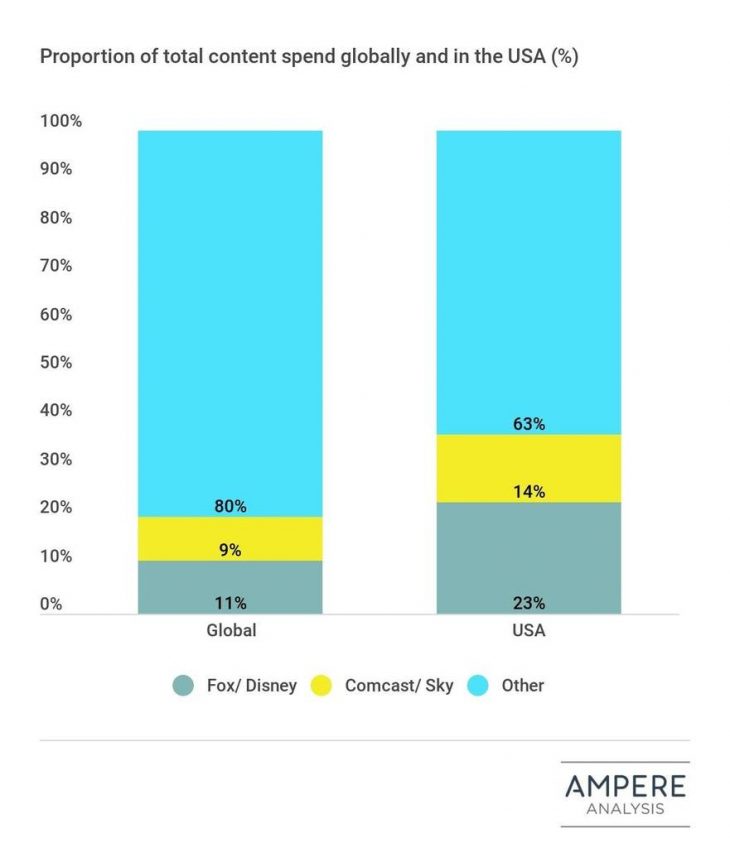

LONDON, UK – The pending media mega-mergers of Disney/Fox and Comcast/Sky means that two in every 10 dollars spent on content worldwide will now be spent by these two entities, says new data from Ampere Analysis. In the U.S., that figure will be almost four in 10 content dollars.

According to the analysis, the combined projected content spend of the two merged players will reach US$43B by the end of 2018. Disney/Fox will have spent US$22B on originated and acquired content, and Comcast/Sky a little less at US$21B. To put that into context, this is more than the combined outlay of the next 10 largest content spenders in the U.S. – including streaming giants Netflix and Amazon.

Wielding such financial authority not only strengthens both entities’ positions in the global market, it also protects against the rising strength of online video, continues the report. Each of the two entities controls an increasingly vast library of original content ready to be exploited through their own direct-to-consumer offers.

Ampere Analysis analyst Daniel Gadher suggests that the increasing level of consolidation may be linked to the growing power of online video platforms, but could come with some unexpected consequences.

“One implication of this consolidation is the effect on independent producers”, added Gadher. “With a shrinking number of content acquirers in the market, the competition for rights will diminish, and this will inevitably impact the indie sector’s ability to negotiate favourable deals.”