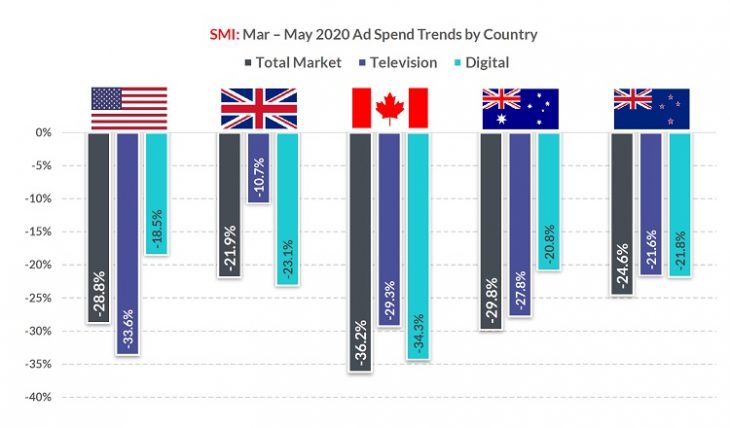

NEW YORK — Media advertising spend in the top English markets around the world — the U.S., the U.K., Canada, Australia and New Zealand — has declined on average by 28.2% during the first wave of the Covid-19 pandemic, according to market analysis from New York-based advertising intelligence company Standard Media Index (SMI).

However, Canada was hit harder. Of the five major English markets, Canada suffered the largest three-month decline, where total national marketer advertising expenditure fell 36.2% compared to the March-May 2019 period. The shallowest decline was in the U.K. where total advertising spend decreased by 21.9%, compared to the same period in 2019.

SMI bases its analysis on its collection of advertising payment data from its multinational and independent media agency partners in the five Anglo markets from the start of the pandemic in March to the end of May.

“This global pandemic is having an impact on advertising markets which is far more severe than what we ever reported during the 2008/2009 global financial crisis when the size of the year-on-year declines being reported each month never reached more than 16%,” said SMI global CEO James Fennessy, in the news release.

Fennessy said SMI’s data highlighted the difficulty large advertisers and media companies have in tracking ad spend across multiple media markets as the trends varied by country.

“There are many aspects of the global media industry which are similar — for example some reality style TV content formats translate across markets — but it’s a very different situation when it comes to advertising as there’s no consistency on how product categories move spend across media verticals,” he said.

“A good example is that in this three-month period insurance companies reduced their investment on U.S. TV by 9.7% but in Australia we saw them grow their TV investment by 3.1%. The data really highlights the degree to which these mostly large multinational corporations are tailoring their media investments according to the local markets.”

SMI’s data tracked varying ad spend trends across key digital sectors such as programmatic, search and social across countries.

“We can see continuing declines in programmatic ad spend through this crisis in the U.S. and Australian markets, but this form of digital advertising is continuing to at least grow share in the U.K. and N.Z. digital media,” Fennessy said, adding different product categories are driving those programmatic trends in each of those markets.

“But it is clear there’s one category with universal declines in ad spend and that’s of course the travel market, with the value of travel category advertising bookings falling 78% in the U.S., 61% in the U.K. and Australia, 65% in Canada and 76% in N.Z. In every market, the loss of such a vibrant category has severely impacted many media,” Fennessy said.

However, SMI provided some good news, saying its data in all countries shows strengthening advertising demand in June, with the U.S. emerging as one of the best-performing markets with the value of ad spend falling just 20% year-over-year.

“The key message here is that the advertising markets are moving off the bottom and are beginning to rebuild,” Fennessy said.