By Greg O’Brien

WHILE SOME PRO SPORTS have returned to play, like the English Premier League, the PGA, NASCAR and others, new and growing outbreaks of the Covid-19 virus in the U.S. threatens the return of the NBA, NHL and Major League Baseball, each currently planning for a July start or re-start.

If marquee North American pro sports don’t come back to TV soon, as planned, there may be permanent effects on the pay-TV bundle and the overall value of the TV rights, says a recent report from Scotiabank’s media and telecom analyst Jeff Fan.

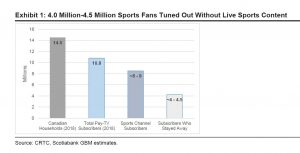

There are between 8 million and 9 million households in Canada which subscribe to the likes of TSN/RDS, Sportsnet and TVA Sports, which represents 75 to 85% of all pay-TV subscribers in Canada and 55% to 60% of all Canadian households, Fan outlines. He also estimates while many sports fans have had their appetites sated by old games and sports docs, about 50% of them have stayed away and found other things to watch.

This is dangerous for Canada’s TV companies, if Covid-19 prevents live games from returning this summer.

“For the pay-TV distributors (cable, telco TV, satellite TV operators) in Canada, with sports vertical integration, we believe live sports broadcasts are the glue for the video bundle and video cord,” writes Fan. “If live sports do not return soon, we fear cord cutting and cord shaving may increase through the summer and fall, particularly for the 50% (4 million-4.5 million sports fans) that have stayed away from sports altogether.

“In Canada, while we have noted that shaving sports channels is not easy because sports content is packaged with many of the popular channel bundles… we believe a prolonged absence of live sports events through the summer and fall, combined with tightening household budgets, could result in more cord cutting.”

(Fan adds its worth noting Telus is an exception to this because it sells sports a-la-carte.)

Those sports channels bring in a huge chunk of revenue for pay-TV companies and the broadcasters. Using the CRTC’s 2018 data (the latest available) “we estimate that the average wholesale cost per subscriber paid by pay-TV operators to broadcasters for non-sports content was approximately $21/month. For a sports channel subscriber, the related wholesale costs for sports content add up to approximately $16/month (in addition to the $21/month). This means sports content comprise over 40% of the wholesale content cost for a sports channel subscriber. On a per-channel basis, sports channels are typically 7x-10x more expensive than non-sports channels,” writes Fan.

So, if NBA, NHL, MLB are cancelled for the year (and the NFL is in danger, too) due to worsening Covid outbreaks in the U.S., this could trigger a domino effect which would hurt companies more reliant on TV revenue than others – as well as team owners like Rogers and Bell.

If sports remain on hiatus and cord-cutting does accelerate, “pay-TV operators may ask for rebates from their sports broadcast suppliers, which then may ask for rebates from the sports leagues, as we are seeing with the English Premier League (EPL) in the United Kingdom,” reads the report.

“According to the Financial Times, the EPL has agreed to a rebate £170 million for Sky Sports as part of the £330 million rebate sought by EPL’s domestic and international broadcast partners. We believe this has occurred much faster in the United Kingdom because the sports packages are sold unbundled, which has allowed subscribers to cancel their sports packages as soon as live sports went off the air. In Canada, there is likely a delayed impact due to the strong bundling of sports content.

“We estimate sports make up 10% to 40% of Quebecor, BCE, and Rogers’ media segment revenue annually. In 2018, the sports broadcasting industry in Canada generated approximately $1.5 billion in revenue annually (of which two-thirds is subscription and the reminder advertising), and approximately $250 million-$300 million in EBITDA… For Rogers, the Toronto Blue Jays revenue is concentrated in Q2 and Q3, and represents approximately 30% to 35% of media revenue in these two quarters,” writes Fan.

However, if sports does come back? How will fans (and advertisers looking to reach them) react to so many important games in a very compressed time frame? If the leagues’ plans go ahead, “the amount of live sports content will be overwhelming. Based on our estimates, the number of games per day for the NBA and NHL are expected to be 100% and 80%, respectively,” says the report.

Given the strong ratings pulled in from the likes of pro golf and NASCAR thus far, that suggests huge pent up demand for more. “This would benefit Rogers, BCE, and Quebecor on the sports advertising front. Conversely, this will likely have a negative impact on Corus Entertainment… on the non-sports advertising front.” Corus has no sports on offer on any of its channels.

“In our media forecast for Corus, BCE, Rogers, and Quebecor, we estimate that sports advertising revenue will be down approximately 50% and non-sports advertising revenue will be down approximately 20%-30% in calendar Q2. If live sports return in Q3, we could see the decline gap narrow, become similar, or even swing the other way in favour of sports, as advertisers shift a portion of their budget mix to sports.”

This week the NBA reported a number of players tested positive for Covid-19 – and the league plans to play its games in a single location in Florida, a state where coronavirus cases are spiking rapidly. The Toronto Blue Jays president Mark Shapiro expects many positive tests when MLB begins testing players and other staff soon. The NHL says it doesn’t plan to keep its players in a bubble when it comes back.

The risks are known and leagues are pushing ahead but with this pandemic far from over, so there’s no guarantee any games will get played this summer, which could change TV as we know it.