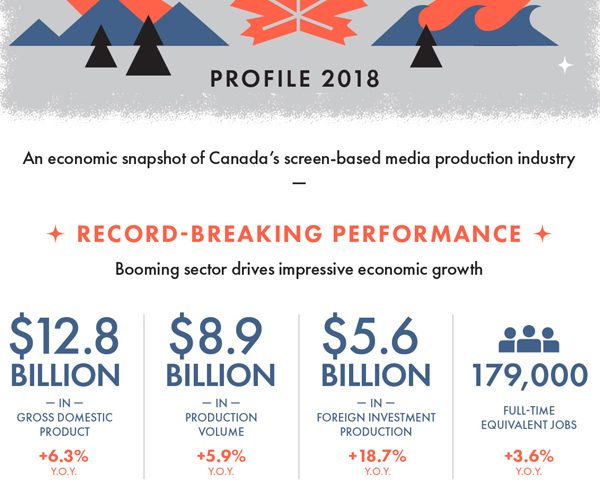

OTTAWA – Canadian film and television production continues to thrive, setting a record $8.92 billion in production volume last year and creating 179,000 jobs, according to the latest annual economic report from the Canadian Media Producers Association (CMPA).

Profile 2018: Economic Report on the Screen-Based Media Production Industry in Canada says that Canada’s screen-based media production industry generated $12.8 billion in GDP, up 6.3% over the previous year, and $5.6 billion in foreign investment production, an 18.7% increase, during the period from April 1, 2017 to March 31, 2018.

“These impressive numbers illustrate that our incredibly skilled workforce, underpinned by strong production infrastructure, have built Canada’s industry into one of the world’s foremost production sectors,” said CMPA president and CEO Reynolds Mastin, in the report’s news release. “However, the numbers show there are clouds forming on the horizon, which require attention if we are to strive for a balanced sector, where Canadian and international productions reinforce one another, and where there is opportunity for Canadian stories to thrive in the digital era.”

The report indicates that although production volume for foreign location and service projects continues to grow, reaching $4.77 billion in production volume, Canadian film and television projects dropped by 8.8% from the all-time peak of $3.3 billion in 2016-17, to $3.04 billion. Furthermore, production of broadcaster in-house projects declined to a volume of $1.12 billion, a year-over-year decrease of 15%.

Cracks continue to show in the current contribution system, which, for decades, acted as a strong foundation for Canadian television production, continues the report. Contributions to the creation and production of Canadian content by broadcasting distribution undertakings also continued its multi-year downward trend. In 2017, the latest year for which data is available, contribution dropped to $404 million, a decline of $15 million.

In addition there has been a decline in the commissioning and financing of Canadian television productions through private broadcaster licence fees. Year-over-year these fees dropped by 17%, from $434 million to $360 million. And over the last five years, private broadcaster licence fees have dropped by nearly 40% ($231 million), from a high of $591 million in 2013/14.

“It’s no secret that ‘cord-cutting’ and shifts in audience viewing habits are upending the system,” added Mastin. “Taken together, these numbers reinforce our support of the federal government’s current Broadcasting and Telecommunications Legislative Review, and with the hope that all players who benefit from our industry also invest in its continued success.”