LAS VEGAS – A TiVo study released today found that the average global viewer spends 4.4 hours each day watching some sort of video. Coupled with the global average of 28 minutes spent each day searching for content to watch, it amounts to nearly five hours per day of video engagement, or 20% of daily life.

“Addicted to Video: The Global Obsession” found that about 90% of households are currently paying for traditional pay-TV service. However, more than 60% are also subscribing to streaming video services like Netflix, Amazon Prime and Hulu. For now, over-the-top (OTT) services are predominantly complementary to pay-TV with Netflix and Amazon dominating the market while the race for top streaming device is more a more heated battle between Apple, Google and Amazon, and strong regional preferences.

“Viewers, content owners, new streaming services and devices have created a feedback loop where both supply and demand have grown exponentially. Though traditional pay-TV providers long refused to offer a true à la carte model, these new platforms and gadgets are allowing customers to curate and build entertainment experiences that work best for them,” reads the report.

The research findings were the result of an online survey, conducted by TiVo, of 8,500 pay-TV and OTT subscribers across seven countries worldwide with 2,500 interviews completed in the U.S., and 1,000 interviews completed each in the U.K., France, Germany, Brazil, Mexico, and Colombia.

The increase in part is the result of the over $130 billion invested in programming globally, and investments in original content from streaming platforms that provides viewers exactly what they want to watch reports the study.

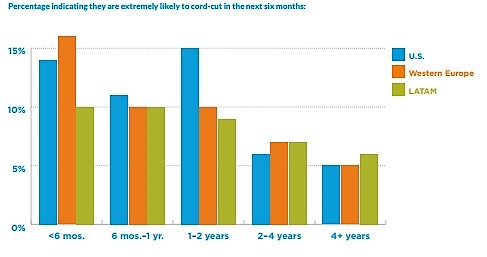

The study found that the traditional pay-TV subscriber base is increasingly comprised of longer tenured customers. For example in the U.S., more than 50% of pay-TV subscribers have been with their service for four years or more. Subscribers with the shortest tenure are also the least dependable: more than 10% of those who have subscribed to cable for a year or less say they're very likely to cut the cord in the next six months.

Commitment Issues

Traditional cable and satellite pricing models attract customers with aggressive sign-up promotions that are recouped in the longer term found the study. “This model creates rising monthly bills and contracts from which customers can’t easily disentangle, eroding trust,” it reads.

Younger generations it says are “fickle” and accustomed to consistently priced, contract-free services that can be cancelled at any time.

“The existence of (highly-rated) show-tracking mobile apps (e.g., TV Time) reflects the trade-off many seem willing to make, though it also highlights the issue that customers need help to keep track of what they’re watching.”

Not only is there more content than ever, people now have more screens than ever at their disposal to watch their favorite videos. Take Latin America, where 50% of all viewing now takes place on a digital device other than a television set, according to the study. In stark contrast viewers in the U.S. say that more than 75% of their video consumption still occurs on their TV.

“As traditional providers and new technology disruptors vie for viewing time and wallet share, those who can make the customer’s life as easy as possible will hold a distinct advantage.”

“Consumers today are acting as their own aggregator, piecing together what they need from a variety of video service and device combinations to suit their individual needs,' said Paul Stathacopoulos, vice president, strategy, TiVo.

“Success in this new environment will not be about a single content source monopolizing the living room, instead it will be about adapting the business model to deliver value, integrated services and personalization to meet the evolving consumer needs.”

The study concluded that Industry players who hold exclusive content access close to the chest and sacrifice the customer experience in the process are most at risk. “As traditional providers and new technology disruptors vie for viewing time and wallet share, those who can make the customer’s life as easy as possible will hold a distinct advantage.”

Companies that work to standardize and integrate their products across platforms will have the best chance of finding a place in consumer homes. “The ability to help viewers make the most of all their options and optimize a custom solution for their needs is the key to success in this shifting new world.”

Click to enlarge images.