TORONTO – Length matters.

That's one of the findings of a poll of Canadian TV viewers and the video content they consume which was conducted by Charlton Strategic Research, and unveiled Tuesday at the CTAM Broadcaster’s Forum in Toronto on Tuesday.

Charlton's Gord Hendren told conference attendees that an online survey of 3,168 Canadians over 18 years of age revealed the total time spent watching long-form video content, or over five minutes in length, is up among total Canadian TV viewers.

Millennials, though, are bucking the trend.

Hendren said his poll revealed younger Canadian TV viewers from 18-34 years of age spend less time watching content via a traditional TV subscription, and more time streaming and with short-form content, or video less than five minutes in length, for a total of 27.9 hours per week. Only 6.9 hours of that is spent watching through a traditional TV subscription (as compared to 17.7 hours for the full populace), while that cohort consumes 7.5 hours a week worth of short form content. The rest was streaming (11 hours) or others like digital downloads or DVDs (2.5 hours) for the 18-34 year olds.

Their preferred sources: Facebook, YouTube or Snapchat. "This is pretty stark when you see this kind of change. This is a wake up call. Things are continuing to change," he said.

The implications for Canadian broadcasters, already experimenting with bite-size video content, suggest it's time to embrace Netflix Canada and the Internet as the saviour of the traditional cable TV bundle.

Take live news and sports content.

Hendren said younger Canadians are increasingly bypassing traditional sources for live news and sports and going online or other digital devices for highlights (Ed note: We like House of Highlights on Instagram) or alternative content. "I'm not suggesting this is the death of sports tomorrow. It (sports) is a very compelling experience, and it's better live. But there's other sources of content. And younger people are beginning to go to that more than they have before," he reported.

So how to get Canadian millennials into the TV fold as they opt increasingly for Netflix, Facebook and YouTube?

Start by bundling streamed video right into the cable TV packages sold Canadians so they can stream video content like regular cable subscribers. Netflix and/or YouTube is available via Bell, Rogers, Telus, Cogeco and others, but only on their premium, (read: most expensive) set tops. Netflix already reaches into 50% of Canadian homes, the Charlton study reported, followed by CraveTV penetrating about 10% of domestic households, with Amazon Prime Video finding its way into 9%.

“It's certainly where the consumers' mindset is.” – Gord Hendren, Hendren Research

Vidéotron’s Club Illico has an 18% share of the OTT market, but that's confined to Quebec.

Among Canadian millennials, however, 71% of respondents told Charlton they subscribe to Netflix Canada, with Amazon Prime and CraveTV signing up 14% each of that market category.

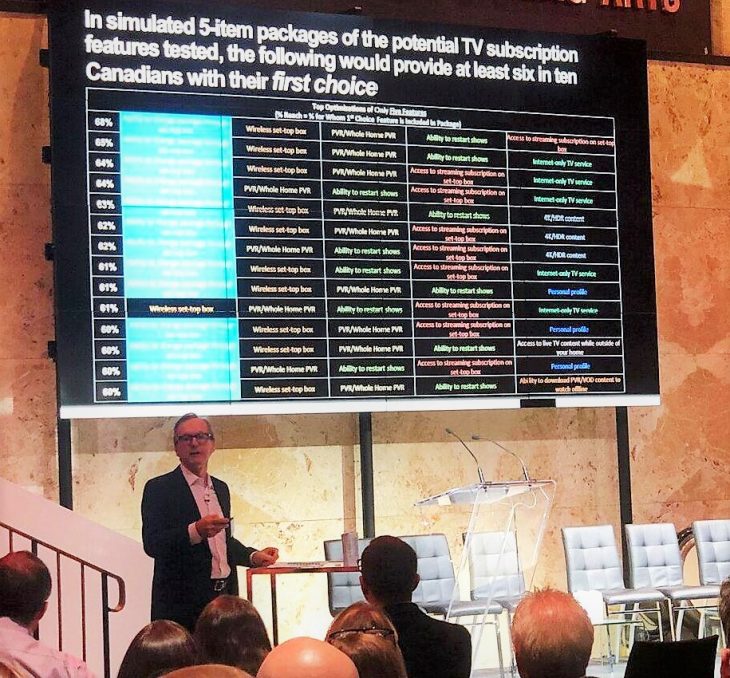

Predictably, Hendren pointed to poll findings that indicate younger Canadians find as their most appealing TV subscription feature the ability to access a streaming service, via their TV set-top box. Older Canadians, more likely to be satisfied with their existing cable TV package, by contrast value most the ability to change or update their channel package through their set-top box.

"We know the efforts are being made, and services are in place, but we think that trend will continue, especially among an 18 to 34 year old demographic," he said. The research also noted that those millennials who do subscribe to paid TV are actually more loyal than 35-plus year olds. “Convincing non-subscribers to come on board will require adapting streaming and/or short form options.”

The fact that short form content has already surpassed TV subscriptions as the main source of video content for younger Canadians “can't be ignored. It's something the industry needs to be thinking about, in terms of how do you speak to that demo, achieve that engagement, through that kind of format," Hendren said.

His third recommendation is “flexibility” when it comes to allowing traditional TV subscribers to change or update their channel packages, such as allowing it immediately, via a click of a remote. "It probably makes you nervous in terms of revenue flow," Hendren told CTAM delegates mindful of churn.

"But it's certainly where the consumers' mindset is," he warned.

A full copy of the research will be made available to CTAM Canada members via the organization’s website.

Photo borrowed from the CTAM Canada Facebook page.