By Dr. Mark Meitzen and Nick Crowley

NO ONE COULD REASONABLY claim a track contest was fair when one runner is required to run uphill against the wind while the other runners cover the same distance running downhill with the wind at their backs, yet that is precisely what is happening in Canadian wireless markets with the naive comparison of nominal prices for wireless services across countries without accounting for the significantly higher costs that Canadian wireless providers incur in providing service.

In terms of costs, Canadian providers are running uphill against the wind.

In previous economic analysis, we measured the individual differences in key mobile wireless service cost drivers between Canada and a set of Benchmark Countries (Japan, Germany, France, UK, Italy, and Australia). That analysis revealed that, for each cost driver examined, the cost was higher in Canada than these benchmark countries (and in certain cases significantly so).

We also identified pronounced differences in critical environmental factors, including the number of days below freezing, annual snowfall and customer density, that contribute to higher mobile wireless service costs in Canada. While Canada is unquestionably a beautiful country, that very same beauty precipitates an inhospitable environment for providing wireless service that is reflected in the costs of providing such services.

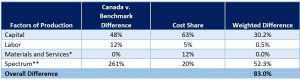

While our previous analysis was informative at a macro level, it did not allow us to deduce the aggregate impact of these cost drivers on the total unit cost of providing wireless service or compare total service costs in Canada with those of Benchmark Countries. In a supplementary analysis, we measure the overall impact of primary cost drivers (capital, labor, materials, services, and spectrum) that account for over 91% of total wireless service costs.

We find Canadian costs are estimated to be 83% higher than average Benchmark Country costs. If prices are in lock-step with costs, and the same price-cost margins prevail in Canada and the Benchmark Countries, Canadian prices would be 83% higher than Benchmark Country prices. Whereas the actual degree of cost pass-through is not directly observable, it is reasonable to expect a cost pass-through of between 75% and 80% of the difference between Canadian wireless costs and those in Benchmark Countries. This suggests that Canadian wireless prices are between 62 and 66% higher than they would otherwise be as a direct result of the markedly higher costs of providing wireless service in Canada.

When assessing the competitiveness of markets and, in particular, whether wireless firms are exercising undue market power, cost differences such as these are an essential consideration. Indeed, as government competition authorities around the world have long recognized, it is simply not possible to draw any meaningful conclusions about the “competitiveness” of markets without benchmarking prices against the underlying costs of  providing the services in question.

providing the services in question.

To do otherwise may serve to fuel populist sentiment, but it does not establish that market forces in Canada are exerting less competitive discipline than those in Benchmark countries.

In fact, our analysis may well suggest that precisely the opposite is true. Because the price differences between Canada and these benchmark countries are presumptively less than the measured cost differences, market forces are actually exerting more competitive discipline in Canada than they are in peer countries to which Canada is compared.

In order to objectively determine the fastest runner in a race, the conditions under which all runners compete must be precisely the same. In economics, a myopic comparison of prices that is not adjusted for cost of living or inflation is commonly referred to as “money illusion.”

A very similar illusion plagues the analysis of those who would scrutinize Canada’s seemingly high wireless prices without adjusting for the dramatically higher cost of providing wireless service in the forbidding environment that Canada poses.

Mark Meitzen is a senior consultant with Christensen Associates with over 35 years of experience in the telecommunications industry. Dr. Meitzen received his Ph.D. from the University of Wisconsin-Madison and worked as a regulatory economist for Southwestern Bell Telephone Company prior to joining Christensen Associates.

Nick Crowley is an Economist with Christensen Associates, specializing in productivity analysis and utility regulation. Mr. Crowley has an M.S. in economics from the University of Wisconsin-Madison and formerly worked as an economist at the Federal Energy Regulatory Commission.

Christensen Associates has consulted with Telus on the matter of wireless service costs.