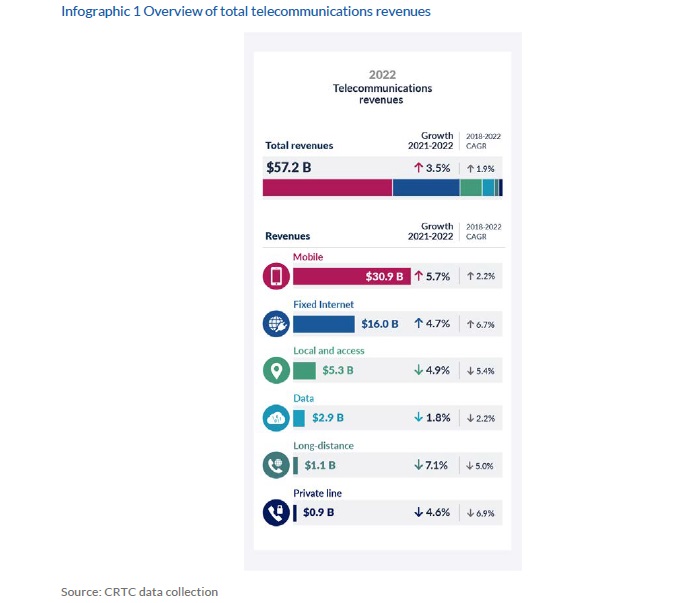

The Canadian telecommunications sector experienced a 3.5-per-cent increase in total revenues in 2022, similar to the 3.4-per-cent growth achieved in 2021 and a clear progression from the sector’s revenue decline in the 2020 Covid-19 pandemic year, according to the CRTC’s Communications Market Report (CMR) for calendar year 2022, released Tuesday.

Telecom revenues totalled $57.2 billion in 2022, primarily driven by the almost $1.7-billion increase in mobile revenues, which represents a 5.7-per-cent increase over 2021, according to the report. Mobile service revenues grew to $30.9 billion in 2022 from $29.2 billion in 2021. This was mostly due to a 6.6-per-cent increase in retail data revenues, which reached $14.2 billion in 2022, and an 88-per-cent increase in retail roaming revenues, which reached $1.6 billion. The average mobile subscriber consumed more data than ever, the report says, with data usage growing by 21.3 per cent in 2022 compared to 2021.

Along with increasing revenues from their mobile services, wireless carriers reported higher margins in their earnings before interest, taxes, depreciation and amortization (EBITDA), stable churn rates and higher capital expenditures (CAPEX), according to the report.

Retail fixed internet service revenues grew faster than telecom revenues as a whole in 2022, experiencing a 4.9-per-cent increase to $15.2 billion from $14.5 billion in 2021. This growth was driven by continued residential subscriber movement toward higher-speed packages and increased usage by business internet customers following the end of pandemic-related restrictions, the CRTC report says.

Looking at total revenue market share by type of service provider, large incumbent telecom service providers (Bell, Telus, SaskTel) account for 56.5 per cent of market share, while cable-based carriers (Rogers, Shaw, Eastlink, Videotron) account for 35.8 per cent of the revenue share, the report says. Small incumbents, other facilities-based carriers and wholesale-based service providers account for 1 per cent, 3.6 per cent 3.1 per cent of market share, respectively.

The five largest providers of telecom services — Bell, Telus, Rogers, Shaw and Videotron, including their affiliates Virgin Plus, Koodo Mobile, Fido Mobile and Fizz — accounted for 87.3 per cent of total revenues in 2022. Large incumbents experienced 4.3-per-cent revenue growth in 2022 compared to 2021, while cable-based carriers saw a 3.8-per-cent increase in revenues. During the same period, revenues for small incumbents, other facilities-based carriers and wholesale-based service providers declined by 4.5 per cent, 0.6 per cent and 6 per cent, according to the report.

Comparing retail and wholesale revenue market share, retail revenues accounted for 92.9 per cent of total telecom revenues in 2022, and wholesale revenues accounted for the other 7.1 per cent. Retail revenues increased 3.4 per cent to reach $53.1 billion, while wholesale revenues grew 4.8 per cent to $4.1 billion.

The number of wholesale internet lines decreased in 2022, declining by 10 per cent to 1.1 million lines across Canada. The decline occurred mostly in Ontario (-12.5 per cent) and Quebec (-12.8 per cent). However, Nova Scotia saw continued growth in the number of wholesale lines (addition of approximately 6,000 wholesale lines), which contributed to the 12-per-cent increase in wholesale lines in the Atlantic region, which grew from about 56,000 to 63,000 lines in 2022.

Looking at CAPEX and capital intensity, total capital investments in 2022 increased 3.3 per cent for wireless and 5.2 per cent for wireline from the previous year. Telecom service providers invested $13.8 billion in CAPEX, allocating $10 billion to wireline networks and $3.8 billion to wireless. Approximately 33.6 per cent ($1.3 billion) of the total wireless capital spent in 2022 was invested in 5G networks, according to the report.

In 2022, the telecom sector’s capital intensity ratio (the ratio of CAPEX to revenues) was the third highest in Canada, after the utilities sector and the educational services, health care and social assistance sector. The capital intensity for the telecom sector is stable, increasing slightly to 25.7 per cent in 2022 from 25.5 per cent in 2021. The top five company groups (Bell, Rogers, Shaw, Telus and Quebecor) accounted for just under 91 per cent of the total telecom CAPEX for both 2022 and 2021.

Wireline capital intensity for cable-based carriers increased to 32.9 per cent in 2022 from 30.6 per cent in 2021, while incumbent telecom service providers (TSPs) — who have mostly invested in fibre — experienced a similar increase in wireline capital intensity, going from 48 per cent in 2021 to 49.7 per cent in 2022. However, over the same period, wireline capital intensity for other facilities-based service providers declined from 54.6 per cent to 50.4 per cent.

Capital intensity for wireless providers experienced a slight decrease in 2022, going from 12.7 per cent in 2021 to 12.4 per cent. This change is explained by revenues increasing at a higher rate than expenditures, according to the report.

The report examined EBITDA margins (EBITDA as a percentage of total telecom revenues) over the 2018-2022 period and found margins for wireless services were consistently above those for wireline, with the gap between both services continuing to widen as wireless margins reached 48.8 per cent and wireline margins reached 34.7 per cent in 2022. Over the 2018-2022 period, average EBITDA margins were approximately 45.2 per cent for cable-based carriers and 40.2 per cent for incumbent TSPs.

In 2022, average monthly mobile churn rates remained consistent with the previous year at 1.1 per cent. Average monthly residential internet churn rates also remained unchanged at 1.5 per cent, while average monthly business internet subscription churn decreased slightly from 1.2 per cent in 2021 to 1 per cent in 2022.

Chart borrowed from the CRTC’s Communications Market Report for 2022.