NEW YORK – Multichannel penetration rates in the U.S. have plunged under rising pay TV bills in the last seven years, particularly among the more economically vulnerable households, says new research by Kagan, S&P Global Market Intelligence.

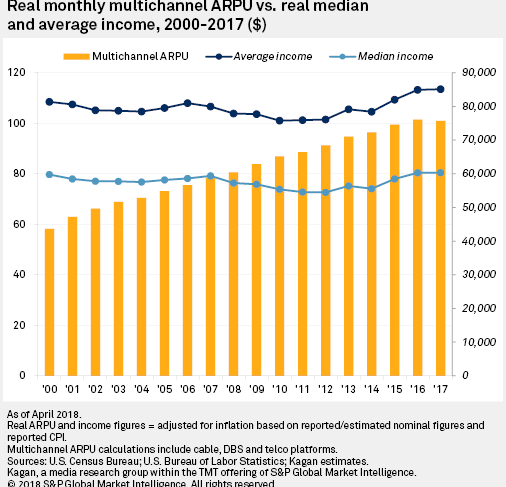

The research estimated nominal average monthly multichannel revenue per subscriber across the cable, direct broadcast satellite (DBS) and telco platforms — viewed as a solid gauge for the average U.S. monthly multichannel bill — rose at a 5.5% CAGR between 2000 and 2017.

For perspective on the impact of the contrasting trajectories between the average annual multichannel cost and household income on multichannel affordability, Kagan calculated U.S. multichannel purchasing power based on 2017 inflation-adjusted annual multichannel average revenue per user, or ARPU, and average income figures.

– Multichannel offerings have evolved a great deal since 2000, including a greater number of networks and advanced services such as video on demand, DVR services and improved user interfaces, with the vast majority of the packages delivered to subscribers digitally and in HD.

– The calculation puts the sharp decline in affordability in perspective, dropping from a 10.0 in 2000 to a 6.0 in 2017. Of note, however, the index fell each year but one — when it remained essentially unchanged — from 2000 through 2014, before reversing the trend in 2015 to log three straight years of improvement through 2017.

– The eroding legacy multichannel affordability partly explains the popularity of over-the-top services such as Netflix and Amazon’s Prime Video.