NEW YORK – They’ve been together before, essentially share the same owner and a new merger has been rumoured for a very long time, but Viacom and CBS finally decided to get back together this week.

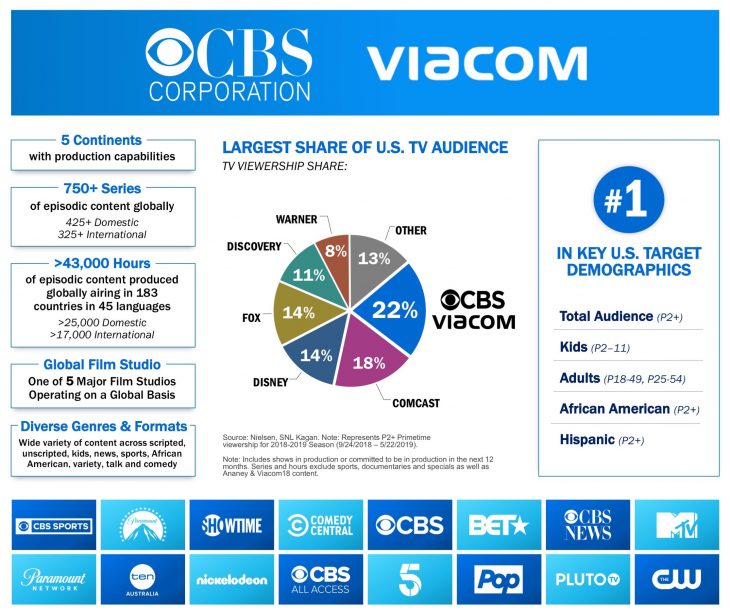

Its brands and channels (traditional and online) feature, according to the release announcing the merger:

- A library of 140,000 TV episodes and 3,600+ film titles

- Production capabilities across five continents, including more than 750 series ordered to or in production, with more than $13 billion spent on productions in the last 12 months

- Global reach of more than 4.3 billion cumulative TV subscribers in over 180 countries

- #1 share of broadcast and cable viewing across all key demographics in the U.S.

- The combined company earns more than US$28 billion in revenue.

Viacom CEO Bob Bakish will lead the combined company as president and CEO while CBS acting chief Joe Ianniello will serve as chairman and CEO, CBS.

The combined company, ViacomCBS, “will be a leading global, multiplatform, premium content company, with the assets, capabilities and scale to be one of the most important content producers and providers in the world,” says the press release.

The company will be the largest television business in the U.S., “with the highest share of broadcast and cable viewing across all key audience demographics, and strength in every key category, including news, sports, general entertainment, pop culture, comedy, music and kids,” adds the release.

“I am really excited to see these two great companies come together so that they can realize the incredible power of their combined assets. My father once said ‘content is king,’ and never has that been more true than today,” said Shari Redstone, vice-chair of the boards of directors at CBS and Viacom. “We will establish a world-class, multiplatform media organization that is well-positioned for growth in a rapidly transforming industry.”

The combined company will possess a portfolio of powerful consumer brands, including CBS, Showtime, Nickelodeon, MTV, BET, Comedy Central and Paramount Network, as well as one of the largest libraries of iconic intellectual property, spanning every key genre and addressing consumers of all ages and demographics, said the announcement.

The company noted it will focus on three main things:

- Accelerate direct-to-consumer strategy. Together, the combined company will be positioned to accelerate and expand its direct-to-consumer strategy through its proven and diverse portfolio of both subscription and ad-supported offerings. These include CBS All Access and Showtime, which deliver premium, branded content live and on demand to millions of subscribers; Pluto TV, the leading free streaming TV service in the U.S.; and niche products such as CBSN, ET Live and Noggin. It also has an opportunity to expand globally by leveraging its existing strength in both subscription and ad-supported offerings, combined library, content production capabilities and international infrastructure.

- Enhance distribution and advertising opportunities. The breadth and depth of the combined company’s reach across both traditional and new platforms – including 22% of U.S. TV viewership – will drive important new distribution and advertising opportunities. For distributors, this includes forming more expansive and multifaceted relationships, and applying the benefit of retransmission consent across a combined portfolio. For advertisers and agencies, the combined company will provide industry-leading reach through a variety of formats, including a portfolio of differentiated advanced advertising and marketing solutions, such as CBS Interactive, Viacom Vantage and Viacom Velocity, which will be applied against significant, expanded inventory across the portfolio.

- Create a leading producer and licensor of premium content to third-party platforms globally. As one of the biggest premium content providers in the world, the combined company is positioned to deliver content to a diverse global customer base that includes MVPDs, broadcast and cable networks, subscription and ad-supported streaming services, mobile providers and social platforms. Notably, in addition to content licensing, CBS and Viacom are developing must-watch programming for a broad range of third-party networks and platforms to feed significant demand for original, premium content.