TORONTO — The economic impact of the global Covid-19 pandemic and the measures taken by government to try to contain the virus will result in a significant revenue slowdown in the Canadian telecom services market in 2020 and beyond, according to telecom and IT market research firm International Data Corporation (IDC) Canada.

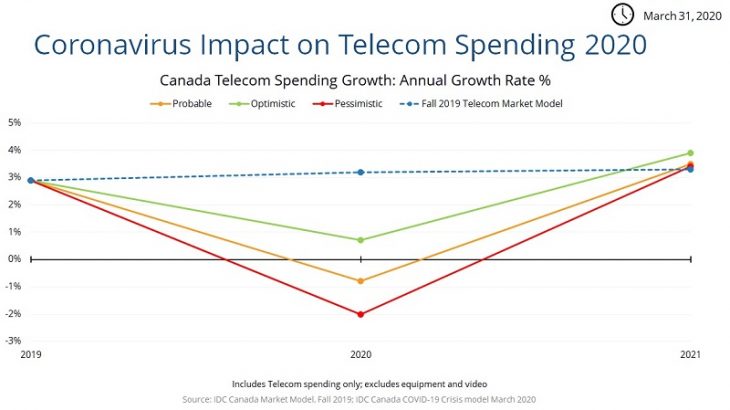

In research analysis released last week, IDC Canada presents three different scenarios for the effect Covid-19 will have on the telecom services market: optimistic, probable and pessimistic. In the most probable scenario, IDC Canada projects the telecom services market will contract by almost $2 billion, with overall revenues expected to fall to $47.9 billion, which represents a 0.8% decline from a year earlier. In December 2019, IDC Canada had predicted 3.2% annual growth for the telecom services sector in 2020. In its pessimistic scenario, IDC Canada expects telecom spending to decline by 2% to $47.2 billion in 2020.

Compared to Canada’s IT market, which is expected to decline in revenue by 5% in 2020, the telecom services sector has been historically more resilient or “recession-proof”, said Lawrence Surtees, research vice-president of communications at IDC Canada, in the news release. However, due to strict containment and lockdown measures in Canada, GDP forecasts by the country’s five major banks have recently been revised down sharply for the second and third quarters of 2020.

“The probable scenario assumes the coronavirus is broadly contained by June. The optimistic scenario, which appears very unlikely, assumes the virus is more rapidly contained, and business and investments recover quickly and accelerate in Q3,” said Tony Olvet, group vice-president of research at IDC Canada. “Finally, a pessimistic scenario that considers a less controlled, longer-lasting, virus ‘rebound’ effect through Q3 and Q4.”

The greatest adverse impact on telecom spending forecasts is the projected number of business failures due to the Covid-19 pandemic, IDC Canada says. Small businesses, of which there are almost one million in Canada, are expected to be the hardest hit.

IDC Canada anticipates some positive factors will moderate the telecom market downturn such as the increased need for conferencing, remote collaboration and broadband access. In its new probable outlook, IDC Canada predicts the wireline voice and enterprise data communications segments will be the hardest hit this year as employees use residential lines and not business networks.

The following is IDC Canada’s outlook for the four primary markets of the telecom sector:

- Wireline voice, which has been a shrinking market, remains the worst-performing segment under all scenarios because of continued wireless and Internet substitution. Consumer and enterprise responses to the Covid-19 pandemic may accelerate cost-saving measures such as cord-cutting for some consumers and due to business failures. However, the formerly lacklustre long-distance voice segment is already experiencing major revenue gains in the interim from burgeoning double-digit growth of toll-free long-distance use for conferencing.

- Data wide area networking (WAN) services are essential for larger enterprises and are subscribed to on long-term contracts, so this segment is less likely to be affected by temporary events but it’s also most susceptible to business failures. The different growth rates among the three scenarios differ mainly on the number of businesses that are anticipated to fail to recover due to Covid-19 shutdowns.

- Internet will be one of the most insulated markets during this pandemic crisis as broadband access has become a greater necessity with many people working from home, students taking online lessons, and families being entertained at home. Network providers are experiencing an unprecedented increase in bandwidth/data consumption since the first day of mandatory work-from-home restrictions. However, higher usage does not translate directly to revenue growth due to elimination or expansion of data caps currently provided as temporary relief by most major Canadian Internet service providers. To meet increased network capacity needs, Canadians ISPs are upgrading their networks to increase available network bandwidth. The costs for this expansion will need to be recovered in 2021. In fact, some smaller ISPs have already served notice they will still raise monthly prices later this spring due to increased telecom wholesale costs to manage increased network load.

- Wireless services, which account for almost one-half of telecom revenue in Canada, remain essential especially to customers whose wireless devices are the only means of communication with coworkers, friends and family. However, stringent travel restrictions between Canada and the rest of the world has put an immediate halt to roaming revenue. The loss of roaming revenue will increase as the lockdown persists. The rollout of initial 5G wireless services at the end of this year, however, may help providers to recover some of their costs associated with the pandemic.

IDC Canada expects the telecom market to get back on track in 2021, provided most businesses return to normal, people return to work and consumer confidence recovers.

For more information about IDC Canada’s analysis of the impact of the Covid-19 pandemic on the Canadian telecom market, please click here.