TORONTO – While Canadians opt for online shopping for many purchases, nearly two-thirds (63%) of customers who have purchased a wireless device over the past six months did it in a physical store, according to a new J.D. Power report.

The 2018 Canada Wireless Purchase Experience Study examines wireless carriers’ performance across sales-related activities in stores, over the phone, and online. Satisfaction is measured in six factors: store representative; online purchase; phone purchase; facility; offerings and promotions; and cost of service. Fielded in February-March 2018, the study is based on responses from 3,605 wireless customers with a postpaid plan from an eligible carrier and who have had a purchasing experience in the past six months.

The study finds that an in-store purchasing experience drives the highest level of customer satisfaction, compared with other channels, and increases year over year. The average customer satisfaction score from an in-store experience is 821 (on a 1,000-point scale), while the online and over-the-phone purchasing experiences yield 815 and 796 points, respectively. In fact, in-store purchasing satisfaction has increased by 22 points year-over-year, compared with a 12-point increase for online and a 13-point increase for over-the-phone.

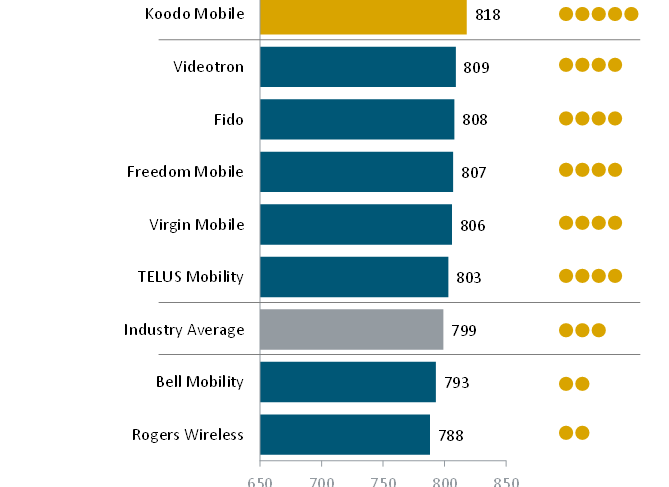

Overall satisfaction averages 799. This marks a 15-point increase from 2017 (784) and a 38-point increase from 2016 (761).

A quarter (25%) of customers who recently visited a wireless store say they felt pressured during their visit, resulting in a significant decline in satisfaction. The study finds a 136-point difference in satisfaction levels between non-pressured customers and highly pressured customers (846 vs. 710, respectively). Highly pressured customers also are less satisfied with their store representative and say they spent less per month, on average ($87), than those who did not feel pressured ($104).

Telus’ Koodo Mobile ranks highest in purchase experience satisfaction for the second consecutive year, with a score of 818. Videotron (809) ranks second and Rogers’ Fido (808) ranks third.

“The tactile experience and immediate gratification are invaluable to customers who shop for and buy their new device in-store,” said Adrian Chung, director of the technology, media & telecom practice at J.D. Power in Canada, in the report’s news release. “Clearly, the physical store is a very important sales channel for wireless carriers to attract new customers and retain current ones who opt to upgrade their phones. However, this comes with a caveat: in-store representatives’ pressure to up-sell or complete the transaction has a counter effect on customer satisfaction.”

Additional findings include:

– Carrier stores have larger market share, offer more relaxed experience: More than half (55%) of recent in-store wireless purchases were made at a carrier store, compared with 45% at a non-carrier store. Nearly four in five (79%) customers felt that carrier stores exerted no pressure, compared with 70% who felt non-carrier stores exerted no pressure.

– In-store pressure silences brand advocacy, scares off customers: Customers who experienced high pressure from store representatives are not only less likely to recommend their carrier, but are also seriously considering switching providers. In fact, 49% of customers who experienced high levels of in-store pressure say they “definitely will” switch their wireless carrier.

– Carriers’ online purchase experience lags: Customers prefer to open their wallets at non-carriers’ virtual stores, with 71% making a purchase via a non-carrier website, resulting in satisfaction levels that are higher than carriers’ online stores (822 vs. 799, respectively). Timeliness of completing a transaction, ease of placing an order and ease of navigation are cited as the main causes of lower satisfaction levels from carriers’ websites.