TORONTO — With people practicing social distancing, businesses cutting hours and services, Canadians staying home to work or self-isolate while the stock markets slide in unprecedented fashion due to the effects of COVID-19, Scotiabank this week released an analysis of where it sees both negative and positive effects when it comes to the telecom and media spaces.

“Over the past week, the initial COVID-19 concerns have expanded dramatically from global device supply chain issues to an unprecedented level of domestic consumer and business disruptions. The equity sell-off in the sector has been indiscriminate,” reads the research note to investors from Scotiabank, prepared by analyst Jeff Fan.

With school closures, employees told to work from home and social distancing becoming the norm in recent days, the resulting behaviour changes will affect the revenue streams of telecom and cable companies, the report says.

In particular, workplace closures are leading to reduced business activities, increased usage of home Internet services, and studio and media production shutdowns. The Scotia research says the resulting effect on revenue will be negative in the following segments:

- Wireline: reduction of business-to-business wireline usage

- Media: reduction of business advertising

- Wireless: reduction of business-to-business wireless usage

- Media: delay of content production

On the positive side, however, the increased usage of residential wireline by employees working from home will have a positive or neutral effect on wireline revenues, the report says. The same is true for the effect school closures will have on wireline revenues, with both young people and their parents increase their use of home Internet services.

With social distancing measures being advised or mandated by health officials, we’ve seen the suspension of sports leagues, restrictions on public gatherings and events, and the closures of theme parks, theatres, retailers and restaurants. For the media segment, this will have a negative impact on  ticket sale revenue and advertising revenue, especially related to the suspension in broadcasting of live sports events. However, Scotiabank anticipates the increased viewership of subscription video on demand (SVOD) and ad supported video on demand (AVOD) content in the home will have a positive or neutral effect on media and residential wireline revenues.

ticket sale revenue and advertising revenue, especially related to the suspension in broadcasting of live sports events. However, Scotiabank anticipates the increased viewership of subscription video on demand (SVOD) and ad supported video on demand (AVOD) content in the home will have a positive or neutral effect on media and residential wireline revenues.

In terms of travel restrictions and public transport closures as a result of COVID-19 concerns, Scotiabank’s analysts expect the wireless segment to experience negative revenue effects due to the reductions in domestic and international wireless roaming and overage charges, plus the reduction of personal and business wireless data usage during commutes.

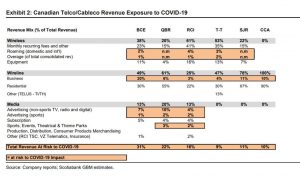

When it comes to the individual publicly traded Canadian companies: Bell, Quebecor, Rogers, Telus, Shaw and Cogeco, Fan writes their wireline business revenues appear to be the most at risk due to the impact of COVID-19. The report notes Bell is the largest B2B telecom provider in Canada, with roughly 20% of its revenue coming from business wireline services. In comparison, Shaw and Cogeco generate 11% and 10% of their revenue, respectively, from business wireline. Quebecor, Rogers and Telus all generate 6% or less of their revenue from the business wireline segment and will feel less of a hit.

“As consumer wage effects begin to play out in the weeks and months ahead, residential wireline spending could be affected as well.” – Jeff Fan, Scotiabank

“In wireline, we believe residential revenue will be much more resilient than business during the first wave due to the drastic reduction in business activities,” the report says. “As consumer wage effects begin to play out in the weeks and months ahead, residential wireline spending could be affected as well.”

Generally speaking, Fan expects fewer in-home wireline activations, resulting in lower net adds, but also lower churn in wireline in the near term. The issue of network capacity, as a surge in wireline network usage is expected as more people at home will be streaming video or using video conferencing for work, will have to be monitored closely by the carriers. Upload capacity of residential wireline will also be important for work-related transmission of large files and video two-way communications, the report says.

Wireless is likely to be the most resilient segment during this period of COVID-19 impact. “In wireless, we estimate that monthly service fees make up a larger part of wireless revenues, which is more recurring in nature. We expect significant erosion in roaming and overage revenues because of reduced mobility and the elimination of travel, but we estimate that those make up a relatively small percentage of total consolidated revenue,” reads the report. Again, Fan writes he expects lower net adds in wireless, but also lower churn in the near term.

Looking at the impact of COVID-19 on media companies in Canada, the investor’s note says the main effects are expected to be in advertising, sports and entertainment events, film production, consumer products/royalties and merchandising. Companies such as Corus Entertainment and WildBrain are highly exposed to the impact on these revenue streams, says the report. In addition, Bell, Quebecor and Rogers will be impacted by reduced advertising in both sports and non-sports TV, radio and digital platforms.

However, as viewership shifts to news programming as households try to stay informed about COVID-19 developments, this could offset some of the negative advertising impact related to reduced advertising in other genres. The analysts note that advertising agreements typically have “make whole” clauses that enable advertisers to shift their spending across content or time. In Canada, both Bell and Corus (Global) have strong conventional broadcast news outlets, where advertisers hoping to hit big hockey-watching demos instead will have their ads placed against increasingly well-watched news programs.

In terms of environmental, social and governance (ESG) corporate activities, the Scotiabank analysts highlight the initiatives the telcos and cablecos have undertaken to help customers and society cope during the COVID-19 crisis. These initiatives include the removal of data overage caps for broadband Internet and flexible payment options, among others. “We were pleased to see that all of the companies have taken important steps to ensure that services not only remain uninterrupted regardless of their customers’ circumstances but also, in many cases, are enhanced to address more work and entertainment at home,” reads the report.

“Beyond connectivity, Telus has also been playing a direct role. Through its various Telus Health subsidiaries, Telus is directly involved in COVID-19 diagnosis, including a remote diagnostic app (partnered with Babylon), mobile clinics under the Telus Health for Good initiative, currently up and running in 10 Canadian cities, and digital healthcare tools delivered through Akira and Medisys. We believe the experience here could raise awareness of these digital services and help Telus expand its future role in the Canadian healthcare system,” writes Fan.