TORONTO – While 2021 has been a year of recovery for the Canadian ad market, traditional media is struggling to return to pre-pandemic levels, according to a new report released by Standard Media Index (SMI) today, which provides a full year review of Canadian advertising spend in 2021.

Throughout the report SMI draws comparisons between 2021 and 2020 as well as between 2021 and 2019, the year before the pandemic hit.

The report shows that in 2021 traditional media spend increased 19% compared to 2020 but declined 15% in 2021 when compared to 2019. Digital, however, increased by 33% in 2021 compared to 2020 and increased by 26% compared to 2019.

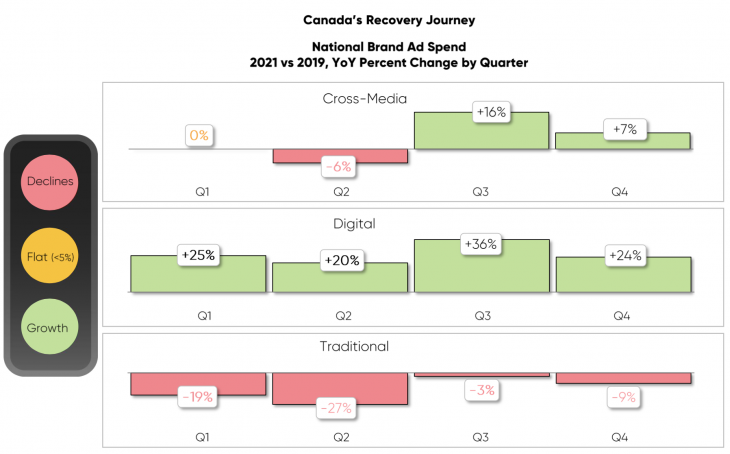

The SMI report further broke this down by quarter (see chart above.) Digital saw growth ranging from 20% to 36% in all 2021 quarters compared to 2019 while traditional saw only declines, ranging from -3% to -27%. Cross media national brand ad spend for 2021 meanwhile was flat for Q1, declined for Q2 (-6%), but saw growth in Q3 (16%) and Q4 2021 (7%) compared to the same quarters in 2019.

Overall, cross-media national brand ad spend in 2021 was reported to be $6.3 billion, which is higher than it was both in 2020 ($4.9 billion) and in 2019 ($6 billion.)

SMI’s report shows Canada’s pandemic recovery is happening more slowly than in other English-language markets. Nevertheless cross-media national brand ad spend saw year-over-year growth in Canada for each quarter of 2021 compared to 2020 (6% in Q1, 81% in Q2, 30% in Q3 and 12% in Q4.)

All categories showed year-over-year growth in 2021 compared to 2020 as well – digital grew 33%, television grew 25%, radio grew 1%, out of home grew 3% and newspapers and magazines grew 1%.

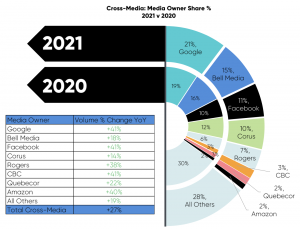

Breaking things down by owners (see chart below), the report shows that combined, the top media owners “hold a 71% share of all national brand ad spend,” and they all saw year-over-year volume growth, although Google, Facebook and Rogers were the only ones that also grew their share.

Charts borrowed from SMI report.