WORLDWIDE SMARTPHONE shipments decreased 11.7% year over year in the first quarter of 2020 — the market’s largest annual decline ever — according to preliminary data from International Data Corporation’s Worldwide Quarterly Mobile Phone Tracker.

“Although the first quarter usually experiences a sequential (quarter over quarter) decline in shipments, with the average sequential decline over the last three years hovering between -15% to -20%, this is the largest annual (year over year) decline ever,” reads the research company’s new release.

Given Q1 2020 marked the beginning of the Covid-19 pandemic and the peak of lockdowns in China (leading to the shutdown of smartphone manufacturing, too), which extended to the rest of the world by the end of the quarter, the decrease was expected.

In total, companies shipped 275.8 million smartphones during Q1 2020. The largest regional decline was in China, which saw shipments drop 20.3% year over year, according to IDC. With China producing almost a quarter of worldwide smartphone shipments, the decline there had a huge impact on the overall market. In addition, the global dependency on China for its smartphone supply chain caused major issues as the quarter progressed, IDC says. Other regions that contributed to the overall worldwide decline include the United States and Western Europe, which decreased by 16.1% and 18.3%, respectively.

“What started as primarily a supply-side problem initially limited to China has grown into a global economic crisis with the demand-side impact starting to show by the end of the quarter,” said Nabila Popal, research director with IDC’s Worldwide Mobile Device Trackers. “While the supply chain in China started to recover at end of the quarter, as IDC expected, major economies around the world went into complete lockdown causing consumer demand to flatline.”

Smartphone Company Highlights

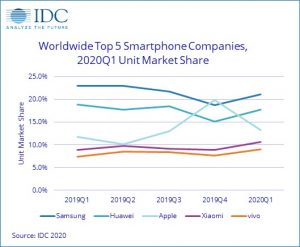

Samsung shipped 58.3 million smartphones in the first quarter of 2020 and regained its top position with 21.1% share, despite an 18.9% year-over-year decline. This is primarily due to the continued success of the A series despite the launch of its premium 5G flagship, the Galaxy S20, IDC says. However, the higher price of the S20 did help grow profits, according to Samsung. Looking ahead, Samsung, like others, will face an uphill battle due to a lack of consumer demand, especially with two new premium devices (Note 20 and Fold 2) coming in the second half of the year, IDC adds.

Huawei held the number two position with a 17.8% share of the global smartphone market, despite a decline in shipments of 17.1% year over year. The company reduced the impact of the downturn with early price cuts on its Mate 30 and P30 series and in its Honor brand’s V30 and 9X series along with a diversified online-offline channel mix which helped reach consumers even during periods of hard lockdown, IDC says.

Apple shipped 36.7 million iPhones in Q1 2020, which placed the company in third with 13.3% share. However, shipments were down only 0.4% year over year, which is the lowest annual decline among the top three vendors. This is primarily due to the continued success of its iPhone 11 series, IDC says. Looking forward, the launch of the recent SE (2020) device targeting the lower-priced segment could work well for the vendor if consumers shift their buying preferences towards more budget-friendly devices in the uncertain economic climate of 2020, according to IDC.