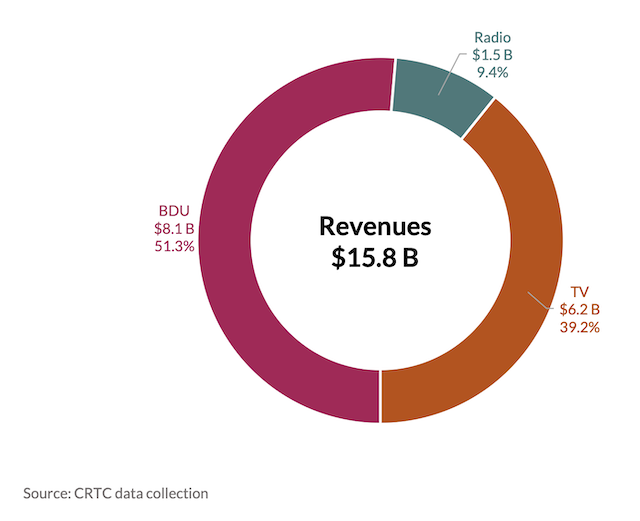

GATINEAU – Revenue from Canadian broadcasting services declined 6.6% to $15.8 billion in 2019-2020 compared to 2018-2019, the CRTC says.

This is highlighted in the broadcasting portion of the CRTC’s Communications Market Report (CMR; formally the Communications Monitoring Report), released last month, which covers the broadcast year spanning from Sept. 1, 2019, to Aug. 31, 2020, and as such includes around six months of the Covid-19 pandemic.

The $15.8 billion in revenue does not include revenues from Internet-based services, known as over-the-top services (OTT), operating under the CRTC’s digital media exemption order.

Over half of the revenues were generated by broadcasting distribution undertakings (BDUs), which reported $8.1 billion in revenue, “followed by television services with $6.2 billion, and radio stations with $1.5 billion,” the CMR says. (See chart above.)

During the broadcast year, “cable continued to generate the most revenues at $4.2 billion,” the report says. This is a 4.4% decline from 2018-2019. IPTV services, which generated $2.2 billion in total revenues in 2019-2020, grew 1.2% and were the only type of service to show a growth in revenues. Direct-to-home (DTH) services generated $1.7 billion, a 5.6% decline from 2018-2019.

Private commercial conventional TV stations, discretionary and on-demand services and CBC conventional TV stations generated $6.2 billion in revenues, according to the report.

“Consistent with previous years, the majority of television revenues came from discretionary services (60%), which relied on subscriber revenues to generate most (70%) of their earnings,” the report reads.

Discretionary television services generated $3.7 billion in revenue for 2019-2020, a 7.1% decline from 2018-2019. On-demand services generated $234.2 million in revenue, a 9.2% decline. Meanwhile, private conventional television stations generated $1.3 billion, a 14.3% decline and CBC/SRC conventional television stations had $926.4 million in revenues, a 2.2% decline.

For radio, most revenue was “from commercial services (77%), which include both AM and FM radio stations broadcasting in French, English, Indigenous and third languages,” the CMR says. “In terms of overall proportion, this is a 5% decrease from 2018-2019 (82%), as commercial services saw significant declines in advertising revenues, while CBC radio revenues remained relatively flat.”

Private commercial radio revenues for 2019-2020 were $1.15 billion, a 20.9% decline from 2018-2019. CBC/SRC radio had $337 million in revenue, a 3.6% increase from the previous year, and other non-commercial radio generated $80.4 million in revenues, an increase of 0.6%.

In Canada, OTT services generated an estimated $4.4 billion in revenue in 2019-2020, according to research from Omdia, the CRTC report says. This is around 28% of traditional broadcasting services revenue.

The number includes $521 million for Internet-based audio services. The estimated growth for these services was 7.9%, which is “about half of its average annual growth rate of 14.4% since 2015-2016,” the report says.

Internet-based audiovisual services had an estimated $3.9 billion in revenue.

“Compared to 2018-2019, revenues of Internet-based audiovisual services grew by an estimated 13.8%,” according to the CMR. “This is the smallest rate of growth in revenues for this type of service in the last five years.”

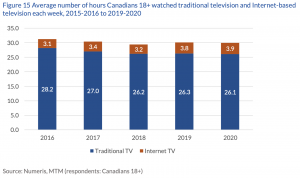

The report emphasizes Canadians 18+ have continued watching and listening to traditional television (right) and radio services.

“In 2019-2020, on average, in any given week, 97% of Canadians watched traditional television and 84% listened to traditional radio,” the CMR reads.

“Although growing steadily, Internet-based audio and audiovisual streaming is consumed by a smaller proportion of the population, at 71% for Canadians watching Internet-based television services in any given week and 45% for Canadians listening to music using an online streaming service in any given month.”

In terms of ownership, as in other years, the broadcasting industry was dominated by a few organizations.

“Three entities (BCE, Corus/Shaw, Rogers) operating radio stations, conventional television stations, discretionary or on-demand services, and BDUs generated 63% of broadcasting revenues in 2019-2020,” the report says. “Entities operating only one type of these services accounted for 6% of total broadcasting revenues.”

In television, there were 76 ownership groups in 2019-2020. The five largest were BCE, Corus, CBC/SRC, Rogers and Quebecor.

“The two largest broadcasters, BCE and Corus, garnered half (50%) of the total television revenues and as well as 73% of the tuning in the English-language market, while the five largest broadcasters generated over 88% of total revenues,” according to the CMR.

In radio, “716 reporting commercial radio stations reported $1.15 billion in revenues, a 20.9% decrease from 2018-2019. This decrease is significantly higher than the annual average 7.2% decrease in revenues from 2015-2016 to 2019-2020.”

The five largest Canadian radio ownership groups in 2019-2020, BCE, Cogeco, Corus, Rogers, Stingray, generated 62% of commercial radio revenues, the report says. “During that period, the two largest groups, BCE (109 stations) and Rogers (57 stations), garnered over 35% of total radio revenues.”

The pandemic has definitely had an impact on Canadian broadcasters.

“All broadcasting sectors have felt the impact of the Covid-19 pandemic, with private commercial radio and conventional television bearing the brunt of this impact,” the CMR says.

“These sectors rely on advertising revenues, and reductions in discretionary spending by many businesses has led to large decreases in spending on advertising. For radio, advertising is responsible for 95% of all revenues, and for television, 91%,” the report says.

The CMR also points out that while according to Statistics Canada, the country’s GDP declined by 4.6% between Aug. 2019 and Aug. 2020, “the broadcasting industry, as defined by Statistics Canada, saw its GDP decline by 11.8% during the same period, over 2.5 times greater than the decline in Canada’s GDP.”

The government did provide broadcasters with some assistance. “In 2019-2020, broadcasters reported receiving $218 million in assistance,” according to the CRTC.

“Commercial radio and conventional television stations and services received approximately 85% of this assistance. The Canada Emergency Wage Subsidy (CEWS) accounted for approximately 90% of the $218 million,” the report says.

“In addition to the above-noted assistance, the Department of Canadian Heritage waived $68 million in Part I and Part II licensing fees waived during 2019-2020, which is not reflected in the above figures.”

For the full report, please click here.

Chart borrowed from the CMR.