NEW YORK – Nielsen’s proposed new cross-platform measurement platform will help to boost U.S. ad-supported cable networks' revenues over the next five years, according to a new report from SNL Kagan, an offering of S&P Global Market Intelligence.

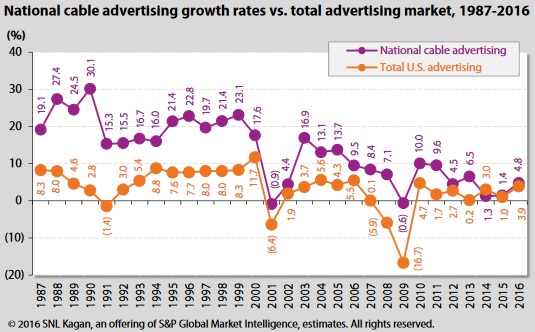

Economics of Basic Cable Networks: 2016 Edition estimates that ad revenue grew 4.5% in 2016, but will jump to 9.3% in 2017 and 7.1% in 2018 before returning to "a more normalized rate" of less than 5% in 2019 and 2020.

Nielsen Media Research’s new ratings system, scheduled to roll out March 1st, will include online and mobile. But the report says that date could be pushed back if Nielsen fails to receive buy-in from the majority of cable networks and advertising agencies.

“Clearly the industry is clamoring for these numbers”, reads the report. “In fact, most of the major media companies are actually doing it themselves, cobbling together information from a number of sources to capture a complete picture of viewing. But for advertisers to buy into this, they would prefer that all of the information comes from one source.”

Basic cable networks' affiliate revenues have surpassed advertising revenue gains for more than a decade, continued the report. In 1995, ads made up 51% of the average cable network's revenue (with affiliate fees at 44.4%), but that figure dropped to 46.9% in 2005 (affiliate fees 49.3%) and 37.8% in 2015 (with affiliate fees at 59.1%).

While factors such as cord cutting, cord shaving and cord nevers weigh on this sector, many cable networks have recently benefited from an influx of digital revenue from companies like Netflix Inc. and Amazon.com Inc., the report added.