Shaw write-down, content pauses, fuel talk of new, or no, partnership

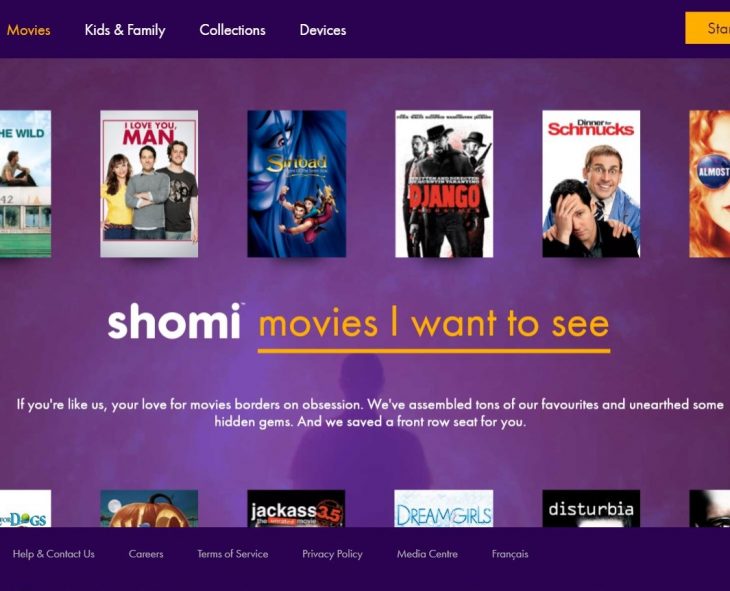

IN JULY, SHAW COMMUNICATIONS wrote down the value of its 50% stake in the shomi streaming service to nil. That move, plus the fact shomi emerged from spring’s annual Los Angeles TV screenings with no new content purchases, has led many in the industry to wonder aloud about the future of the Rogers-Shaw joint venture.

At the time of the write-down, Shaw CFO Vito Culmone told analysts the $51 million accounting charge taken after it had sold its traditional media assets to Corus Entertainment did not "say anything more about our future prospects at this point in time in regards to the shomi joint venture in any way, shape or form." Shaw retained its 50% stake in shomi when Corus Entertainment bought Shaw Media for $2.65 billion earlier this year.

During Rogers Communications’ July conference call with Bay Street analysts a week after Shaw’s Q2 call, its CFO Tony Staffieri also did not say much when asked about shomi. “As we heard on their call, it really relates to the Corus transaction and their exit from media, so that was a specific event for them. We continue like our investments, continue to always look at our alternatives and maximizing value and given that Shaw is a partner with us in that, there is not a lot we can or will say until we have something to say together with our partner.”

Last week, a Shaw Communications spokesman told Cartt.ca he wouldn't comment on speculation the company plans to exit the streaming joint venture it launched in late 2014 with Rogers. Rogers Communications spokesman Aaron Lazarus also denied that Shaw is about to bail on the streamer as the joint venture tries to gain traction against dominant Netflix Canada and local rival CraveTV.

"While we don’t comment on rumours or speculation, we are pleased that our joint venture continues. Every day shomi is signing up more Canadians who are finding the shows they love and discovering new favourites," Lazarus told Cartt.ca.

Neither Rogers nor Shaw have ever divulged subscriber numbers for shomi, but a survey of Canadian consumers, which we reported on in June, pointed to limited adoption of both shomi and CraveTV by Canadians, when compared to Netflix.

(Some have also pointed to the fact Rogers Cable is running a high-profile promotion this summer offering free Netflix to customers for a year as evidence it was shuffling shomi firmly to the backburner. However, we find that reasoning to be seriously old-school thinking. Customers want Netflix, and an offer of free Netflix is a good promotional idea, no matter what may or may not be happening with shomi.)

DESPITE THE DENIALS, Cartt.ca has learned from several sources who asked not to be named because they are not authorized to speak or they do not want to jeopardize business relationships, that Rogers Communications is weighing its role in the future of shomi as Shaw Communications considers a possible exit.

As Rogers decides whether to double down on shomi by potentially buying out Shaw's stake or securing another partner to take Shaw’s place, Rogers Media has acted on its own to negotiate a series of content renewals for programming for shomi within the past three weeks, say sources with direct knowledge of the deals – which are for big money, but only year-long terms.

"One possible option would be Amazon."

Shaw moving away from shomi would also allow Rogers to end the challenge of maintaining a separate infrastructure for the streaming joint venture, which is unlike Bell Media’s CraveTV. There, the acquisitions and originals strategy is headed up by Bell programming boss Mike Cosentino who can buy a show at the LA Screenings or anywhere else and have an idea of how it will window – whether first on CTV and then to CraveTV, possibly launch simultaneously, or go exclusively to CraveTV. That versatility allows a better-informed purchase when having to deal with the studios.

According to content owners and others, shomi is somewhat hamstrung when acquiring shows because managers from both broadcasters (when Shaw still owned Global), for the most part, make their own buying decisions, separate from shomi.

So if Rogers and Shaw were at the Los Angeles screenings and bidding on a new U.S. show, they can't, in the heat of battle, say ‘let's buy that show at $125,000 an hour’ and know shomi will swallow a portion of the purchase price/rights, however small. For Shaw, this loss of leverage is far more pronounced since it retains the stake in shomi but has no TV channels any more since Corus bought them. Our sources also insist Corus executives have made it clear the company is not interested in taking on 50% of shomi.

"So neither Shaw nor Rogers, in heat of an acquisition battle, could bulk up knowing their own SVOD division could eat X percent of a total all/rights purchase price," added one observer.

Besides unifying shomi's programming and distribution effort, Rogers could also start making original shows for the streamer. While Bell Media struck deals with HBO and Showtime to help CraveTV take on Netflix Canada, it has also made original shows like the recently renewed Letterkenny and the upcoming Russell Peters show.

Rogers in sole control of shomi would also allow the media group to better use City and other channels to promote the streaming service, and to more fluidly migrate acquired and original shows from Rogers channels to shomi.

If Rogers were to decide against taking charge of shomi on its own, there's always the option for the partners to sell the streamer. One possible option would be to Amazon, which has already held exploratory talks with shomi, say our sources. The giant global retailer and OTT streamer dearly wants to launch its Prime Video in the Canadian marketplace but has been unsuccessful winning rights to popular away from Netflix and its Canadian competitors for Canada.

While shomi and its existing content contracts would be a ready-made option for Amazon, such a sale would be a surprising denouement for the Canadian owners of the streaming portal should such a deal actually happen.

With files from Greg O’Brien.