TORONTO – As Canadian media companies feel besieged by their industry's digital whirlwind, Blue Ant Media, like its larger rivals, has had to think about how to get bigger and wider to navigate the gathering and growing streaming storm.

But what if bigger isn't always better?

Jamie Schouela, president, Canadian Media, at Blue Ant, told Cartt.ca after his company's Upfront presentation to advertisers at the Royal Ontario Museum Wednesday he recognizes Big Media has a need for scale via mega-deals to compete against Netflix.

Blue Ant, however, has an alternative growth strategy: premium scale, or innovating through new partnerships and key audience categories. For example, striking partnerships with certain name brands aims to steal Canadian audiences and ad revenue away from vertically-integrated rivals like Corus Entertainment, Rogers Media and Bell Media.

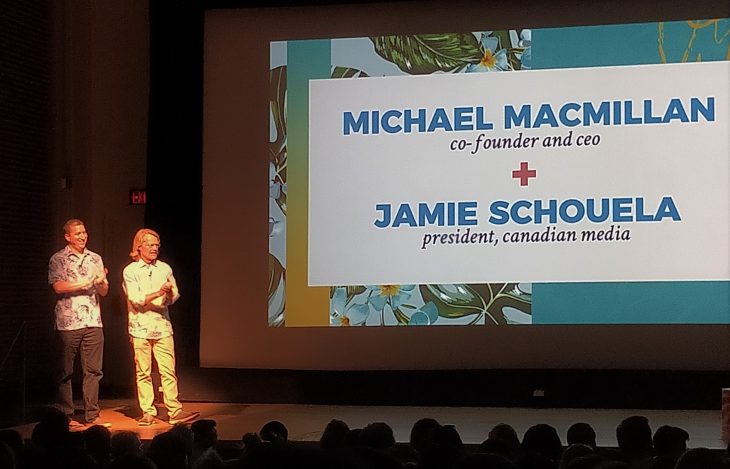

"Our size and scale is defined in categories where we can compete and in categories where we can offer real value, both for advertisers and partners working with us," explained Schouela (pictured during the summer beach party event with company founder Michael MacMillan).

Blue Ant's digital ad play is to take core Blue Ant channels like Cottage Life, Makeful and BBC Earth and video gaming content producer Omnia Media to create four target audience segments – outdoor lifestyle, women's lifestyle, science/tech and gaming. Did you know Blue Ant is a global leader in gaming content?

Each segment is then underpinned by complementary, content-driven branded partnerships for additional scale. "We're not trying to be all things to all people. We're trying to service very specific audiences and categories. Those pieces are core within our portfolio and we've brought in extra partners to build that scale, to make it a more robust offering from an advertiser perspective," Schouela argued.

Amid an avalanche of new content as audiences increasingly embrace premium video across premium digital platforms, Mitch Dent, senior vice president of Blue Ant sales and Blue Ant Plus, said the old equation of advertisers solely making TV, print or digital buys won't do.

Dent sees advertisers increasingly looking to a vertically-integrated media conglomerate or a social media platform like Facebook or Twitter to solve a business problem, whether that's to increase sales or drive a new corporate narrative.

"They come to us and say, we don't know exactly what the solution is, but here's the insight or here's the problem we're trying to solve," he explains. "In those instances, if you don't have scale or reach, you don't have enough power in the marketplace to solve the problem," he said.

Except if you can make more targeted cross-platform advertising effective and affordable, via Blue Ant Media's four key audience segments. "Typically, these advertisers don't mind if the solution is television, digital, print or trade show. They just want to make sure it will work," Dent added.

For example, in the science/tech category, Blue Ant sells the Canadian ad inventory for the American publishing group Bonnier, which produces special interest magazines like Popular Science and Popular Photography.

“It's not scale for the sake of scale. It's scale in areas where we're adding value and can compete.” – Jamie Schouela, Blue Ant Media

So Blue Ant generates advertising reach by finding complementary audiences in magazines like Popular Science and Popular Photography, a new partnership with Mobile Syrup, a Canadian news site for tech enthusiasts, and niche TV channels like Smithsonian Channel or BBC Earth.

Another option is the media company's fastest-growing business unit, Blue Ant Gaming. Blue Ant launched itself in gaming five years ago by acquiring the YouTube gaming network Omnia Media and recently partnered with Toronto-based Enthusiast Gaming to generate around 60 million monthly video views countrywide currently, and 550 million subscribers worldwide, while offering 850 custom channels, 500 creators and over 55,000 attendees at Enthusiast Gaming Live Expo-branded consumer shows.

The result is Blue Ant now offering advertising reach across four buckets: a network of YouTube influencers, the Enthusiast Gaming publishing platforms, the EGLX consumer shows and Blue Ant's gaming content production business in Omnia Media.

Dent insists Blue Ant as a standalone company has the flexibility and focus to solve business problems for advertisers better than a media monolith too set in its ways. "We've blended a TV property with a magazine property, with many digital properties and with trade shows, just so we can compete and do a better and more personal job of solving business problems than a big broadcaster might do because they sometimes suggest the same solutions over and over again," he says.

Blue Ant is securing scale by other means, including rebranding niche channels as BBC Earth and the Smithsonian Channel, for example, launching TV channels on new and emerging digital platforms like Amazon Prime and Apple Plus in Canada, and doing a deal with DHX Media, another indie media company, to have the Blue Ant ad sales unit sell inventory for their three channels, give its sales force an expanded 11-channel offering.

The goal is allowing Blue Ant to look at a fast-changing media landscape its own, custom-tailored lens. "It's not scale for the sake of scale,” argued Schouela. “It's scale in areas where we're adding value and can compete.”