NEW YORK – Spending on advertising is recovering from its pandemic declines, according to ad intelligence company Standard Media Index.

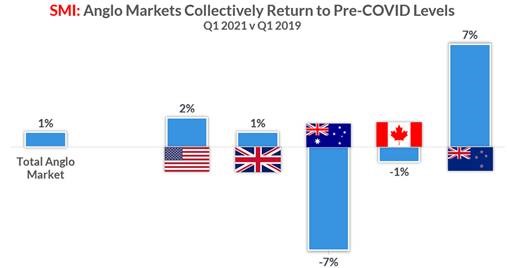

SMI, which collects and publishes national advertising spend and pricing data in the U.S., U.K., Canada, Australia and New Zealand, says collectively in those markets, the combined ad spend has lifted 4% above the total recorded in Q1 2020 and 1% above the pre-Covid Q1 2019 period.

If the trends continue through the year, the final result for 2021 could be a +7% increase in total advertising expenditure, said SMI CEO James Fennessy in a press release.

“Given the level of economic disruption from the Covid pandemic it’s phenomenal to see such a positive increase in advertising expenditure back to pre-Covid levels even before the global pandemic has been arrested,” he added.

The Q1 results have been boosted by a very strong March result across all markets (up 18% in total) after small declines in January and February, explains the release. But in March strong rebounds in the U.S. and Canada (+22% and +20% respectively) underpinned the global gains, with N.Z. reporting the next highest level of percentage growth (+9%) followed by Australia (+2%) and the UK (+0.4%).

With large portions of Canada in some sort of shutdown or stay-home order through April and May, Q2 results here are likely to be different than in the other countries covered by SMI.

“The highest growth we’ve seen this quarter is for digital media with total bookings up 22% on the 2020 numbers as all the key digital sectors delivered large double digit percentage growth and the highest gains seen in the programmatic, social media and video sites sectors,” Fennessy said.

“And when compared to the first quarter of 2019 digital spend has grown an even stronger 25%. Indeed, first quarter ad spend for all digital sectors exceeded the 2019 and 2020 totals in every country.”

As a result, SMI found digital media’s share of the total advertising pie in these combined markets has grown to 48% of all ad spend, overtaking television’s share of total spend (at 44%) in Q1 2021 and leaving just 7% of ad spend for all other media types.

“While most markets reported much stronger growth in television ad spend in March, softer January and February results meant combined ad spend was down 4% on the Q1 2020 level and down 10% on Q1 2021,” reads the release.

When it comes to category ad spend, in Canada advertisers in the household supplies market were rapidly growing their media budgets

“The only consistency evident in the category data was the fact that the travel/tourism category reported the largest quarterly declines in each market, with the only exception being Canada where entertainment ad spend fell slightly more,” adds the release.