MONTREAL – It was almost a game of regulatory Call Of Duty for Bell Canada on Friday as company executives brandished figurative pistols to whack as many of its enemies claims as it could while defending its position on its deal to buy Astral Media for $3.38 billion.

While the company recommitted itself to providing everything it promised earlier in the week, and reiterated how the combined company’s level of ownership and audience share would not “come anywhere close to any reasonable or customary assessment of dominance in any developed country,” said BCE CEO George Cope, Bell’s panel of executives also let loose on its competitors who want the deal stopped.

“Some have accused Bell this week of acting inappropriately , with many unsubstantiated allegations and in some cases outright fabrications,” said Cope about what he heard this week from the likes of Quebecor, Cogeco, Telus, Rogers and others who intervened in the process in the hopes the CRTC will say no to the deal or alter it. “When it comes to Quebecor, it’s plain for all to see that they, as both the largest broadcaster and cableco in Quebec, simply don’t want to compete with a transformed and re-energized Bell,” added Cope.

As for Rogers, Cope said he found that company’s complaints that Bell is too big and powerful “ironic,” given Rogers’ very size and added: “The reality is that Rogers wants Astral’s English-language specialty and pay channels, and they would like you to force us to sell them,” he told the commissioners.

Bell’s regulatory chief Mirko Bibic went through some of the complaints registered by intervening companies one by one, noting it’s a bit unusual to get into the details of, and directly refute, such grievances, but he felt he had to address some of them one by one. “I’ve been in the room for much of the week and there have been several references throughout to serenity. I can tell you that my own serenity was tested several times as I’ve listened to a number of baseless accusations and misleading statements,” he said.

He then went through some of the specific complaints, including that of Quebecor which noted its exasperation that Bell Media did not initially offer it the company’s new sports channel RDS2. Quebecor, Bibic continued, “neglected to mention that when Bell sought hundreds of hours of TVA content for its VOD platform, Quebecor refused and it took a ruling from the Commission for us to even be able to negotiate for that content.”

Bibic noted Bell’s Fibe TV still doesn’t have TVA content on VOD because it felt Quebecor’s $7 million offer to sell to Bell was far too expensive so it walked away in 2011. When Bell tried to approach Quebecor to re-start talks for that content it was told TVA Group president Pierre Dion was on vacation and Bell hasn’t heard from the company since, added Bibic.

THE REPLY PHASE TOOK A bit of a twist Friday when CRTC legal counsel Anthony McIntyre did most of the questioning after Bibic, Cope and Astral Media CEO Ian Greenberg were finished their formal presentation. Many have grown used to the commissioners asking all or most of the questions, but apparently having legal take the lead for some questions was a bit more commonplace years ago.

McIntyre sparred with the Bell executives over a few issues, and two in particular seemed to catch them off guard. Announcing a “hypothetical” question, McIntyre asked: “Would BCE purchase Astral Media for the price of $3.38 billion were the Commission to regulate wholesale rates for discretionary services?” There was a bit of a pregnant pause in the room before Bibic took to the mic and told him the CRTC, through its final offer arbitration process can regulate rates, in the end, ex poste.

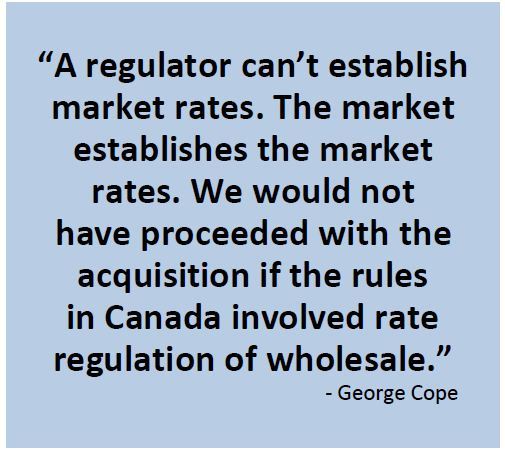

McIntyre clarified he meant real economic rate setting and Cope, visibly perturbed, left no doubt what he thought of that idea. “I can help you with that,” he said. “We never would have proposed to acquire Astral if the concept of regulating wholesale rates was on the table. It’s not a part of the structure of the industry today and we absolutely would not have proposed this transaction.”

When McIntyre said they would be market rates, “or based on what a market would provide,” a stern looking and sounding Cope explained: “A regulator can’t establish market rates. The market establishes the market rates. We would not have proceeded with the acquisition if the rules in Canada involved rate regulation of wholesale.

“If you can regulate our input costs from international content providers, which you can not, then that would be a very different model but that’s impossible. We would not have pursued this transaction if that was contemplated. And it’s not the rules of the industry today at all.”

When McIntyre turned to a question of the impact which the new HBOGO-like service Bell executives announced Monday might have on the combined company and whether or not the company could provide some financial details so the Commission could examine how it might affect the overall benefits package of the transition, Cope again appeared vexed. “Can you help us understand why we would provide financial detail of a new product for the marketplace that doesn’t change the valuation of Astral from a benefits perspective?”

“It goes to the incrementality of the benefit,” said chairman Jean-Pierre Blais, since Cope had turned to him and asked directly. Puzzled, Cope queried that comment quietly but audibly on the mic repeating “incrementality of the benefit?”

Bibic pointed out that no benefits monies are going towards this new service. “We are going to fund that entirely on our own but it’s made possible by pooling the Bell Media and Astral assets,” he explained.

When pushed further by McIntyre, who said the Commission wanted to evaluate additional synergies of the new service, Astral’s Greenberg also stepped in. “We have worked on this model for quite some time and I can assure you, though I haven’t seen their numbers, that this particular project will not make money for many years. It’s an investment… to protect our core business. There will be no additional profits for years to come on this project,” said Greenberg. “If anything they are negative synergies.”

Blais was undeterred, noting that Bell brought this new service up on their own just on Monday when the company opened the hearing and because of that the Commission has every right to ask for some more detail now. “The challenge we have is that instead of this being added to the public record early in the process, which would have allowed the normal back and forth between the Commission, we get it at the last minute, so we are where we are,” said the chairman.

“I suggest that you do what you can to unpack more because we need a little bit more.”

The Commission will get lots more as the intervenors have until Friday to file final written comments based on what they have heard – then Bell has another week to make one last reply. Then, we wait for a decision, which will come in due course (this fall sometime) since no mention of a hard deadline or number of days was made Friday.

Watch for more coverage of this hearing and its issues later this week.