funds and Amazon does not?

Now, $31 million falls well short of the $413 million in subscription revenue Corus earned from its specialty channels in 2019, according to CRTC  figures. This number will grow, however, and it’s a lot more than what was being earned by the specialty channels Corus recently shuttered.

figures. This number will grow, however, and it’s a lot more than what was being earned by the specialty channels Corus recently shuttered.

As an exercise, we’ve broken down the four ways in which Rogers customers can subscribe to the Corus 12 – and the monthly retail costs to an individual account holder. Two of the ways customers can buy the channels see all of the revenue fall under some form of taxation where percentages are allotted to make Cancon. The cheapest of which is the traditional cable theme packs, where the retail price is $97/month. Subscribing to the channels one at a time is next cheapest at $102/month. Neither of these options include an internet package and there are other packaging options. We selected the least expensive.

One way to subscribe has some of the revenue (the TV part, not the broadband part) going to help make Cancon, at $135/month.

Falling just below that is the Rogers SmartStream way to get to the Corus 12, at $126/month. Of course, all of this money doesn’t go through Rogers like the others do. The customer has three bills to pay under this option and none is diverted by regulation to fund Canadian content.

(Ed note: With the Rogers 150 Mbps internet package retailing at $100/month, that would seem to indicate the 48 TV channels in the Flex 10 bundle are worth $35 in that package.)

We would note, too, there are probably very few Rogers customers watching the StackTV this way. Most of the company’s 1.6 million TV customers, making some assumptions based on Rogers quarterly financial releases and filings with the CRTC, would be buying broadband and TV packages. But not being privy to the company’s internal accounting, we don’t know how much revenue from such bundles (and there are more options than what we show here) is assigned to video, for the purposes of Cancon funding.

This exercise is not to call into question Rogers or Corus. The companies have adapted to a changing media and connectivity market with new products as best they can. They have responded to changing times in innovative ways in a fashion our regulations have not. StackTV is an early success and SmartStream looks to be a neat way to reach some cord-nevers.

I don’t even mean to say that that our current regulations should be applied to the likes of Amazon, Netflix, AppleTV and others. But, one way or another change has to happen, and quickly. The imbalances in the video market aren’t fair to the current Canadian players and leave others out.

one way or another change has to happen, and quickly. The imbalances in the video market aren’t fair to the current Canadian players and leave others out.

Piling everything new that comes up under the DMEO umbrella seems untenable since so much revenue now flows to foreign companies operating under that protection. A chorus of voices is building among creatives, producers, independent broadcasters and others who believe the current regs and the DMEO can’t stand for much longer.

Right now, most of those in TV in Canada are waiting for the federal government’s adaptation of the Broadcast and Telecom L egislative Review panel report into new legislation to be introduced to try to address imbalances. This is expected in the fall and there is a long road ahead of new laws being passed in a minority Parliament and even if new law comes to be, the CRTC must then launch new public proceedings to change its own regulations.

egislative Review panel report into new legislation to be introduced to try to address imbalances. This is expected in the fall and there is a long road ahead of new laws being passed in a minority Parliament and even if new law comes to be, the CRTC must then launch new public proceedings to change its own regulations.

However, the Covid-19 crisis has accelerated shifts in consumption while draining away ad and subscription revenue, so a regulatory reckoning is approaching quickly, perhaps too quickly to be able to wait for the laws and regs to be updated.

It’s getting more complex by the day and by the time we have new regulations in place, much may be lost for good.