TORONTO – Given the pile of money Rogers Communications paid for the rights to the National Hockey League games for the next 12 years, look for the wholesale fees paid for sports by BDUs – and their customers – to shoot up.

A research report recently published by Scotia Capital analyst Jeff Fan says that if you think sports makes up a big portion of BDUs’ programming costs now, just wait. When the sports genre was deregulated by the CRTC back in 2010, CTV/Bell Media served notice that rates for TSN (which had been the same for more than a decade) would be going up – and they surely have.

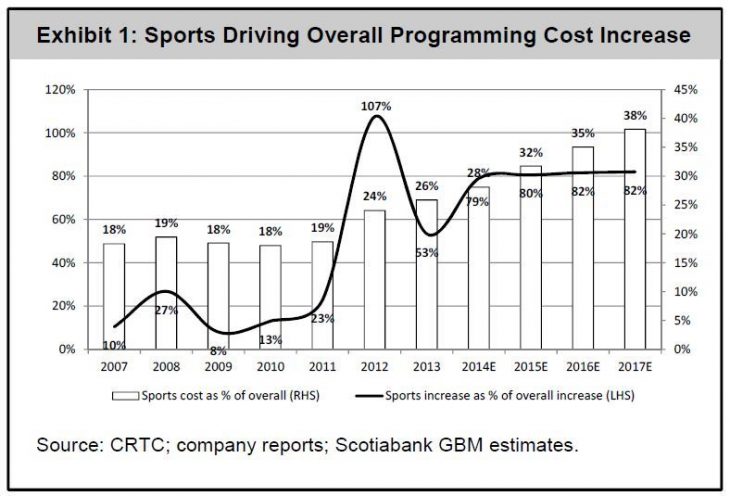

“To put this into perspective, in 2013, sports programming cost was approximately 26% of all TV programming cost, up from 24% a year ago,” writes Fan. (See graph at right. Clicking on it makes it bigger). “Sports programming cost continues to be the largest driver of programming cost inflation, accounting for more than 50% of the increase in 2013 and over 100% of the increase in 2012. The increase was largely explained by BCE’s TSN/RDS, although Rogers’ Sportsnet properties and (Quebecor’s) TVA Sports were also contributors in 2013. The gain in 2013 content cost inflation was not as sharp as 2012, which was mostly driven by TSN. We believe 2014 will likely be similar to 2013 but we expect 2015 will be quite different and will likely be similar to the trend in 2012.”

As BDU contracts with Rogers expire (and Fan says he believes the deals with Cogeco and Telus are about to, if they haven’t already), Rogers will be seeking big increases from carriers in order to help pay for its huge hockey commitment. “RCI may very well be timing those negotiations to the point when it can put its best foot forward (i.e., negotiate near the start of the NHL season). We believe RCI and TVA’s objective is to monetize the rights, which in turn, will have a significant impact on programming cost in 2015,” Fan writes. TVA has sublicensed some of the rights from Rogers for the Quebec French market.

As it stands now, there is a substantial revenue gap between what TSN earns from distributors and what Rogers earns from its suite of Sportsnet-branded channels. Rogers will surely want to narrow that gap (depicted in the chart below). “For RCI, given the revenue gap between TSN and Sportsnet , we believe this is one of those opportunities that it believes it can close the growth gap against its peers. If we assume RCI’s objective is to match TSN/RDS’ subscriber revenue, then we estimate RCI’s Sportsnet will grow subscriber revenue over 20% CAGR (compound annual growth rate) over the next four years, from approximately $260 million in 2013,” reads the report.

That means a near-doubling of sports rights costs for distributors, come 2015 compar ed to what they were paying as recently as 2011. “In 2012, we experienced the first upsurge with TSN. This upcoming wave from RCI Sportsnet could be even more dramatic,” writes Fan. “In 2011, before the TSN rate hikes, we estimate sports programming cost per subscriber was approximately $3.66 per month. In 2013, the cost per subscriber rose to approximately $5.41, which was an increase of 22% CAGR over the two-year period. In another two years by 2015, we estimate the cost will be $7.21, which will be another 15% CAGR over two years.”

ed to what they were paying as recently as 2011. “In 2012, we experienced the first upsurge with TSN. This upcoming wave from RCI Sportsnet could be even more dramatic,” writes Fan. “In 2011, before the TSN rate hikes, we estimate sports programming cost per subscriber was approximately $3.66 per month. In 2013, the cost per subscriber rose to approximately $5.41, which was an increase of 22% CAGR over the two-year period. In another two years by 2015, we estimate the cost will be $7.21, which will be another 15% CAGR over two years.”

And in even better news for BDUs (Ed note: A little sarcasm…) Fan’s report notes these increased sports costs will place big pressure on margins and profit since TV subscriptions are not growing, and there seems to be little room for growth in an area which has matured, while starting to feel the hit of customers trimming or cutting what they pay for from traditional video providers.

“And if distributors attempt to pass on the costs through higher prices, we believe it could very well be the next catalyst that will drive further TV penetration decline and subscriber pressure in 2015,” says the report. “Currently, the Canadian pay-TV (total TV subscribers/total households) is just under 80% and the penetration has been declining at an annualized rate of 0.6% and total subscriber is relatively flat.”