By Ken Kelley

TORONTO – The latest installment of a Corus Entertainment survey examining the ongoing impact of the coronavirus pandemic upon Canadians revealed a somewhat cautious increase in optimism among respondents, but with that renewed outlook also comes a healthy dose of realistic expectations.

Released last week in a webcast, Canadians In Isolation: Exploring the Impact of Covid-19 on Canadian Consumers polled a sample of 3,000 English-speaking Canadians aged 18 to 54 over a more than two-month span, from the end of March to the beginning of June. The survey sought to determine how Canadians are feeling and their perceptions of the Covid-19 crisis, the economic impact of the pandemic as well as a number of measures of consumer demand and the continuing impact on brands.

While one of the most pressing matters in the survey’s previous wave centred on the anticipated duration of the pandemic, with 63% of respondents expressing concern, the latest survey results show that figure dropped to 49%. Concerns about the global economy, Canadian economy and the impact of the pandemic on personal finances also showed decreases in concern.

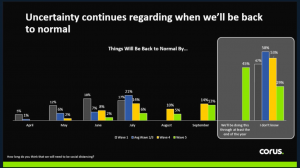

Asked how much longer Canadians anticipate social distancing will be necessary, Shauna Houlton, director of consumer insights at Corus, said last wave’s somewhat optimistic hopes that things would be back to normal by September have been replaced with what is perhaps a more realistic view.

“We’ve got 45% of respondents who think we’re in this until the end of in the end of 2020 at least,” Houlton said. And we also still have 30% of respondents saying they don’t know how much longer social distancing measures will be necessary.”

The data shows concerns about the country’s food supply chains have been in steady decline over the entirety of the survey period, dropping from 65% in wave one to 49% in wave five as our food supply holds strong.

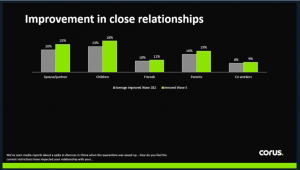

However, while approximately half of respondents remain concerned about food security, the sudden dead-stop that the coronavirus pandemic brought to many Canadians continues to be beneficial in other aspects of our health. “If you think about all of the time deficits that exist in everyday life, the time we spent commuting to and from work, eight plus hours a day at the office, running errands, shopping, kids to activities and spending time with friends,” Houlton said, “when you remove all of that, what you get back is time. And we are deriving benefit from that time, whether it’s spending time with family, having time to ourselves, being able to slow down, having time to watch TV and movies that we wanted to see, as well as the positive environmental impacts that we’re seeing from the shutdown.”

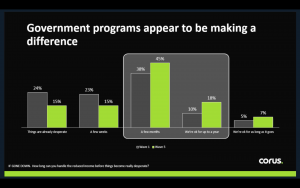

“Where we are seeing positive momentum is the government programs that came on board a couple of months ago seem to be making a difference,” – Shauna Houlton, Corus Entertainment

Asked how Canadians are managing Covid-19-related news, Houlton said fewer respondents (45%) reported feeling overwhelmed in the most recent wave. That marked a six-percentage point decrease since wave one. Of those saying they feel overwhelmed, a remarkable 35% of respondents said they are successfully limiting their exposure to the news, a 12-percentage point increase since wave one.

Corus’ data also shows the number of respondents stating they’ve experienced job loss has seemingly levelled off at 13% in the most recent survey, after having climbed as high as 19% previously.

“Where we are seeing positive momentum is the government programs that came on board a couple of months ago seem to be making a difference,” Houlton said. “They’re taking some desperation away from Canadians, and they’re also giving them runway. We see fewer people saying things are desperate now and more people saying I can go for a few months or we’re okay for a year.”

One of the biggest reveals that came out of Corus’ latest round of research is the preparedness of some Canadians to get back to “regular” life, while others are a bit more cautious and a third group not interested in engaging in public activities or events whatsoever.

That “ready to go” segment represented 41% of respondents and were more likely to live in B.C. and Alberta (where the rate of Covid cases are far lower that Ontario and Quebec). They are the most optimistic about Canada’s progress against Covid-19 and had an average household income of $80,000. The “cautiously optimistic” cohort was most likely to be living in Ontario and had an average household income of $90,000, while those that are “hunkered down” boast an annual income of $84,000.

The data definitively showed consumer confidence was highest in brands and companies that have clearly outlined or stated exactly what they are doing to protect customers during these times. Specifically, it increased the confidence of the “cautiously optimistic” cohort. When it comes to Covid-19-specific ads, the data shows Covid-specific theme spots continue to resonate with consumers. But interestingly, a Covid-specific spot wasn’t required for a positive brand impact.

“What we’ve seen is that throughout the duration of this crisis, spots are working very hard for the brand across the board with consumers,” Houlton said, “and as we become more optimistic, they start to work even harder. But similar to the recession, this is a very challenging time for brands, and (Canadians) are under tremendous pressure to save. But just as the recession did, this crisis is going to end and there will be brands that emerge stronger, and brands that emerge weaker. Canadians are still very open to all types of commercial messages. Directionally, what we are seeing, is that optimism increases positive brand momentum.”