WITH THE LACK OF sports programming accounting for nearly 30% of all TV ad spend losses in the second quarter of calendar 2020 due to the pandemic lockdowns, the early viewership returns for NHL, NBA and MLB games should be good news, says data from Standard Media Index.

“With sports programming back up and running, we have seen U.S. audience ratings results increase over in the first few games of the MLB season, suggesting there could be similar behaviour in Canada across the different leagues,” said James Fennessy, SMI’s CEO, in a press release.

At this point, however, it’s not certain MLB season will press on with its entire, abbreviated season, with players testing positive for Covid-19.

“In Q2 2019, live sports programming accounted for 17% of all TV spend in Canada – virtually all of which was lost in Q2 2020,” added Fennessy. “Our data suggests that we will see an influx of spend into the market during the August to October period, aided not only by strong sports audiences, but also the concentration of the remaining regular season games and playoffs.”

For the NHL and NBA, both leagues posted very healthy ad revenue figures prior to the Covid-19 pandemic, according to SMI data. After the success of the Toronto Raptors Championship win in the 2019 season the NBA enjoyed major gains in ad spend (+33% YoY).

Despite the Raptors NBA champion win, ad revenue in NHL broadcasts were four times higher than that of the NBA in 2019. “In this current season (2019-2020) we saw the average cost for a :30s spot on major networks at $6,911 for an NHL in-game broadcasts, and $2,546 for an NBA in-game broadcasts, up to the month of February. In the coming months we will gain a better understanding of how the cost of ad placements has been affected based on Covid-19,” said Fennessy

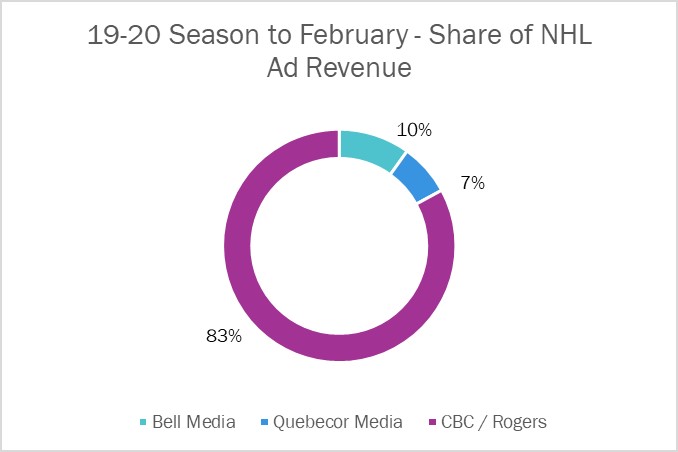

See illustrations for ad spend per broadcaster.