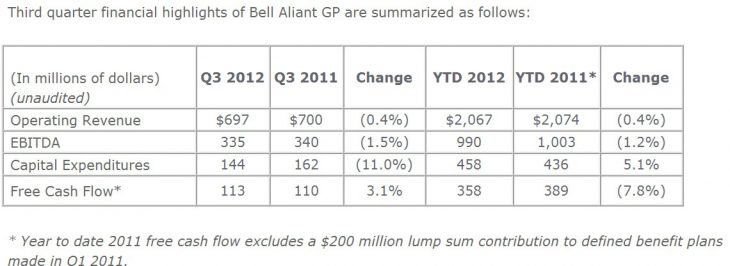

HALIFAX – Bell Aliant says earnings increased by nearly 22% or $16 million to $92 million in the third quarter, due in part from lower restructuring costs compared to the previous year. Operating revenues were $697 million, down $3 million (0.4%), compared to the same quarter last year.

“We had another productive quarter in Q3 as we further expanded our fibre-to-the-home (FTTH) coverage area and had our best quarter yet for new FibreOP customer additions,” said Karen Sheriff, president and chief executive officer, Bell Aliant. “I am very pleased that more and more customers are coming on board and experiencing our great FibreOP TV and Internet services.

“We now have over 100,000 IPTV customers and IPTV was our largest area of revenue growth in the quarter. We also had strong Internet revenue growth and our NAS declines again were better than the same quarter last year, following the trends we have experienced in prior quarters of 2012.

“We have been adding more FibreOP customers with each passing quarter, and with more than half of the homes in Atlantic Canada now having access to these services, we are beginning to have sufficient FibreOP scale to make a difference in our overall results. This kind of steady progress is what we envisioned when we launched our FTTH rollout in 2009. While we expect 650,000 premises to have access to our FibreOP services by the end of this year, we will still have more to do. I expect to announce our plan for further expansion in early 2013.”

Growth in data revenues, including Internet and TV, wireless and other revenues, largely offset declines in local and long distance revenues says Bell Aliant. Operating expenses in the third quarter of 2012 were up $2 million from the same quarter in 2011, reflecting growth in TV content costs from higher FibreOP TV customers and other costs of revenues, which were largely offset by productivity savings. As a result, EBITDA declined $5 million (1.5%) in the third quarter of 2012 compared to the same quarter in 2011.

Capital expenditures in the third quarter of 2012 were $144 million, down $18 million (11.0%) from the same quarter a year earlier, mainly due to lower FTTH footprint expansion in the third quarter of 2012 compared to the same quarter in 2011. In the third quarter of 2012, Bell Aliant passed an additional 47,000 homes and businesses with FTTH compared to 104,000 incremental premises in the third quarter of 2011. Total FTTH coverage reached 621,000 premises at the end of September 2012 and Bell Aliant continues to expect to reach 650,000 premises with FTTH by the end of the year.

Free cash flow was $113 million in the third quarter of 2012, up $3 million from the same quarter a year earlier. The increase was primarily a result of lower capital expenditures offset by lower EBITDA and lower cash from changes in working capital in the third quarter of 2012 compared to the third quarter of 2011.

Total data revenue including Internet and TV increased $21 million (9.6%) in the third quarter of 2012 compared to the same period in 2011.

Internet revenue increased $10 million (7.9%) with residential high-speed average revenue per customer (ARPC) in the third quarter of 2012 up 7.1% from the same quarter a year earlier. The telecom says selected pricing action, lower promotional discount effects and customer movement to premium services, including FibreOP, drove the increase. FibreOP Internet customers grew by 16,500, bringing total FibreOP Internet customers to 92,000 at the end of September 2012.

FibreOP Internet additions include existing Bell Aliant customers migrating from DSL and fibre-to-the-node (FTTN) networks to the upgraded service. Bell Aliant says the migrations do not contribute to overall high-speed customer growth, but increasingly contribute to improved customer retention and growth in overall customer ARPC. Overall net high-speed Internet customer additions were 7,500 in the third quarter of 2012, bringing total high-speed Internet customers to 913,600 at the end of September 2012, up 2.4% from a year earlier.

IPTV revenue grew $10 million in the third quarter of 2012 compared to the third quarter of 2011 with total IPTV customers of 107,400 at the end of September 2012. FibreOP TV customers grew by 14,200 in the quarter to reach 79,500, a portion of which were migrations from Bell Aliant’s FTTN TV service. Overall net IPTV customer additions were 12,300 in the third quarter of 2012, compared to 9,000 a year earlier.

Other data revenue grew $2 million (1.7%) in the third quarter of 2012 from the same quarter a year earlier, continuing the improved trends of recent quarters as a result of data demand growth.

Local service and long distance revenues declined $16 million (5.0%) and $12 million (12%), respectively, in the third quarter of 2012 compared to the same quarter in 2011, driven by NAS declines of 5.1%. Net NAS declines of 32,400 in the third quarter of 2012 improved 14% from the same quarter in 2011 with improved residential customer activations, winbacks and retention in FibreOP markets.

Wireless revenues were up $3 million (9.7%) in the third quarter of 2012 compared to the same quarter in 2011, driven by 6.8% customer growth and 2.5% wireless ARPC growth compared to a year ago. Other revenues also increased $1 million (2.3%) in the third quarter compared to a year ago, driven largely by higher product sales.